How Much Does The Average Mortgage Cost?

Calculating the cost of a mortgage is not a quick straightforward task, whether you’re looking for your first mortgage or to remortgage. There are different types of costs and variables to consider, from interest rates to term lengths, which can change at any time. In this article we explore the current mortgage rates and what to consider when calculating the average cost of a mortgage.

Watch this video we produced for a full explanation on what to consider when calculating costs and the current trends and rates in the market:

Average mortgage interest rates as of Feb 2024

| Rate Type | Average Interest Rate | Source |

|---|---|---|

| 2 year fixed rate, 95% LTV | 5.74% | BSA.org.uk |

| 2 year fixed rate, 75% LTV | 4.77% | BSA.org.uk |

| 3 year fixed rate, 75% LTV | 4.55% | BSA.org.uk |

| Standard Variable Rate | 7.92% | BSA.org.uk |

Please note that mortgage rates vary greatly from one lender to another. Different deals will also be available with the same lender for different circumstances e.g. Loan to Value amount, applicant’s credit history, etc.

There has been a lot of news surrounding the increase in Base Rate and its potential effects on mortgage rates. The Bank of England (BoE) meets approximately every six weeks to determine whether the Base Rate should be raised, lowered or remain unchanged.

The average mortgage length

The length of the mortgage is another contributing factor in the cost of the mortgage. In the UK, mortgage terms start from as little as six months and can be as long as 40 years. The most common length of a mortgage is 25 years but 30, 35 and 40 years are now available with some lenders.

People choose to take out longer terms to lower their monthly payments. This allows them to spread their loan repayments out over a longer period. However, it does mean that they will end up paying more interest throughout the lifetime of the mortgage.

House prices have risen dramatically in recent years and mortgages over longer terms have increased in popularity. The average UK house price was £286,000 in May 2023, as published by the GOV.UK. This rise in house prices has made it much more difficult for people to buy property, particularly with bigger deposits required now too.

House prices also vary massively depending on the area of the UK, with people in London facing the most expensive house prices and biggest mortgage loans.

Would you like to estimate your monthly mortgage payment?

Get in TouchWhat is the average mortgage payment in the UK?

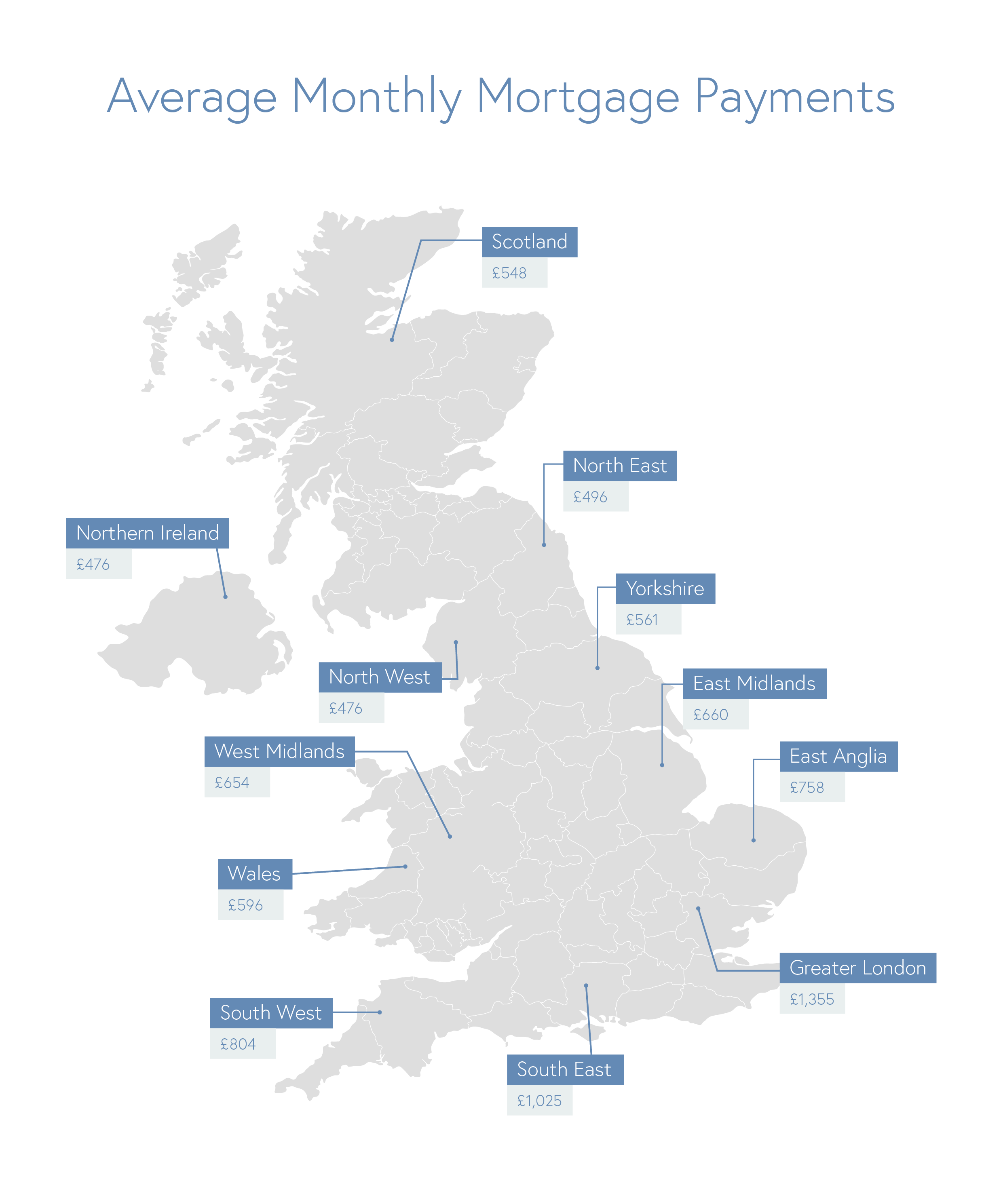

In March 2022, the average mortgage payment in the UK was £759, according to Llyods Banking Group. This has risen 31% in the last 10 years, but monthly payments do vary depending on the region.

Monthly payments generally include the mortgage interest payments, the capital repayment of the mortgage and any mortgage protection premiums. The huge range in different monthly payments by region is largely down to the house prices in each of the areas. If a mortgage arrangement fee has been charged (typically around £1,000), this could also be added into the loan repayments. Although you can usually choose to pay this separately instead.

It’s also important to note that the monthly payments on a mortgage depend on a large number of variables, such as:

- Type of mortgage i.e. interest only, repayment or a combination of the two

- The interest rates that the applicant is eligible for

- Length of the mortgage term

- Amount of deposit paid

- House price

- Interest rate type (fixed or variable)

To get the lowest monthly payments, you need to be approved for a mortgage with the lowest interest rates. If you have a bad credit history, you will often have to work with a specialist lender that will apply higher interest rates and therefore higher monthly payments. The loan amount and length of time will also have a significant impact on how much the monthly payments are.

See What Our Clients Have To Say

How to lower monthly mortgage payments

Choosing an interest-only mortgage will make your monthly payments cheaper compared to taking out a repayment mortgage. This is because you are only paying off the interest on the loan and not the loan itself.

This is an affordable way of purchasing a home, but once the mortgage term finishes, the loan is still outstanding which means you don’t own the property.

Other ways to reduce your monthly mortgage payments is putting down a larger deposit, extending the term length or making overpayments.

Average mortgage cost (including interest)

The average total mortgage repayment in the UK is between £285,000 and £385,000. This is dependant on whether housing prices and interest rates increase or decrease, so it is important to keep track of current pricing trends.

The average UK mortgage debt in 2023 was £129,130 with an average monthly repayment of around £664.

The average outstanding mortgage term in the UK is 25 years.

It it important to bear in mind that this is an average taken across all regions, property types and loan terms. The total cost of a mortgage is influenced by a number of factors, including the loan amount, the mortgage term, interest rate and any fees for arranging the mortgage (if applicable).

Some mortgage brokers charge fees, whilst others such as Boon Brokers don’t charge any client fees, which is a cost-effective solution without any compromise on quality.

When you are provided with a mortgage illustration, the provider will show you exactly how much you will be paying off over the full term of the mortgage.

Here is an example of how the term length and interest rates affect the overall cost, indicated by HM Land Registry of a house worth £227,000:

25 years with interest rate of 1.70% = £284,247 (which includes £54,247 in interest)

30 years with interest rate of 1.70% = £295,522 (which includes £65,522 in interest)

25 years with interest rate of 4.33% = £381,018 (which includes £151,018 in interest)

From these calculations, the high-interest rate of 4.33% that is typical for someone with bad credit, would result in paying nearly £100,000 more over a 25-year period. Based on the 1.70% interest rate, by choosing a 30-year term rather than a 25-year term, there would be over £10,000 more interest to be paid.

Many homebuyers do not fully consider how much interest they will be paying off on a mortgage, as the interest rate seems quite small. However, a mortgage is a huge sum of money and 25/30 years is a long time to pay interest, which is why it accumulates to such a significant amount.

This is an insight into how critical it is to find the lowest mortgage rate possible. It is often a better to spend some time improving your credit score in order to ensure you are not paying much higher amounts of interest over the term.

Before applying for a mortgage, you should check your credit score to identify any issues that may impact the interest rates you are eligible for. Saving a bigger deposit and choosing a smaller loan term will also help to ensure you are not paying a high total amount of interest.

There are things you can do to help boost your credit score before you apply for a mortgage, such as updating your records on the electoral roll and ensuring you make your payments on time. Your debt-to-credit ratio will be taken into account, so paying off any credit cards can significantly improve your credit score. If you have any missed payments or CCJs then it may be better to wait until these are cleared from your credit history.

Speak to a Mortgage Broker

The cost of mortgages varies greatly depending on the variables outlined above but the good news is that there are plenty of options available to suit your circumstance. There are solutions for homebuyers who want to be able to afford a home or for those who are looking to ensure that their overall interest amount is as low as possible.

For people who would otherwise struggle to afford a home, the option to choose a longer-term can be the best solution. However, for those looking to keep interest payments at a minimum, a shorter-term and finding the lowest possible interest rate would be the best solution.

If you would like any advice on the available mortgage solutions for your requirements, complete our Request a Callback form or email us at enquiries@boonbrokers.co.uk.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Choosing A Mortgage Broker

- How To Get A £250,000 Mortgage

- How Much Deposit Do I Need For A Mortgage

- How To Improve Your Chances Of Getting A Mortgage

- Mortgage Broker Costs 2023: How Much Do Mortgage Brokers Charge?

- 12 Reasons Why Mortgage Applications Are Declined

- Buying a House with Cash Vs Getting a Mortgage

- Getting a Mortgage as a Single Parent