All You Need to Know About Buy-to-Let

Although the principle of taking out a mortgage is fairly similar whichever type of mortgage you take out, there are some significant differences between a residential mortgage and a buy-to-let mortgage.

From the eligibility criteria, to the different terms on lending, this article should provide you with all of the information you need regarding buy-to-let mortgages.

What is different about a Buy to Let Mortgage?

A buy-to-let mortgage is taken out by a landlord when they buy a property to rent it out to a tenant.

Typically, this will be where a landlord buys property in order to make a profit from renting it out.

However, there are lots of costs that a landlord is responsible for that must be taken into account if they are considering renting out a property.

The criteria for being accepted for a buy-to-let mortgage is stricter than for a residential mortgage and generally involves higher interest rates and a larger deposit.

These are the key differences you will usually find:

- Higher deposits required for buy-to-let mortgages.

Whilst residential mortgages can be provided with a minimum of 5% deposit, buy-to-let mortgage lenders will usually require at least a 25% deposit.

This is because a buy-to-let can be seen as a higher risk to lenders, with issues such as landlords not being paid rent by their tenants, or the property being vacant for times.

- Interest rates are higher for buy-to-let.

Interest-only mortgages are more common with buy-to-lets but with repayment mortgages, across the market the interest rates are higher than the residential mortgage interest rates.

At the time of writing this article, the lowest residential interest rates were coming out at around 1.50% initial rate for fixed mortgages, whilst buy-to-let were around 2% at least.

- Higher fees for buy-to-let.

People looking at buy-to-let mortgages should also expect to see higher fees for setting up the mortgage, many lenders apply charges of £1,500 to £2,000, whilst residential mortgage fees will usually be half of that.

What should I consider if taking out a buy-to-let?

There are many costs, risks and responsibilities that a landlord takes on when they decide to rent property out.

To start with, there are the tax rules that you must consider, including tax on profits.

There will usually be a stamp duty when you purchase a new property, and if/when you sell the property, you will need to pay capital gains tax.

You will also need to decide whether you want to rent the property through a letting agent, or deal with the letting yourself.

Agent fees can vary depending on how much they are responsible for, as some will arrange maintenance, some will just find a tenant and then you manage the letting, so you must work out which one is the best option for your circumstances.

Buildings and contents insurance will be required to protect the property, with specific landlords insurance being an option that provides further levels of cover.

As a landlord, you are responsible for the costs of repairs to the property and this can be very costly, especially if boilers need replacing or other large outlays.

You also need to consider whether you can afford to pay the mortgage if your tenant misses payments, or if there are periods of time when there is no tenant in the property.

Whenever the property is vacant, you are responsible for paying council tax and any bills that arise in that time.

Another consideration is that interest rates can change, as can landlord’s tax responsibilities, so getting tied into a long buy-to-let loan might not be the best option if you want the flexibility of selling the property without an early repayment charge.

Further to this, you have to think about the possibility of not being able to sell the property at the time that you need to or want to.

The demand for houses in that area could drop, the housing market could crash etc.

Free phone and video consultations are provided in the U.K.

Get StartedHow big can the loan be?

The amount of the loan will depend on a variety of factors but mostly calculated based on the amount of rent that the property will be able to command, which will vary depending on the type of house and the area.

The amount of deposit will also be taken into account and mortgage lenders will look at an applicant’s credit report too when deciding how much to lend.

Typically, lenders will require the rental income to be around 20-30% more than the monthly mortgage payment for them to take on the risk of the loan.

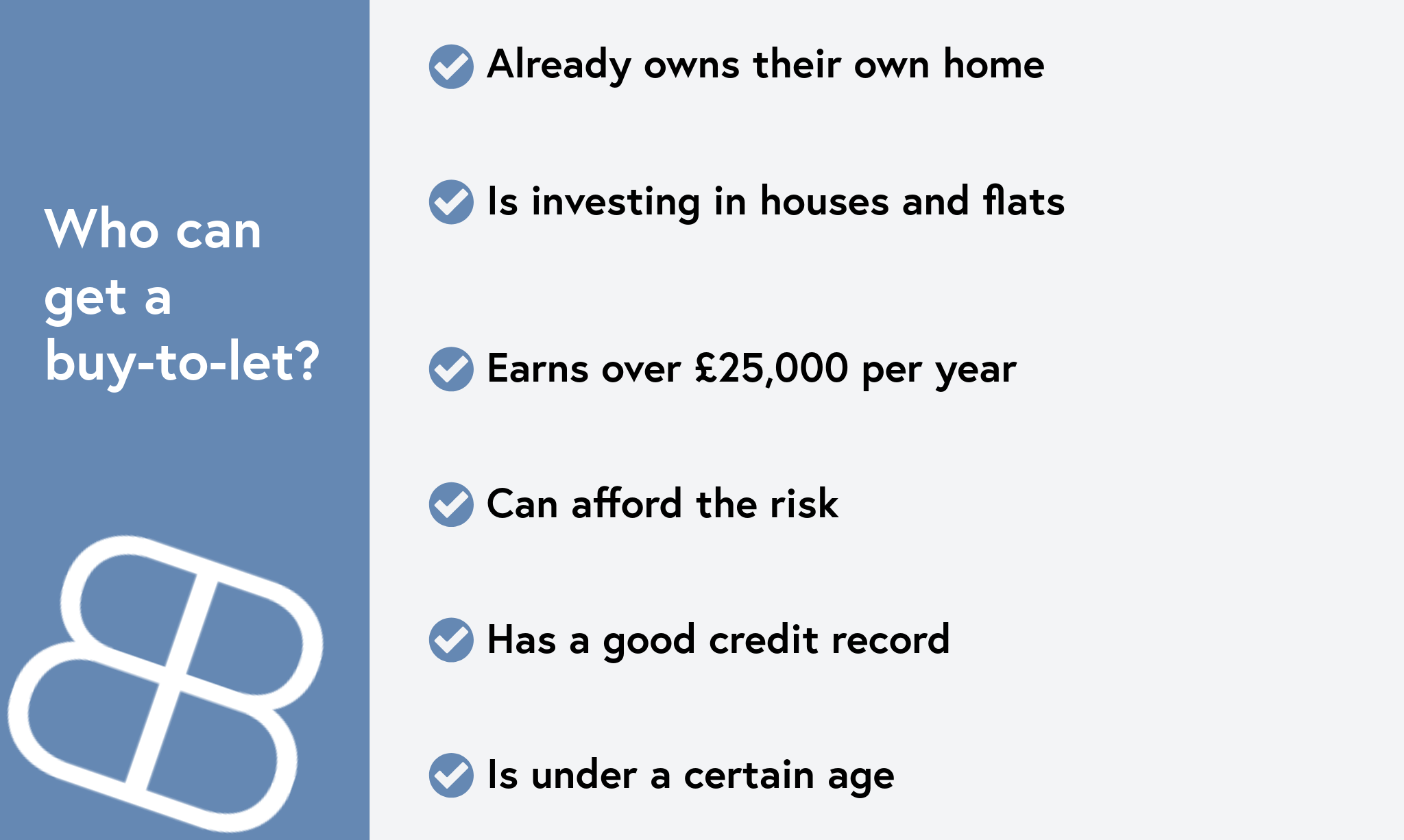

Who can get a buy-to-let?

A buy-to-let mortgage will only be available to people that match a certain set of criteria, this generally includes that the applicant:

When the mortgage lender is looking at whether to accept a buy-to-let mortgage application, they will conduct a thorough check of credit history and affordability.

They will usually require some kind of evidence of the amount of rent that the property can expect to receive, through a letter from a surveyor.

Planning ahead

It is really important that anyone considering buying a property to rent out and taking on the commitment of a buy-to-let mortgage is well prepared for the different scenarios that could happen.

One of the biggest concerns for landlords is when they do not have any rent coming in and needing to find the money to pay for the mortgage, usually on top of their own mortgage if that is outstanding. Therefore, it is advisable to have cash set aside for that type of scenario.

As well as having the property vacant for periods of time, there is also the possibility that the tenant doesn’t pay their rent.

This could be a one-off scenario, or you could even face a tenant not paying for several months and you then need to take legal action to evict them and to try and get your rent payments back.

You must also plan for events such as big repair costs.

As a landlord, you are responsible for paying for repairs to the heating system and other maintenance.

A big cost like replacing the boiler, replacing windows or other costs can come along when you least expect it, so again having a pot of money to cover those unexpected issues is a good idea.

Tenants can also cause a lot of wear and tear and damage to your property, which might mean replacing the carpets and decorating is required more often than you would have anticipated.

Your tenancy agreement should include tenants paying for any damage to property and you should also obtain a deposit from tenants before they move in, in case they do cause any damage to the property.

Another element of getting a buy-to-let mortgage that requires planning for, is the event that you may not be able to sell the property when the mortgage ends, or you cannot get the value that you want when you sell the property.

See What Our Clients Have To Say

What happens when the mortgage ends?

If you opted for an interest-only mortgage then you will need to pay the outstanding cost of the property from when you bought it.

In most cases, landlords will sell the property so that they can pay off the mortgage but there can be problems with this, for example if you cannot sell the property for the cost of the mortgage.

Conclusion

Whilst many landlords are still able to make good profits from renting property out and taking out buy-to-let mortgages, there are a lot more considerations to take into account.

Difficult tenants, regular maintenance and repair costs, as well as covering the mortgage payments when no rent is coming in are some of the main problems that landlords face but there are many more.

If you are considering taking out a buy-to-let mortgage to rent property out as a landlord, you should do plenty of research into all of the responsibilities and costs that you are liable for.

Taking out the right level of insurance is one way to protect yourself but speaking to a specialist buy-to-let mortgage broker will also help you to decide whether it is the right option for your circumstances.

A good mortgage broker will be able to find you the best buy-to-let deals and talk through all of the options, discussing the financial factors that you should take into consideration before making your decision.

If you would like to speak to a professional broker service with buy-to-let expertise, call Boon Brokers.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- What Is A Tenants In Common Agreement?

- How To Buy A House After Lockdown

- How Much Deposit Do I Need For A Mortgage

- What Should I Ask When Buying A House?

- What Proof Of Income Is Needed For A Mortgage?

- Should I Use My Estate Agents Mortgage Broker?

- How Much Deposit For A Mortgage?

- Reasons Why Mortgage Applications Are Declined

- How To Get A Mortgage With A New Job

- Reduce Mortgage Term Or Overpay

- Choosing A Mortgage Broker

- How Long Does A Mortgage Application Take?

Authorised and regulated by the Financial Conduct Authority. No: 973757

Authorised and regulated by the Financial Conduct Authority. No: 973757