How To Choose a Mortgage Broker: The Essential 2026 Guide

There are many reasons why you might want to use a mortgage broker, from saving time and money to receiving the most up-to-date advice and guidance in helping secure the best mortgage product that is available to your specific circumstance.

Here at Boon Brokers, we’ve heard all the questions that you might have around choosing the best mortgage broker, that’s why we’ve created this essential guide to how you can choose the best mortgage advisor for you. Let’s dive in and explore what a mortgage broker is, how they can help, and all the benefits and various services a mortgage broker could provide you.

Short for time? Here’s a quick video overview of what to take into account when choosing a mortgage broker.

The Definition of a Mortgage Broker

A mortgage broker is someone who will act as an intermediary between a mortgage borrower and mortgage lenders. A mortgage broker will work directly with you, learning your exact needs and requirements to provide you with specialist advice on available mortgage deals that match your specific financial circumstances.

Whether you’re a first-time buyer, an established property owner, or looking to remortgage your current home, it is the job of a mortgage broker to first evaluate your requirements and then to explore and provide the best advice and opportunities available to you through a variety of mortgage lenders.

What Do Mortgage Brokers Do?

In the world of finance and mortgages, it’s a fair and common question to ask: “what do brokers do?”

Simply, a mortgage broker will provide tailored guidance in helping you navigate the difficulties of mortgages. This specifically includes exploring options related to your financial standing and circumstances – a service that is particularly useful for those who have unique circumstances, adverse credit, or are simply unknowing about the processes and proceedings of acquiring a mortgage.

The main benefit of using a mortgage broker is that they have an in-depth knowledge of the mortgage market, often with specialist knowledge about certain lenders, government schemes, and upcoming opportunities that can help save money and accelerate your search for your perfect property purchase.

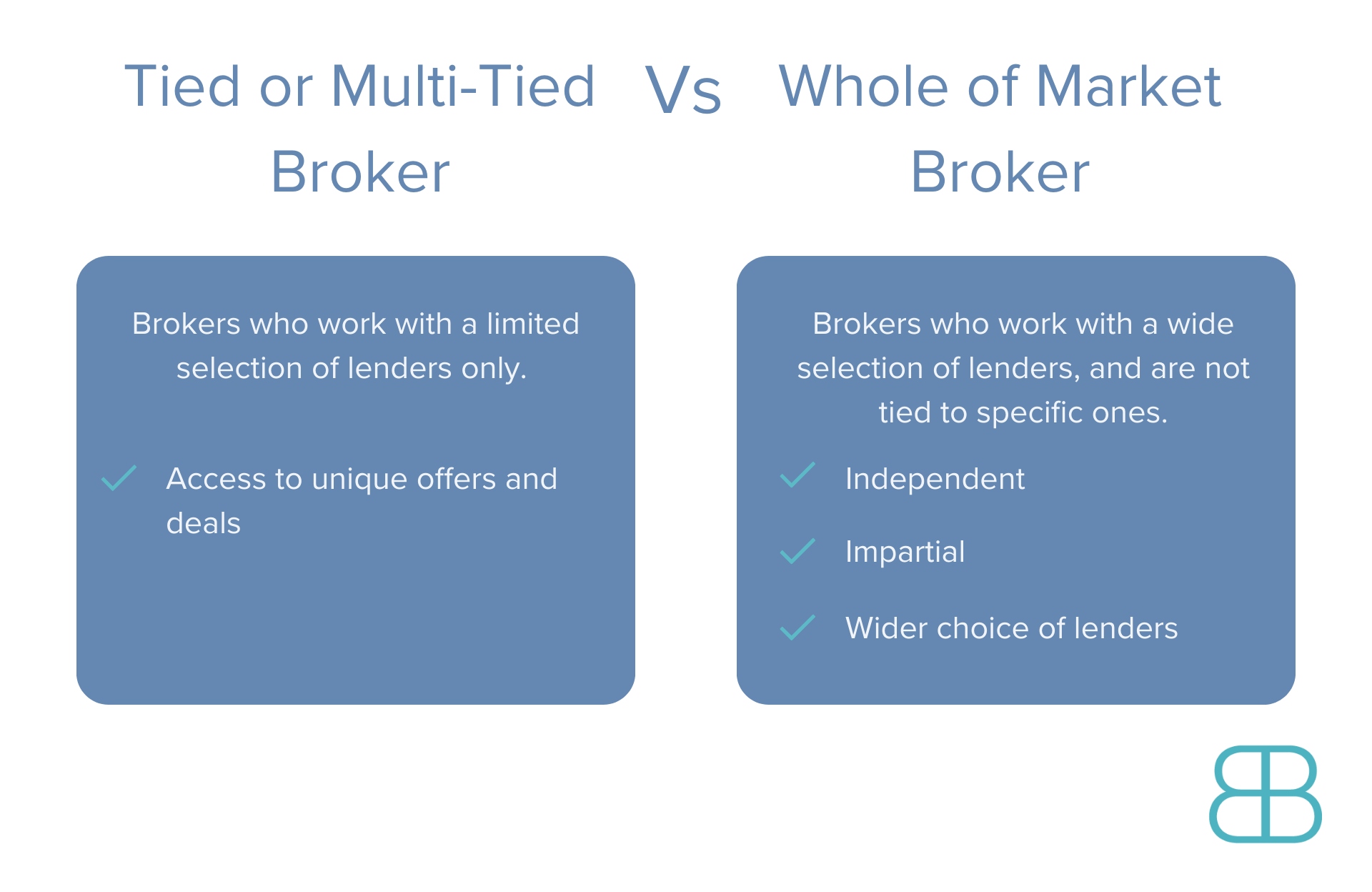

There are three main types of Mortgage Brokers, these include:

- Tied mortgage brokers: work with a single lender or small number of lenders

- Multi-tied mortgage broker: Work with a small number of lenders

- Whole of market mortgage broker: Have a broader view of all lenders and look at the widest range of products

Here at Boon Brokers, we are a fee-free mortgage broker with a whole of market mortgage license – and we think that’s of crucial importance when getting to know exactly what your mortgage broker will offer you. As a whole of market mortgage brokerage, our specialists can take a holistic view of both your circumstances and the available mortgage products that would be accessible to you on the wider market – meaning we can help find you the best possible mortgage tailored to your financial situation.

Why Use a Mortgage Broker?

Now that we’ve highlighted exactly what you can expect from a mortgage broker, it starts to become apparent as to the massive benefits and reasons to use a mortgage broker. Armed with their expert knowledge and years in the field of navigating the world of both mortgage lenders and mortgage borrower queries, an established and trusted mortgage broker is in the ideal position to help you find and choose the right mortgage for your financial situation.

How Mortgage Brokers Help Borrowers

Choosing the right mortgage can make a significant difference in your overall costs, and so choosing the right mortgage deal can potentially save borrowers – that’s anyone applying for a mortgage – thousands of pounds.

When you work with a trusted Broker, they bring a wealth of knowledge and context to the party, and will have inevitably worked with a variety of different lenders before. This is a massive advantage when it comes to understanding the specific criteria of each lender, as it should be noted, generally, not all lenders will be available for just any applicant.

In reality, there are a wide-range of lenders with differing criteria and even specialist lenders that could be utilised in certain situations. Established brokers have a deep understanding of this context and can use their knowledge to help guide you through applying for the best mortgage for you.

Generally, when borrowers apply for a mortgage, lenders will assess their financial standing based on the following:

- Credit report

- Loan amount

- Loan-to-Value (LTV) ratio

- Income and employment status

- Any other key financial details

Leaving the entire search for a perfect mortgage to yourself could leave you on the back-foot when it comes to the breadth and depth a broker could provide. In addition to this, whole-of-market mortgage brokers have access to industry specific software that can help quickly match borrowers with the best available deals that are on the market today.

When to Use a Specialist Mortgage Broker

If you’re in a situation whereby your financial circumstances are not ideal for a typical mortgage loan – for example those with a low credit score or fluctuating incomes – then using a specialist mortgage broker could prove to be invaluable. Specialist mortgage brokers can help match borrowers with mortgage lenders that offer specific advantages predicated upon a variety of situations. For example, these lenders might specialise in mortgages for NHS workers, offer increased flexibility when calculating the mortgage, or even offer specific professional mortgage perks – such as the Kensington Hero Mortgage product.

It’s also important to note at this juncture that for self-employed borrowers, completing a mortgage application can be quite challenging without knowing the differentiating factors from employed work. As such, self-employed workers can also really benefit from specialist mortgage brokers and can help ‘steer the ship’ through the hurdles of irregular payslips, fluctuating income, and proof of income.

The Key Advantage of a Fee-Free Mortgage Brokers

One of the massive advantages of using a fee-free mortgage broker is that it is exactly what it says on the tin, and can save borrowers looking for an ideal mortgage both time and money. Using a trusted mortgage broker’s depth of experience and understanding can help speed up the entire mortgage process and can streamline a lot of the formal proceedings. This includes tasks like paperwork, speaking to different lenders and solicitors, all of which can be very time consuming – not to mention the chance of potentially losing out on a property purchase if a mortgage approval takes too long.

In addition to this, all mortgage brokers should be regulated by the Financial Conduct Authority (FCA). This legislation is in place to protect the borrower and makes sure that each official mortgage broker meets the specified industry standard.

The Risks of Getting No Advice

If you’ve already dabbed your toe in the world of mortgages and finance then it will go without saying – mortgages are complex. There are many spinning wheels when it comes to a successful mortgage application and without advice on getting a mortgage from a broker, there are a variety of risks that you may run into, from paying more than necessary to being hit with high and unforeseen interest rates. Furthermore, by choosing not to work with a broker, you will also lose the protection of any safeguarding that a broker can offer.

A free mortgage broker advice service – like Boon Brokers fee-free services – can help ensure that you are guided each step of the way with specialist industry knowledge and expert recommendations. And so for no additional cost, a fee-free broker can help you avoid expensive mistakes and potentially save money when finding the best mortgage deal for you.

Unsure about your broker? Get in touch.

What Types of Mortgage Brokers are There?

As mentioned above, there are typically three main types of Mortgage Brokers, these include:

- Tied mortgage brokers: brokers who will work with a single lender or small number of lenders.

- Multi-tied mortgage broker: Brokers who will only work with a small number of lenders.

- Whole of market mortgage broker: Brokers who have access to a broader view of all lenders and look at the widest range of products.

It’s important to check exactly what your broker offers and how they operate. Not all brokers who claim to be whole-of-market mortgage advisors will check direct-only deals. Here at Boon Brokers, we always suggest checking the reviews and customer/clients experience before committing to a free mortgage broker.

Mortgage broker fees and commissions

There are typically two ways in which Mortgage brokers may charge a fee for their services; an upfront fee for their service, or they may simply apply a fee to the lender.

While the average mortgage broker fees are around £500, the overall amount can vary depending on specific brokers and their policies. For example, some brokers will charge a fixed fee, while other brokers will charge for their time in hourly rates. In some cases, brokers may charge both the lender and the borrower based on a percentage of your mortgage.

For those looking for a fees-free mortgage broker – such as Boon Brokers – we do not charge clients at any stage. Instead, we will receive a small commission from the lender for our services, allowing you – the borrower – to have access to free and expert mortgage advice truly at no cost.

It can be important to note that under the FCA regulations, all mortgage brokers must be transparent about their fees. As such, should you encounter any mortgage brokers that are not upfront about their charges – this could be a huge red flag – and borrowers should be cautious.

Key Questions to Ask a Mortgage Broker

Getting equipped with some of the essential questions to ask a mortgage broker can really help streamline your overall mortgage process and ensure you get a broker that is right for you. Before choosing your broker, it’s important to know that they can use their background and industry insights to help match you with a mortgage that is ideal to your circumstances.

Thankfully, here at Boon Brokers, we’ve heard them all! So, if you’re unsure on where to start, here are some essential questions to ask a mortgage advisor so that you can make an informed decision.

Are You A Whole-Of-Market Mortgage Broker?

Being a whole-of-market mortgage broker means they will have access to all of the available mortgage deals on the market. This is a huge advantage when it comes time to match you with a mortgage deal that is bespoke to your financial standing.

Will You Tell Me About Mortgages That are Only Available Directly from Lenders?

The best advice here – and actually for every question in this list – is if you don’t ask, you’ll never know. It’s not uncommon for mortgage brokers to include deals from online home lenders or those offering direct-only mortgages.

We also suggest that you prioritise researching reviews on mortgage lenders and comparing broker-advised deals with those from top-rated mortgage lenders as this can help provide you with a more holistic perspective on what is available and help you make an informed decision.

What are Your Fees and Charges?

Perhaps one of the most important questions and answers is finding out exactly how much you’re expected to pay for the services of a mortgage broker. Well, the average mortgage broker fee can vary depending on their method of charging for their services. For example, some may apply a flat fee while others will charge a percentage of your mortgage. Working with a fee-free mortgage broker – like Boon Brokers – we will earn commission from the lender instead of charging the borrower.

Our experience and advice: you should be able to find a reputable mortgage broker that will not charge you any fees for their service because they will be paid by the lender instead.

What is Included in the Service You Offer? And Will You Handle All Admin and Chase Lenders?

The main advantage of using a mortgage broker is that they will manage the mortgage process for you and do all the heavy lifting. This will include all of the admin and paperwork, liaising (and sometimes chasing) with lenders, and making sure that your application process is progressed at a smooth pace.

When deciding on which broker you would like to work with, it is important that you ask for a clear breakdown of their mortgage advice services. This will provide you with clear insight into what services they offer and how much they are prepared for. Just as with all walks of life – some mortgage brokers will offer the minimum service, while others will always try and go the extra mile for you.

When Will You Be Available?

A crucial question when time is of vital importance to you. Our advice is to never assume that the broker will be able to start working on your mortgage search/application immediately. It is most likely that they may handle lots of other clients, which could cause a slight delay to your personal mortgage advice.

If time is a priority for you, we suggest that you ask about their availability and expected timelines.

How to Choose a Mortgage Broker?

There are three main factors that you should consider before choosing your mortgage broker:

- Are they a whole-of-market broker?

- What are the charges or hidden fees?

- How much experience do they have?

As we’ve already discussed in this article, a whole-of-market broker – like Boon Brokers – can offer significant benefits over a tied mortgage broker. If you’re looking for access to the best mortgage providers, then we suggest working with a reputable, whole-of-market broker – ensure that you have access to all available mortgage products that are on the market today.

It goes without saying that knowing whether you will be charged a fee for your service is important. Make sure that you know if your mortgage adviser has a fee or whether it is a fee-free broker like Boon Brokers.

Know the company or broker you choose – research their process and most importantly look at some online reviews. A reputable mortgage broker will have great reviews from their clients which will provide an insight and testimony to their knowledge and experience.

In addition to these 3 factors, it is also important to ask yourself – would you be happy with online advice, or would you prefer in-person consultations? Some mortgage brokers operate with a web-based service only, and so deciding on whether you’re comfortable with a wholly online experience or being able to talk to someone face-to-face about your mortgage details is important.

Finally, you should also check what qualifications a mortgage adviser has. In the UK, the qualification approved by the FCA is the Certificate in Mortgage Advice and Practice (CeMAP). All brokers should also be authorised by the FCA, so you can check that they are by searching on the Financial Services Register .

See What Our Clients Have To Say

Know Your Rights When Using a Mortgage Broker

When you decide to work with a mortgage broker for mortgage and financial advice, they should complete a detailed review of your circumstances in order to establish the best deals that are available to you, tailored to your financial standing.

Additionally, your broker should be able to advise you on both the advantages and disadvantages of the available mortgage types, and be able to advise you on which one would be better suited to your circumstances. All recommendations made by the broker should be fully justified with an accurate breakdown of the finances of the deal, with an explanation as to why the deal is a better option for you.

Speak to a Mortgage Broker

There are so many reasons for using a mortgage broker when buying a home. Purchasing a house is a significant investment and mortgage deals vary greatly. Without taking expert advice from a broker, you risk paying thousands of pounds more than if you had been shown a better deal from a broker.

As brokers have access to many more lenders than you would be able to access yourself, it makes sense to use them and save a lot of money. With the majority of brokers not charging mortgage applicants for their services and instead working on commission from the lender, there is usually no additional cost for the applicant.

If you are looking for free expert mortgage advice, look no further as we can help. Get in touch with us by calling 01508 483983 or filling in our contact form.

Need Mortgage Advice?

Submit an Enquiry

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Should I Use A Broker Or Go Direct?

- How To Not Get Ripped Off By A Mortgage Broker

- Advantages Of A Mortgage Broker

- The House Buying Process

- What Is A Guarantor Mortgage

- Should I Use My Estate Agents Mortgage Broker?

- What Proof Of Income Is Needed For A Mortgage?

- What Should I Ask When Buying A House?

- What Is An Offset Mortgage?

- How Much Deposit Do I Need For A Mortgage

- What Are Solicitor Searches?

- Everything You Need To Know About Buy To Let