Stamp Duty Reform Sparks Public Outcry and Financial Uncertainty [September 2025 Study]

New research from Boon Brokers reveals that UK homeowners are concerned with the proposed reform plans to Stamp Duty Land Tax (SDLT), with the majority concluding both an annual property tax and seller-paid SDLT as unfair and unmanageable. Download the full research file in the footer of this article.

Key Findings:

- 96% of respondents believe that the 0.5% proposed annual property tax would rise over time

- 75% of respondents believe retired and working homeowners would suffer most under the annual tax

- 71% of respondents aged 65 and over believe retired homeowners would suffer most

- 66% of respondents aged 65 and over say the tax would cause financial strain

- 57% of respondents are very concerned about future tax increases

- 51% of respondents would be less likely to buy property if an annual property tax were introduced

- 42% of respondents believe the proposed Stamp Duty changes are unfair

- 21% of respondents say they could not afford the proposed annual property tax

Data Summary:

| 1,000+ respondents – TLF Research |

| Participants from North, East, West and South of England |

| All Age Groups |

| Homeowners |

To better understand how UK homeowners view the latest government proposals on property taxation, Boon Brokers’ latest research asked public opinion on the two potential reforms:

- Current rules: Buyers pay Stamp Duty Land Tax (SDLT) as a fixed sum when purchasing a property. Sellers have no SDLT liability.

- Proposed reform 1: Responsibility would shift from the buyer to the seller. Sellers of properties valued over £500,000 would be required to pay SDLT based on the value of their property when they sell.

- Proposed reform 2: SDLT would be abolished entirely and replaced with a 0.5% annual property tax, levied on property above £500,000, based on the current value of their property.

The research revealed that both proposed changes have been met with strong scepticism, with homeowners expressing concerns that the reforms could unfairly impact those already under financial pressure. These concerns are particularly pronounced among retired and older working households who have already paid off their mortgages.

For many in this group, the data highlights a perception that an annual property tax could pose a significant financial burden and threaten the financial security long associated with homeownership.

Beyond personal finances, the research also reveals broader market risks with a clear resistance by homeowners to moving or selling if either of the proposed taxes were introduced. Homeowners stated that an annual property tax on high-valued homes, or shifting SDLT to sellers, would ultimately discourage mobility, reduce incentives to improve properties, and make social mobility increasingly difficult.

An Unfair Double Taxation

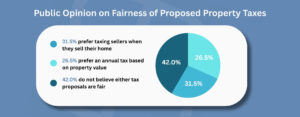

In answer to the question “Which proposed method of taxing property do you believe is most fair?” Research revealed that, out of three options, the largest proportion of respondents (42%) stated that neither the annual property tax nor a seller-paid SDLT would be a fair taxation.

A main point of contention that the research highlights here is public concerns of a “double taxation”, particularly among recent homeowners who have already paid SDLT on their property purchase.

For these homeowners, the impact is perhaps more tangible. While complying with current SDLT regulations, recent homeowners have already paid a percentage of their property purchase. The introduction of a 0.5% annual tax would, therefore, impose an additional cost on an asset that does not generate income.

To compound the matter further, the research also revealed that 44% of all respondents would experience financial strain should an annual taxation be introduced, with a shocking 20% stating that they simply could not afford it.

These statistics underline the public feeling that the implementation of either proposed taxation is likely to penalise homeowners. Whether the tax implication is shifted to the seller or whether an annual taxation is planned, those who have already climbed onto the property ladder will inevitably face additional tax and increased financial pressure.

Tax Reform Hits Retirees and Older Homeowners

Households with limited income, such as retirees, are thought to feel the brunt of this taxation with 37% of respondents listing retired homeowners as the category that would suffer most from an annual property tax.

Among those aged 65 and over, this concern is even more pronounced, with 71% stating that retired homeowners would be the hardest hit, highlighting the fear among older generations about the potential financial impact.

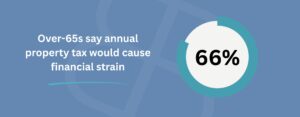

Many retirees have spent their lives working to pay off mortgages, leaving them “asset rich but cash poor”, and the research shows how the suggestion of an annual property tax would threaten this very group: 66% of homeowners aged 65 and over believe that an annual property tax would create financial strain.

For this group, the proposed SDLT reforms are viewed as particularly challenging. Many retirees have planned their later years around the expectation of reduced living costs and mortgage-free homes, with research indicating an annual property tax is being perceived as undermining that very security – especially amongst those who are reliant on fixed incomes such as pensions.

Across all respondents, 75% believe that retired and working homeowners would suffer the most under the proposed reforms, pointing to a broader topic of concern around fairness and the knock-on financial impact over a longer period of time.

Housing Market Mobility Freeze

Focusing on the wider implications on the housing market, the research points towards additional risks for the housing market, and most specifically on how the proposed SDLT reforms could influence homeowner behaviour.

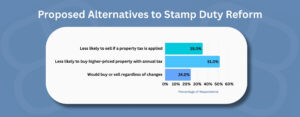

35% of respondents said they would be less likely to sell if sellers were required to pay a property tax, while over half (51%) stated they would be less likely to buy a higher-priced property if an annual property tax was introduced. But most revealing, only 24% of respondents said they would continue as planned, regardless of the reforms.

Following this data, the predicted behavioural changes suggest a potential “mobility freeze” within the housing market. Fewer homeowners may be willing to sell, while buyers could be deterred from purchasing higher-value properties, slowing overall market fluidity. As a result, families might remain in homes that no longer meet their needs, raising concerns around affordability, downsizing, and the long-term financial commitment of moving into higher-priced properties.

Introducing an annual property tax risks undermining the natural fluidity of the housing market. Rather than encouraging people to move for work, family, or space, it could trap households in properties that no longer meet their needs, which seems counterintuitive to the broader goals of a healthy housing market.

Gerard Boon Managing Director (B.A Hons, CeMAP, CeRER)

A key stat reflecting this constrained mobility is that among the age groups most active in the housing market – those aged 25 – 64 – 52% reported that they would be less likely to purchase a higher-priced property if an annual property tax were introduced.

This is a significant finding as it indicates that the proposed reforms would unintentionally introduce barriers for the very demographic that is responsible for driving movement in the market.

Fear of Future Property Tax Hikes

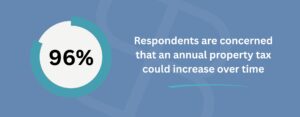

Beyond the immediate financial pressure, the research also explored concerns about the long-term implications of an annual property tax and, specifically, the potential for future tax increases.

Respondents were asked: “How concerned are you that, once introduced, an annual property tax starting at 0.5% could increase significantly over time?” And the data revealed an overwhelming concern, with 96% of respondents expressing worry about future tax rises.

A closer look at the data reveals that 57% of respondents are very concerned that, should an annual property tax be introduced, the government would increase the percentage of tax over time. This reflects a strong public perception that the initially proposed 0.5% tax could become a significant and recurring drain on household finances over time.

The research also found that 77% of older homeowners – aged 65 and over – were “very concerned” about future tax increases, further highlighting the anxiety about long-term financial strain in retirement.

Amid uncertainty around exemptions, caps, or safeguards, the research shows a clear public concern that their most valuable asset – their home – could become an unforeseen financial burden with the implementation of these proposed SDLT reforms.

Homeowners Speak Out on Proposed Property Tax

Boon Brokers’ research shows a clear message from UK homeowners: the proposed changes to Stamp Duty Land Tax are widely viewed as unfair. Many fear double taxation, with recent buyers concerned they could be hit again on properties they have already purchased.

Older homeowners are particularly alarmed, seeing the reforms as a threat to retirement security, while the wider population anticipates that an annual property tax could restrict mobility, discourage improvements, and make moving to larger or higher-value homes less appealing.

Beyond immediate costs, homeowners worry that introducing a 0.5% annual tax now could be a foot in the door for future increases, potentially turning a modest levy into a recurring burden that erodes financial stability and confidence in the housing market.

Overall, the research highlights strong public opposition and widespread concern, with homeowners seeing the proposed reforms as unfair, financially challenging, and likely to disrupt both personal finances and the broader housing market.

Notes to the editor

Research was conducted between 5th – 12th September 2025 amongst 1,000 applicants.

About the Researcher:

The Researcher for this article is Gerard Boon (B.A Hons, CeMAP, CeRER). Mr. Boon is the Managing Director of Boon Brokers Limited, a Directly Authorised Online Mortgage, Insurance & Equity Release Brokerage in the U.K. Boon Brokers boasts over 9,000 clients across the country and is quickly scaling year on year. Mr. Boon is passionate about Artificial Intelligence in the industry. During his studies at the University of Leeds in 2018, he achieved a First classification for his dissertation project titled “Artificial Intelligence in Financial Intermediation: An Investigation into the Prospects of Robo-Advice Developments for Independent Mortgage Brokers in the United Kingdom”. Since 2018, AI technology has rapidly developed. Mr. Boon is hoping to update his research on the topic following this survey.

Download the Full Results – Stamp Duty Survey – September 2025