How Much Deposit Do I Need for a Mortgage?

Before the 2008 financial crisis 100% mortgages were commonly approved and, in some cases, as much as 125% mortgages were available from lenders. This means that lenders were prepared to lend the full value of a property and more.

However, the crash in 2008 forced an overhaul of the mortgage market, with lenders removing the higher risk 100% mortgages from their offering.

Since the crisis, stricter lending criteria has made it more difficult for people to buy their own home, although there are some alternative options to the original types of 100% mortgages.

In this article, we look at different mortgage deals and how much deposit is required for each one, as well as the financial impact that your deposit amount will have over the short and long term.

Short for time? Here’s a quick video overview of mortgage deposits.

- 0% Deposit Mortgages

- What is a guarantor mortgage?

- Mortgages with deposits

- How is the mortgage deposit amount calculated?

- What is the recommended mortgage deposit amount?

- How to calculate your mortgage deposit amount

- What does LTV stand for?

- What are the benefits of a higher mortgage deposit?

- Options for people who can't save up a large mortgage deposit

0% Deposit Mortgages

Despite the pre-2008 0% deposit mortgages no longer being available, there are still some options to get on the property ladder with a small deposit or no deposit at all.

The only way to get a 100% mortgage in the current market is to take out what is called a guarantor mortgage.

What is a guarantor mortgage?

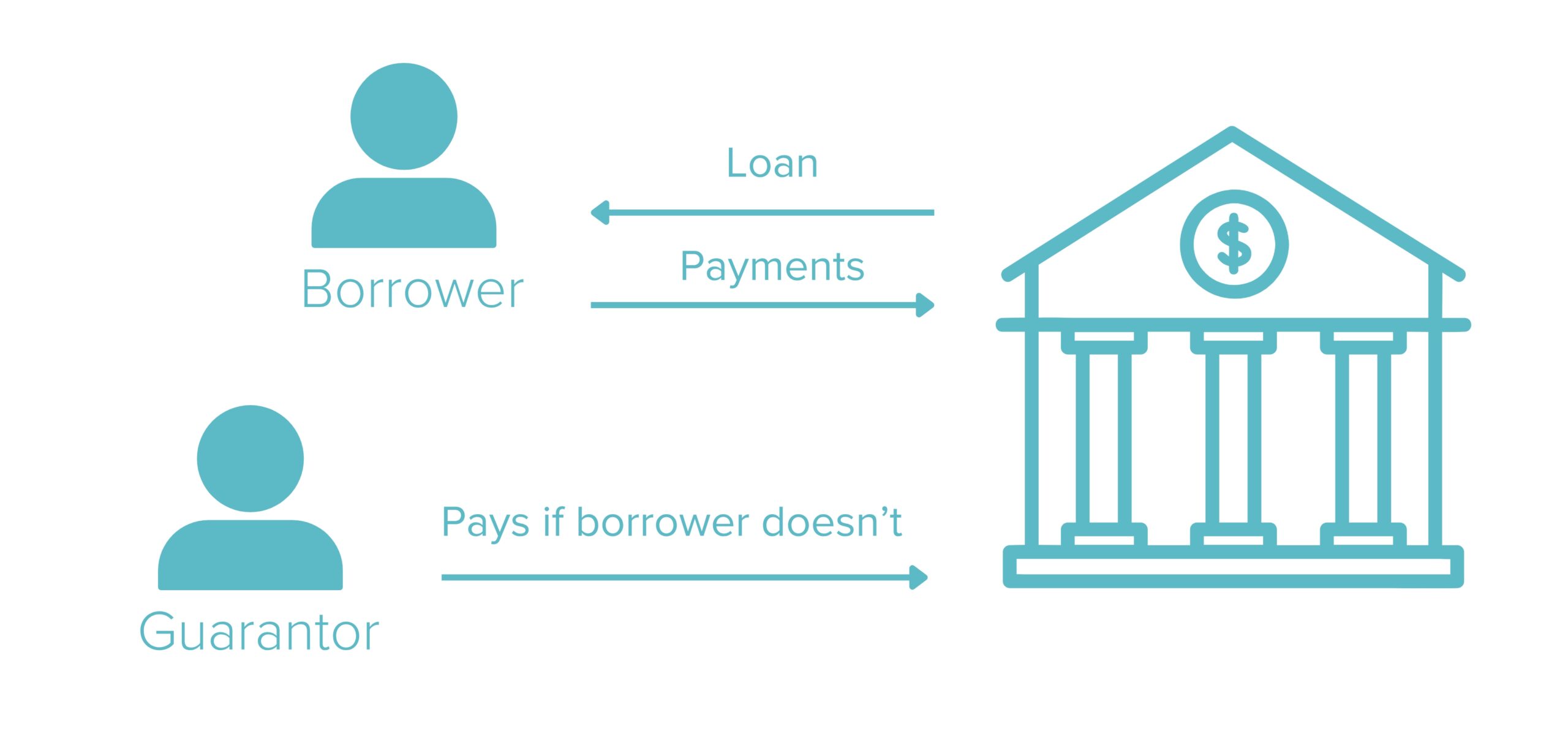

A guarantor mortgage involves taking out a mortgage but with the requirement to have a guarantor.

This essentially means that someone you know, such as a relative or friend will agree to be a guarantor on your mortgage.

The guarantor (usually parents or grandparents) will be required to use their savings or even their own home, as security against the mortgage.

In return for this security, certain lenders will be prepared to offer a 100% mortgage with no deposit.

While this type of mortgage is very useful for people who cannot save up a deposit, it is risky for the guarantor.

If mortgage repayments are not made on time, it is their savings or property that is on the line. They could potentially lose their savings or home if the mortgage repayments are not paid.

However, for many families, guarantor mortgages offer a good solution as an alternative to parents gifting a lump sum for a deposit.

Another option for people to get onto the property ladder from a young age would be getting a mortgage with their parents.

Free consultations are offered in the UK.

Get Started NowMortgages with deposits

In April 2021, the UK government introduced a 95% mortgage guarantee to help first-time buyers to purchase their own home.

Prior to this, when COVID-19 first struck the U.K. economy, most lenders required a 10% deposit as part of the lending criteria.

The scheme works by the government guaranteeing the 95% mortgages, so there is less risk for the lender.

Other than the government guarantee mortgages, most mortgage products require a minimum of 10% deposit, with some asking for 15% or even 20%.

Higher risk borrowers may be required to pay a larger deposit to offset some of the risk.

How is the mortgage deposit amount calculated?

The deposit is calculated as a percentage of the property that you are buying. For example, if you are buying a house for a £200,000 purchase price, a 5% deposit would be £10,000 and a 10% deposit would be £20,000.

As you can see, the difference between 5% and 10% is quite considerable, so the government guarantee has helped to make buying a home more realistic for many people.

Even people on the average UK salary with minimal outgoings would usually have to save up for a long time to reach the 10% required without this scheme.

What is the recommended mortgage deposit amount?

Although a lot of first-time buyers will opt for a mortgage deal with the lowest deposit possible, the more deposit that you put down, the better the interest rates available.

Therefore, if there is the possibility to save up for a while longer, you could save a significant amount of money in interest.

For example, if you have a 20% deposit, you should be able to get a deal with a lower interest rate than if you only have a 5% or 10% deposit.

To access low-cost deals, it is recommended that you aim for a minimum deposit of 20%. Interest rates will continue to fall in 5% LTV brackets until you have at least a 40% deposit.

After that stage, you could have a 40% deposit or an 80% deposit, as an example, and you would have access to the same interest rates.

How to calculate your mortgage deposit amount

To calculate 20% deposit for the house price you are looking to pay, multiply the price by the deposit percentage.

For example: £250,000 x 20% = £50,000.

For 10% you multiply by 10%, so the deposit on a £250,000 property would be £25,000.

For 5% you multiple by 5%, which on the same value property is £12,500.

What Our Clients Have To Say

What does LTV stand for?

The loan to value (LTV) is the term that is used to describe how much you are borrowing compared to the value of the house.

Working out the LTV is similar to working out the deposit:

If the house value is £250,000 with a deposit of £50,000, your mortgage amount is £200,000.

Then you divide the mortgage by the house price:

£200,000 / £250,000 = 0.8

Multiply this by 100 to get the percentage of LTV = 80%.

When you start looking at different mortgage rates you will see them listed with the LTV displayed for each product.

The same lender will usually have several deals available, each one applying to a different LTV amount.

The LTV is not just important for when you are looking at first-time buyer mortgages, it is also a significant factor when homeowners look to re-mortgage when they want to get a better deal.

After several years of paying off a mortgage and the good possibility of the house value increasing, many homeowners will have a better LTV compared to when they took out their existing mortgage deal.

This often gives people the opportunity to switch to a new mortgage deal with a lower interest rate once their fixed rate period ends.

There are some exceptions to this, for example, if they have missed payments on their mortgage or have other adverse finances affecting their credit score.

In these situations where there is now adverse credit on the client’s credit file, regardless of whether or not the LTV has reduced since the last mortgage application, it is likely that the interest rate will be higher for the remortgage.

This is because there is now a greater risk to the lender of the applicant not meeting their mortgage payment obligations.

There is also the possibility that the property could decrease in value, in which case the LTV might not improve even if two, three or five years of mortgage payments have been made.

What are the benefits of a higher mortgage deposit?

When you are deciding whether now is the best time to buy a property or you should wait and save up more deposit, these factors can help you to decide:

Better mortgage deals

The higher deposit you have, the more chance you have of getting a mortgage deal with a lower interest rate.

Less risk

One of the biggest risks when you buy a property is that you could end up with negative equity.

This happens when the value of the property is less than the amount that is outstanding on the mortgage.

While this is fairly uncommon due to the fact that property values generally increase over time, a crash in the property market or an issue with your specific property or area could lead to negative equity.

When you have negative equity in a property, it can make it difficult, if not impossible, to move home or switch to a better mortgage deal.

The more deposit you pay, the less chance of negative equity as you are taking out a smaller mortgage and there is less likelihood of the value dropping below the mortgage amount.

Improved acceptance rate

One of the major benefits of saving up a bigger deposit is that there is an improved chance of having a mortgage application accepted.

When you have a better LTV, you pose less of a risk to a mortgage lender, as there is a lower chance of negative equity.

Options for people who can’t save up a large mortgage deposit

Saving up a large deposit is the ideal scenario, but it is not a realistic option for most people.

Even saving up a 5% deposit can be very challenging when there are bills such as rent to pay and your income minus your outgoings does not allow you to make savings each month.

Fortunately, there are some alternative options available to help people to get onto the property ladder when they are not able to save up a deposit.

We discussed the option of guarantor mortgages earlier in this article, where a guarantor is required on a mortgage in exchange for a 100% mortgage.

Shared ownership

Another option available to people who want to buy their own property is a shared ownership scheme.

In this scenario, you are buying part of the property and you pay rent on the rest of it.

The stake that you own will vary depending on the specific property you are looking at, but it will be between 25% and 75%.

The rest of the property will be owned by a housing association, and you will pay rent on the stake that they own.

As an example, if you bought a 40% share in a property worth £200,000, the value of your share would be £80,000.

Lenders will require you to contribute a certain deposit sum and they will calculate LTV from the value of your share.

As the value is £80,000 instead of £200,000 for the full property, a 5% deposit would be £4,000 instead of £10,000 so it can help people to buy a property faster.

Typically, you would then pay rent of around 2.75% on top of the mortgage repayments.

There are pros and cons of using the shared ownership scheme and if you want to eventually own the property, you would need to ensure you are able to staircase.

This allows you to buy bigger stakes in the property up until you own it outright.

If you sell a property that you have shared ownership with, any equity would be split by the percentage of stake each owner has.

One of the negative aspects of the shared ownership scheme is that it only applies to certain properties and you might not be able to find a shared ownership property in the area you want to live in.

Lifetime ISA

A Lifetime ISA (LISA) is available to people aged 18-39 and allows them to save up to £4,000 per tax year towards a home, with the government adding a 25% tax-free bonus on the savings.

Therefore, if you are able to save the full £4,000 allowance in a year, it will be topped up by £1,000.

The maximum bonus available per annum is £1,000.

After two years you would have £10,000 deposit to use for a property, which reduces the length of time it takes to save up the deposit.

Parents and grandparents can put money into their child’s LISA to help the savings to increase quicker and the bonus is still applicable to that money.

Free consultations are available in the UK.

Get Started NowConclusion

To conclude, there are multiple options in terms of how much deposit is needed for a mortgage.

If you are able to arrange a guarantor mortgage, you would not need any deposit at all.

However, if this is not a possibility or you do not want to choose this option, the lowest amount of deposit required is 5% of the property value.

Due to the government’s 95% mortgage guarantee scheme, there are currently many products available on the market that require a 5% deposit.

Before you apply for a mortgage you should review all of the available options and consider the impact of waiting and saving up a larger deposit.

The overall interest on a 90% mortgage compared to a 95% one will be considerable over the term length, so waiting until you have a 10% deposit will help you to keep your total mortgage costs down.

Boon Brokers is a fee-free whole-of-market brokerage and has a vast knowledge of the mortgage industry.

We have helped many first-time buyers purchase their home through finding the best available mortgage deals.

To help find the right mortgage deal for your short-term and long-term requirements, contact us for an informal chat and we can get started.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Mortgage Broker Fees

- How Much Does The Average Mortgage Cost

- How To Get A Mortgage With A New Job

- Mortgage Borrowing Calculator

- How To Get A Mortgage After Bankruptcy

- The Mortgage Underwriting Process

- Advantages Of A Mortgage Broker

- How Long Does A Mortgage Application Take?

- Purchasing A Property With Shared Ownership

- The House Buying Process

- What Should I Ask When Buying A House?

- Military Mortgages Guide