Mortgage Broker Costs 2026: How Much Do Mortgage Brokers Charge?

If you’re in the market for a home or a remortgage, then you’re probably wondering about mortgage broker costs and whether working with a broker is actually worth it.

Do mortgage brokers charge fees and what does a fee-free mortgage broker actually mean?

Simply, a mortgage broker’s main job is to help you understand mortgages and finance. They work to find the best mortgage deal for your financial needs.

However, not all mortgage brokers are the same. Some mortgage brokers will charge fees with differing pricing plans. Others focus on giving mortgage advice as a fee-free service.

In this article, we will explain everything you need to know about mortgage broker fees. From costs to value and everything in-between. Let’s begin.

Short on time? Watch our quick video on Should You Pay for Mortgage Advice?

How Much Will a Mortgage Broker Cost?

The exact amount a mortgage broker will cost you will depend on the mortgage broker you choose and their individual fee structure or payment policy.

Crucially, all mortgage brokers receive a commission from mortgage lenders. This means that any client fees charged are additional income for the broker.

A mortgage broker can choose to charge a fee in exchange for their services. These services can include many activities, including consultations, lender negotiation, or even managing your mortgage application. This is how mortgage broker fees can vary depending on your chosen broker’s payment structure and the exact services that you may require.

Asking about both the services and mortgage brokers costs is important before you start working with a mortgage broker. This is because broker fees and pricing structures can vary significantly between brokers.

Additionally, asking for any agreement to be put into writing can also ensure that there are no hidden fees or unexpected costs down the line.

At Boon Brokers, we pride ourselves on providing expert, fee-free mortgage advice tailored to your unique financial situation. As a trusted whole-of-market mortgage broker, we’re also able to work closely with a wide range of mortgage lenders, helping you to secure the best mortgage deal – completely free.

To provide you with a better understanding of other mortgage broker fees and pricing models, we have provided a list below:

Fee-Free

Some mortgage brokers – like Boon Brokers – choose not to charge any fees to borrowers. Instead, they earn commissions from the mortgage lenders.

Simply, with a fee-free model, you can enjoy their expert service, without the need to pay a single penny. Working with a fee-free mortgage broker can be a big financial help, especially when you take into account the unavoidable costs of covering solicitor fees and other legalities.

Hourly Rate Cost

Some brokers charge an hourly fee, with their exact rate depending on the specific services they provide.

The danger with this is that costs can quickly escalate. In the event that there is any unfortunate complications in your application, you may be required to pay your broker for any increase in the hours that they work.

If you’re considering paying for an hourly rate service, it is often expected for clients to request an estimate of how many hours the broker will charge you for. This can help you gauge the overall cost and better understand the cost-to-value for yourself.

Fixed Charge

Brokers with a fixed charge provide a more transparent approach to their fees. As the name suggests, there will be a single, fixed charge for their service.

That being said, it is important to ask about any additional costs that can occur in the future. This will help eliminate the surprise of any hidden costs that may be excluded from the initial quote.

Crucially, fixed charge fees can be charged either upfront or upon completion of the mortgage transaction. As such, it is best to confirm with your chosen broker before you begin your mortgage application.

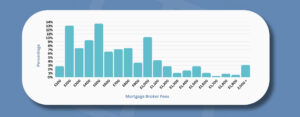

Boon Brokers recent research into the average mortgage broker fees revealed that the average amount charged for a mortgage brokers’ services was £500. While the highest cost recorded reached upwards of £1,000.

The graph below illustrates the proportion of UK mortgage brokers charging specific fee amounts, highlighting how common each fee is across the market.

Percentage

With a percentage model, the broker will charge a percentage of the mortgage that the applicant is taking out. As such, buying a higher value property could mean you end up paying a lot more than the average mortgage broker fee.

For example:

- Let’s suppose your mortgage broker is charging a 1% cost of the mortgage.

- And you take out a mortgage for £250,000.

- The resulting costs will equal £2,500.

This would ultimately result in a significantly higher cost than the average (£500) mortgage broker cost.

Combination

There are a number of brokers who will use a combination of these models. For example they might charge you an hourly rate while also securing commission from the lender. Alternatively, a broker may charge you a fixed fee and a percentage of the mortgage amount.

It is crucial that you understand your broker’s pricing model. Take the time to confirm – in writing – any mortgage broker charges before engaging their services.

What Our Clients Say About Us

Is Paying a Mortgage Broker Worth It?

There’s no ‘one-size-fits-all’ answer to this question. It will ultimately depend on the quality and services of the mortgage broker you choose.

Importantly, the price tag of a broker’s service will not always correlate to the quality you will receive.

There are excellent mortgage brokers who will choose to charge fixed client fees, just as there are highly reputable brokers who offer their services for free.

For example, Boon Brokers operate as a fully independent whole-of-market and fee-free mortgage broker. Our service is aimed to help keep your costs down. As a result, our dedicated experts specialise in helping you compare and secure the best mortgage deals at no cost to you.

The ideal solution is to find a reputable broker, experts in their field, who will not charge you for their services. That’s why, at Boon Brokers, we’re proud to offer expert mortgage advice, without any cost to you.

It is important to do your research before working with a mortgage broker. A good way of finding out whether your mortgage broker is of high quality is through trusted reviews.

Feedback from previous clients on independent review sites, like Trustpilot, is an excellent way to determine if a broker is the right fit for you. This can help you establish whether you can trust them to provide reliable, expert advice.

Crucially, you should also make sure that any broker you select is authorised and regulated by the FCA (Financial Conduct Authority), either through a network or directly. This will provide you with protection, even in the event of poor mortgage advice service.

Is Fee-Free Mortgage Advice Too Good to Be True?

When something is free, it is only natural to ask: “Is this too good to be true?”.

An important distinction to make is that a fee-free broker is free for the client. In reality, most fee-free brokers will of course still earn money, and this is by a commission based pricing structure.

It’s important to understand that a fee-free mortgage broker is only free for the client – not free in general. Most fee-free brokers will still earn income through a commission-based structure, charging the mortgage lender their fees, rather than the client directly.

Take Boon Brokers as an example. As a reputable fee-free mortgage broker, we profit from the commission we charge mortgage lenders, not our clients. This allows us to offer expert mortgage advice without the need to charge you a single penny for our service.

In short: You will receive the full benefit of professional fee-free mortgage advice, without any compromise on quality or support.

There really isn’t a catch when it comes to fee-free brokers. However, as mentioned earlier, it’s essential to assess the quality of service offered. You need to be confident that your broker will deliver expert and reliable support throughout the process.

When you are looking at the different broker options available, you should be looking for brokers that offer whole-of-market access. This means they have access to every lender on the market to find you the best possible deal.

We conducted a survey at Boon Brokers that found there was a general lack of understanding around what mortgage brokers can or should offer. Worryingly, one in seven of those who have used a mortgage broker didn’t know if they had whole-of-market access.

Why Does Whole-Of-Market Access Matter?

A whole-of-market mortgage broker will have access to the latest mortgage deals from a broad range of lenders – not just a select few. This access is a major advantage, and will allowing them to compare multiple options for you, helping them to find a mortgage deal that is ideal to your financial situation.

For example, the financial implication of obtaining a mortgage deal with a better interest rate can be very significant. Over a 25 or 30-year term, even a small percentage of difference could end up costing you thousands of pounds over the full term.

Can Fee-Free Mortgage Brokers Help Remortgage?

Yes, fee-free mortgage brokers can absolutely help with remortgages – and they don’t charge for it.

Trusted brokers like Boon Brokers offer ongoing support, not just during your initial mortgage, but throughout the lifetime of your borrowing. In fact, Boon Brokers has systems in place to make remortgaging simple and stress-free.

Many fixed-rate mortgages last for 2, 3, or 5 years. When this period ends, your mortgage will be switched to the lender’s standard variable rate (SVR), which can often be much higher and lead to an increase in monthly payment.

To help you avoid this, Boon Brokers send clients automated email and text reminders six months before their current fixed-rate deal ends, ensuring that there’s plenty of time to remortgage and secure a new deal with better rates, before being moved to the lender’s Standard Variable Rate (SVR).

How Will a Fee-Free Mortgage Broker Help with my Remortgage?

A fee-free mortgage broker can help you save on your monthly repayments by remortgaging to a new deal with better interest rates and terms.

If you use a mortgage broker who charges a fixed fee or hourly rate, these costs can reduce your overall savings. For example, if your broker charges £500 or more every two to three years (every remortgage), the total mortgage broker costs can quickly start to add up.

This is why it is a good idea to find a high-quality fee-free broker that you trust. It is then very easy to go back each time when you need to remortgage.

This is why it’s important to find a high-quality, fee-free mortgage broker you can trust. Simplifying your mortgage needs, Boon Brokers can support you with your remortgages – all without charging you a fee. Our free service is structured to make it both simple and cost-effective for you to return to us whenever you need to review or switch your mortgage deal.

Given our 5-star reviews on Trustpilot, we are confident in our ability to assist you.

How Do Mortgage Brokers Get Paid?

Mortgage advisers are paid on a commission basis paid by the mortgage lender. The mortgage lender will give a commission of around 0.35 percent of the full loan size after the mortgage is completed by the adviser on behalf of their client.

Here’s a table showing example commission amounts based on different loan sizes, assuming a commission rate of 0.35%:

| Loan Amount | Commission (£) |

| £100,000 | £350 |

| £150,000 | £525 |

| £200,000 | £700 |

| £250,000 | £875 |

| £300,000 | £1,050 |

Lenders benefit from providing larger loans, so they often pay brokers higher fees for arranging bigger mortgages. However, from the applicant’s (borrower’s) perspective, the broker’s effort to find a good deal on a £200,000 loan is no different than for a £100,000 loan.

Is a Mortgage Broker Fee Worth the Money?

In short: No, paying a mortgage broker fee will not always be worth the money.

It is true that working with a mortgage broker will grant you access to mortgage deals that you may not be able to find on the market yourself. And that the nature of these deals will often come with lower interest rates and better terms.

But this is true whether you decide to pay a broker fee or not.

If you choose a broker who charges a fee, it’s important to weigh the cost against any potential savings they can help you achieve.

The biggest advantages of using a good mortgage broker is that they will:

- Be able to identify the best mortgage deal that will suit your specific circumstances.

- Make the entire mortgage process much easier for you

Working with a trusted and reputable mortgage broker means they will know exactly which lenders will provide a loan to you and for exactly how much. By providing them with all the information, you essentially have streamlined access to the best mortgage products on the market today.

Additionally, their expertise in the field can often help speed up process.

Many Brokers who have been in the industry for years might have worked with specific lenders, know about special deals, and will have the top tips ready at hand that could save you a large amount of money. Simply, the better their knowledge of the mortgage market – the quicker and easier the application process should be for you.

In reality, many fee-free mortgage brokers can provide the same quality service compared to those who charge fees.

Which Mortgage Brokers Should I Use?

At Boon Brokers, our dedicated mortgage experts combine industry insights with tailored advice as a completely fee-free service. Our aim is to help you secure the best mortgage deals, without any additional cost to you.

However, your best approach is always to review feedback from past clients to see if a broker is the right fit for your needs and circumstances. Reviews can provide unique insights into a companies service and show how responsive they are to any problems.

If you would like to learn more about mortgage brokers, check out our full article on how to choose the perfect mortgage broker.

Frequently Asked Questions

When and How Do I Pay the Broker Fee?

If your broker charges a fee, this will usually be paid either upfront, at application, or on completion. The exact structure, method, and amount will depend on your chosen broker’s terms and policies.

Should you choose to work with a fee-free brokerage, then you should not be charged for any mortgage advice or service. For example, at Boon Brokers, we provide completely fee-free mortgage advice.

Do Mortgage Brokers Favour Lenders That Pay Them Higher Commission?

Reputable and Financial Conduct Authority (FCA) regulated brokers are required to act in your best interests, regardless of commission levels.

As a whole-of-market, FCA regulated mortgage broker, Boon Brokers will only recommend products based on suitability for your financial circumstances and never on the commission we receive. We believe in full transparency and client-first advice.

How do I check if a mortgage broker is legitimate and qualified?

You can check if a mortgage broker is authorised by the Financial Conduct Authority (FCA) by visiting the FCA Register. All qualified brokers should provide a Client Agreement or Initial Disclosure Document, outlining how they operate.

Boon Brokers is fully FCA-regulated and offers fee-free, transparent, and impartial mortgage advice.

Are There Hidden Mortgage Broker Fees I Should Know About?

It is important to always ask for a clear breakdown of all the fees in writing before choosing your mortgage broker. While some brokers may advertise “no fee” services, there could be charges down the line or hidden admin or processing fees later.

At Boon Brokers, we guarantee fee-free mortgage advice with no hidden costs with no surprise charges.

Can Fee-Free Brokers Help With Complex Cases Like Bad Credit or Self-Employment?

Yes, fee-free brokers like Boon Brokers regularly handle complex cases, including bad credit, self-employment, low deposit, and much more.

Our dedicated mortgage experts have a wealth of experience dealing with unique financial circumstances. And because we work with a wide range of lenders, we have the knowledge to know who specialise in unique circumstances to help find you the most suitable options that are tailored to your financial profile.

How a Mortgage Adviser Can Help With Your Mortgage Options

Buying a property is a massive milestone and will usually be on of the biggest investment in life.

While the stand out cost of a property might be the main concern, there are many additional costs that you need to consider. Costs such as mortgage arrangement fees, interest fees, solicitors’ fees, and valuation fees – to name a few.

Having an expert mortgage adviser by your side can help you navigate the complexities of mortgages and increase your chances of securing the right mortgage deal, tailored to your needs.

If there are any factors such as poor credit history, being self-employed or any other reason that makes it harder to get a standard mortgage, a broker will be the best option for finding you the best deal.

If you require flexible lending criteria or don’t fit the typical strict criteria of leading lenders, working with a mortgage broker is often the best way to find competitive mortgage options suited to your unique situation.

At Boon Brokers, we can provide you with expert, clear and easy to understand mortgage advice. As a whole-of-market brokerage, our dedicated mortgage specialists have access to a wide-range of lenders, comparing both leading high-street banks against specialist lenders, all to find you the ideal mortgage for your requirements.

Whether you’re a first-time buyer or looking to remortgage, our dedicated team is here to help you find the best mortgage deal, completely fee-free.

Contact Boon Brokers today to benefit from expert guidance and secure a mortgage that truly fits your needs.

Need Mortgage Advice?

Submit an Enquiry

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Should I Use A Broker Or Go Direct?

- How Much Does The Average Mortgage Cost

- How To Get A Mortgage With A New Job

- Reasons Why Mortgage Applications Are Declined

- Mortgage Borrowing Calculator

- Military Mortgages Guide

- How To Avoid Early Repayment Charges

- What Is A Mortgage In Principle?

- What is CheckMyFile?

- How To Build Home Equity

- How Much Deposit Do I Need For A Mortgage

- What Are Solicitor Searches?