How Much Does Equity Release Cost?

For homeowners who are retired or are due to retire in the near future, equity release can be the ideal financial solution to allow them to have a more comfortable retirement.

One factor that often puts people off though is that equity release can end up costing a lot of money in interest.

If you are considering taking out an equity release product, you should make sure that you are fully aware of the financial implications before you take the decision to accept a loan secured against your property.

Unlike most loans where there is a set term, equity release loans run until the homeowner passes away or moves into permanent residential care.

This makes it more difficult to calculate the total cost of taking out an equity release loan.

There are alternative options to equity release, such as downsizing to a smaller property.

However, for people who want to remain living in their home, equity release is a more attractive choice.

In this article, we break down the typical costs involved in equity release products, to help you to make the right decision for your personal circumstances, we have also produced a helpful video:

What is a lifetime mortgage?

With a lifetime mortgage, you can borrow some of the property’s value at a fixed interest rate.

You borrow money that is secured against the property, with the loan being repaid when you die or move into permanent residential care.

You are able to continue living in your home until that point, while the interest builds up.

You have different options in terms of how you receive the money; so, you could take one large sum or you can choose drawdown, where you take smaller amounts at different times.

Most lifetime mortgages will allow you to make repayments, which will help to keep the interest amounts down.

Free consultations are offered in the UK.

Get Started NowWhat is home reversion?

Home reversion is less common, mainly due to it involving selling part or all of your property at below market value.

Although you are able to live in the property until you die, if the property value increases, the lender benefits from the increase on their portion, not you.

When you die or move into long-term care, the property will be sold and the sale proceeds will be split as determined by the percentage owned by the lender.

What can you spend the equity release loan on?

One of the main benefits of taking out equity release rather than other types of loans is that there are largely no restrictions on what you can spend the money on.

Money can be spent on a more comfortable lifestyle during retirement, holidays, holiday lodges or to provide family with financial support while you are still alive.

Some other types of loan will only be approved for certain expenditures, for example, home improvements. So, the flexibility around what you can spend equity release money on is a key benefit to this type of financial solution.

Average interest rates:

Current interest rates for equity release are cheaper than they have been for a long time, but the interest can add up to a very significant amount over the years.

The average interest rate on lifetime mortgages right now is around 4%, with the lowest rate being approximately 3%.

To give an idea of the variance between the different lenders and products, the lifetime mortgage interest rates available on equityreleasesupermarket.com (as of 15/11/2021) span from 2.93% to 6.90%.

The Premier Flexible Black with Legal & General offered the lowest rate of 2.93%, while at the other end of the scale, the Heritage Supreme Max from Pure Retirement had a rate of 6.90%.

Aviva were offering a Lifestyle Flexible Enhanced lifetime mortgage with 3.01% interest rate and Scottish Widows had one product with a rate of 3.44% and another at 3.49%.

The following table* gives some examples of the equity release products that are currently available on the market.

| Product Name | Interest Rate | Lender |

|---|---|---|

| Premier Flexible Black | 2.93% | Legal & General |

| Lifestyle Flexible Enhanced | 3.01% | Aviva |

| Lifestyle Mortgage FR1 | 3.44% | Scottish Widows |

| Lifestyle Mortgage FR2 | 3.49% | Scottish Widows |

| Tailored Lifetime 1 | 3.49% | more2life |

| Heritage Supreme Max | 6.90% | Pure Retirement |

*All figures taken from equityreleasesupermarket.com on 15/11/2021

All equity release products differ in regards to the terms, with some having set early repayment charges and voluntary repayment options, amongst other details that vary between one product and the next.

Over the last few years, equity release interest rates have been falling steadily.

Five years ago, the average interest rate was 6.06% and in April 2021 the average had plummeted to 4.07%.

These lower interest rates, plus the fact that there is significantly better protection from the Equity Release Council (ERC), has led to a large upturn in applications for equity release.

Historically, there were concerns that negative equity could result in owing a higher amount than the property value.

The no negative equity guarantee that the ERC requires ensures that this is no longer a risk.

How much does equity release cost?

The cost of Equity Release will depend on whether you choose a lifetime mortgage or home reversion plan.

As mentioned, the cost of a home reversion plan is simple to calculate because the provider is paid their share of the property’s value when it is sold.

For lifetime mortgages, the amount of interest that compounds will depend on how long you remain in the property, the interest rate and whether you decide to make interest-payments to prevent compounded interest.

As an example, if you acquire a lifetime mortgage for £300,000 at an interest rate of 2.75%, fixed for life, and allow the interest to compound annually, the total balance payable after 15 years would be £450,659.

However, if you decide to make monthly interest payments towards the mortgage, the amount will not increase as quickly if at all.

As there are a few variants that will determine the cost of a lifetime mortgage product, it is always best to discuss your specific case with a qualified equity release broker such as Boon Brokers.

Other fees

Similar to standard mortgages, there are lots of additional fees to be aware of if you are considering taking out equity release. These fees include:

Arrangement fees

Many lenders charge an arrangement fee, sometimes known as a booking fee.

This fee will vary from one lender to the next but typically will be between £300 and £1,000.

This fee can often be added to the mortgage sum on completion.

Boon Brokers does not charge any equity release fees, so you will not pay arrangement fees when you choose us.

Solicitors’ fees

Due to the legal work involved in arranging a loan against your property, a solicitor is required to act on your behalf. Again, the fees for this will vary but the average solicitors’ fee for an equity release product is £650.

The legal fees charged will depend on a number of factors such as whether the property has a leasehold or freehold tenure.

Properties with a leasehold tenure tend to be more time-consuming than freehold properties for solicitors to process.

This means that if you are applying for Equity Release on a leasehold property such as a flat, expect higher legal fees.

The fees charged by solicitors is correlated with the time that they need to allocate to your case.

Therefore, if there are causes for additional legal work, such as complications around the legal title of the property, expect higher solicitor fees.

Early repayment charges

If you want to have the option to repay some or all of your equity release loan, some products have early repayment charges applicable in certain circumstances.

Even if you are not considering paying the equity release back early, your circumstances could change, so you should ask your broker to find a product with minimal or no early repayment charges just to provide another option for you.

Fortunately, most lifetime mortgage providers will waive early repayment charges in certain circumstances. These circumstances normally include:

- You repay after the Early Repayment Charge Expiry Date (i.e after a set number of years outlined by the lender)

- You die or move into long-term care

- You move to a new property and transfer the lifetime mortgage to the new property

- You move to a property that does not meet the lender’s lending criteria and you are eligible for downsizing protection

Therefore, in most scenarios where a lifetime mortgage will need to be redeemed, the early repayment charge will currently be waived by most lifetime mortgage lenders.

Each applicant’s circumstances are different, so you should ask your broker for financial calculations based on your property value, your age and the interest rates of the available products.

You should never just opt for the cheapest interest rate, as there can be other charges that will end up costing you more than taking out a product with a slightly higher interest rate.

For example, arrangement charges and early repayment charges can end up costing more than a product with a slightly higher percentage of interest rate.

What Our Clients Have To Say

Other factors to consider

When you are deciding whether equity release is the right option, you might also need to consider the impact that it will have on your family.

If you are hoping to leave some inheritance, equity release can significantly reduce the amount of money you leave. It is possible to take out an equity release product where you can ‘ringfence’ a specified amount for inheritance.

It may help to have your family involved in the discussions that you have with your broker, so that they understand how the equity release works and what will happen upon your death.

The executor of the will is responsible for arranging the sale of the property and the repayment of the loan with the proceedings.

Therefore, keeping them involved in the process will be helpful for when they need to make the repayment. It also ensures that your family understand your reasons for taking out equity release.

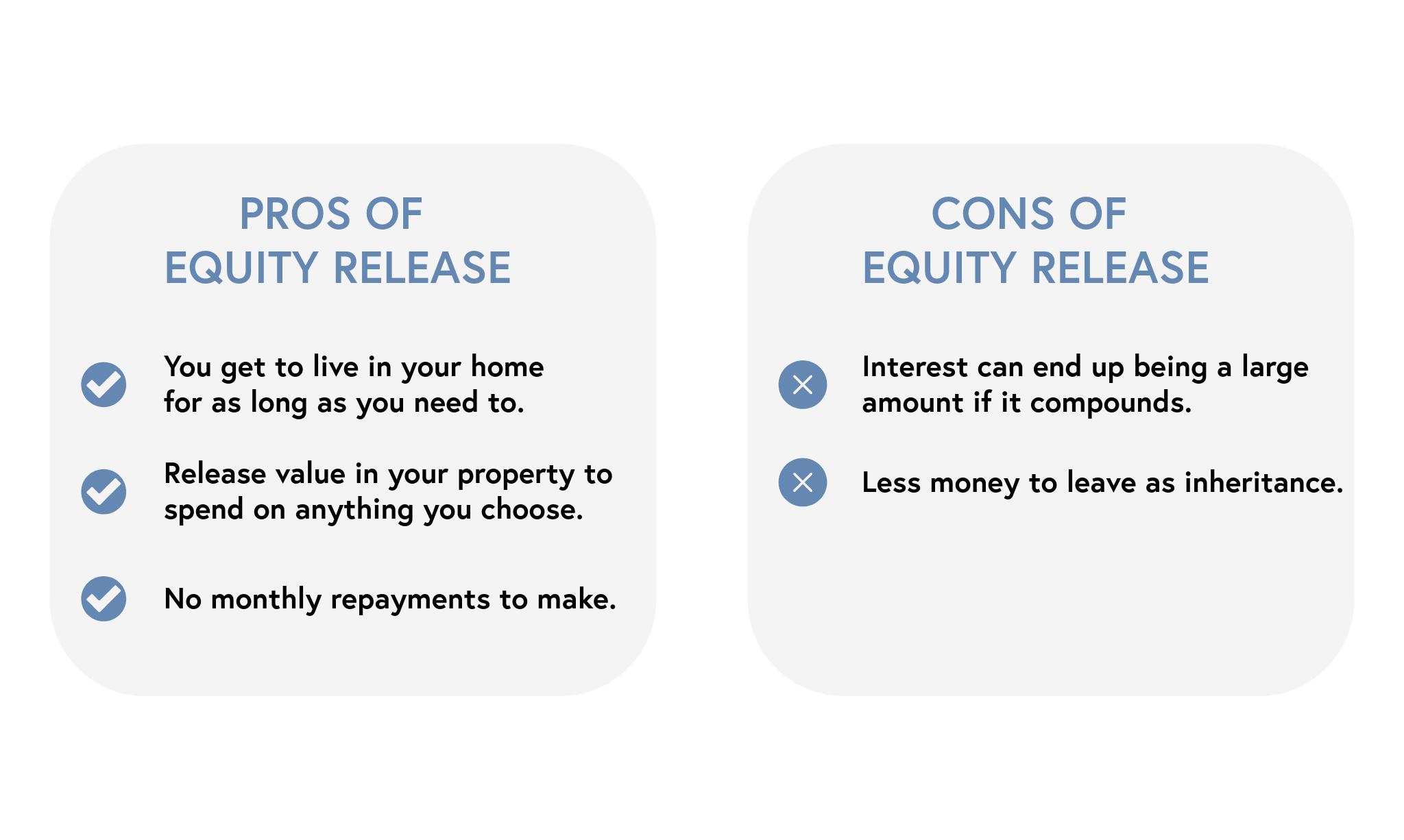

Pros and cons of equity release

There are a number of pros and cons to taking out equity release, such as:

Is equity release the right for me?

Hopefully, this article will have helped you to understand the costs involved with taking out equity release to enable you to make the best decision for you and your family.

The ERC requires that professional advice is provided before anyone is allowed to take out equity release, so choosing a high-quality broker will be very beneficial.

Boon Brokers has been providing equity release advice for many years and we always help our client to find the best financial solution to suit their needs.

As well as receiving expert guidance, our services are free, as we do not charge any equity release advice or arrangement fees to our clients.

Contact our equity release team today and we can help to find the most suitable equity release product or recommend an alternative.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Can I Sell My House If I Have Equity Release?

- What Happens On Death With Equity Release?

- Can I Release Equity To Purchaes A Second Home

- Releasing Equity To Help Child Buy Their First Home

- How Does Equity Release Affect Your Family

- Everything To Know About Equity Release

- Equity Release For A Buy To Let Mortgage

- How Much Equity Can I Release?

- What Is Home Reversion?

- How Does The ERC Protect You

- What Is A Lifetime Mortgage?

- How Much Does Equity Release Cost?

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757