15 Red Flags That Could Ruin Your Mortgage Application [2024 Study]

When people are thinking about applying for a mortgage in the near future, they are usually aware that factors such as income and credit history will impact their application but not many are aware of how their bank activity could affect a mortgage application.

To learn more about red flags on mortgage application, watch this informative video we have produced:

- How many people are aware of the fact some of their bank activity may be a red flag?

- How does bank activity affect mortgage applications?

- Gamblers are taking a risk on their mortgage application

- Should applicants hide things on their bank statement?

- Full data breakdown

- Demographic summary

- What to do if you have any of these red flags on your bank records?

How many people are aware of the fact some of their bank activity may be a red flag?

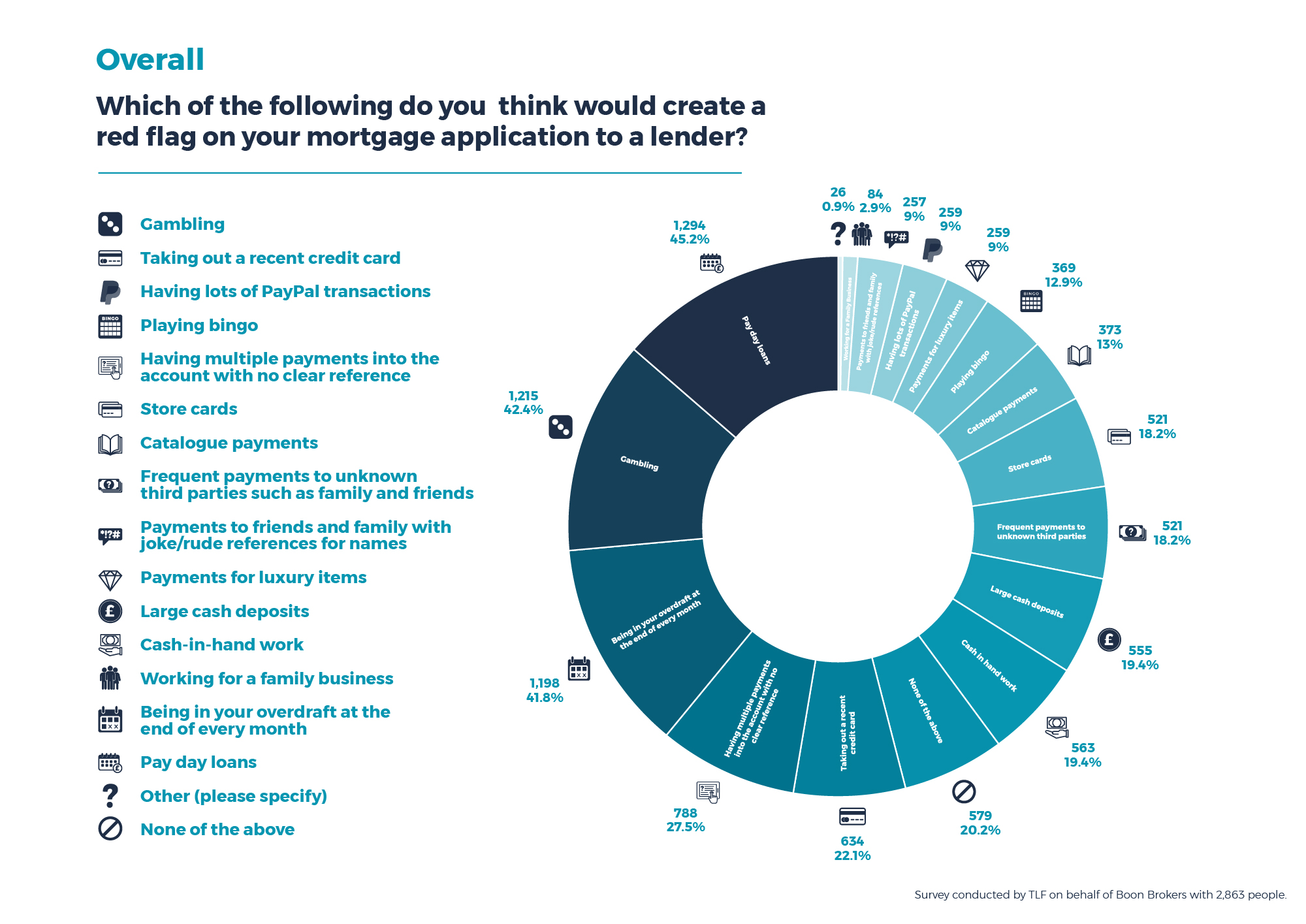

A recent survey conducted by Boon Brokers revealed that 83% of people are unaware of certain bank activity that will be a red flag during a mortgage application.

Over 2,800 respondents were given a list of potential red flags and were asked which of them they thought could impact their mortgage application.

The findings showed that there is a general lack of awareness of how certain bank activities can affect mortgage applications.

How does bank activity affect mortgage applications?

When lenders are reviewing applications, some lenders will analyse bank account transactions to check for any signs that there are potential issues that could affect the applicant’s ability to repay their mortgage.

For example, transactions for betting companies can be a red flag for lenders, although infrequent, small deposits are less likely to affect the application.

Large and regular deposits into gambling accounts or at casinos can be deemed to be a risk though. This is because if there are signs of a gambling addiction, this could prevent someone from repaying their mortgage.

Gerard Boon, partner at Boon Brokers gives some further insight into this:

Not all lenders will scrutinise your bank statements, but if you’re seen as a higher risk, perhaps with a smaller deposit or you’re self-employed, lenders are more likely to take a closer look.

Anything which shows the account holder may struggle with debt or to control their spending is likely to create questions.

Free consultations are offered in the UK.

Get Started NowGamblers are taking a risk on their mortgage application

Many mortgage applicants are oblivious to the fact that what they see as a harmless and affordable hobby could prevent them from getting their mortgage approved.

In the survey, 58% of respondents were unaware that their gambling transactions could cause an issue for a mortgage application.

One of the other concerning discoveries was that 72% said they were not aware that having numerous payments with no clear reference would also be a red flag.

For lenders, having transactions without any information to indicate what the money is spent on is a concern and could suggest that they are trying to hide what the money is used for.

Should applicants hide things on their bank statement?

It is never a good idea to hide financial transactions from a mortgage lender, as this could hold up your mortgage application.

However, the survey showed that a small percentage of people would consider hiding things on their bank statement.

Gerard Boon explains why this is not recommended:

Our research did reveal that the equivalent of 1.38 million current homeowners (four percent) would consider trying to hide things on their bank statement to make sure their mortgage got approved which we definitely would not recommend! If you’re planning on applying for a mortgage or remortgage in the next six months, it’s worth being aware of what may lead to further investigations even though in many cases it’s totally harmless and easily explained.

You don’t want any unnecessary delays to your application which could stop you getting the property you want.

As our research revealed, not all the things that could cause an issue are automatically that obvious gambling, pay day loans and being in an overdraft are the ones people are more aware of, but there are others too.

What Our Clients Have To Say

Demographic summary

The survey respondents provided their age, gender and location, so that we could review any key variances. The high-level observations were as follows:

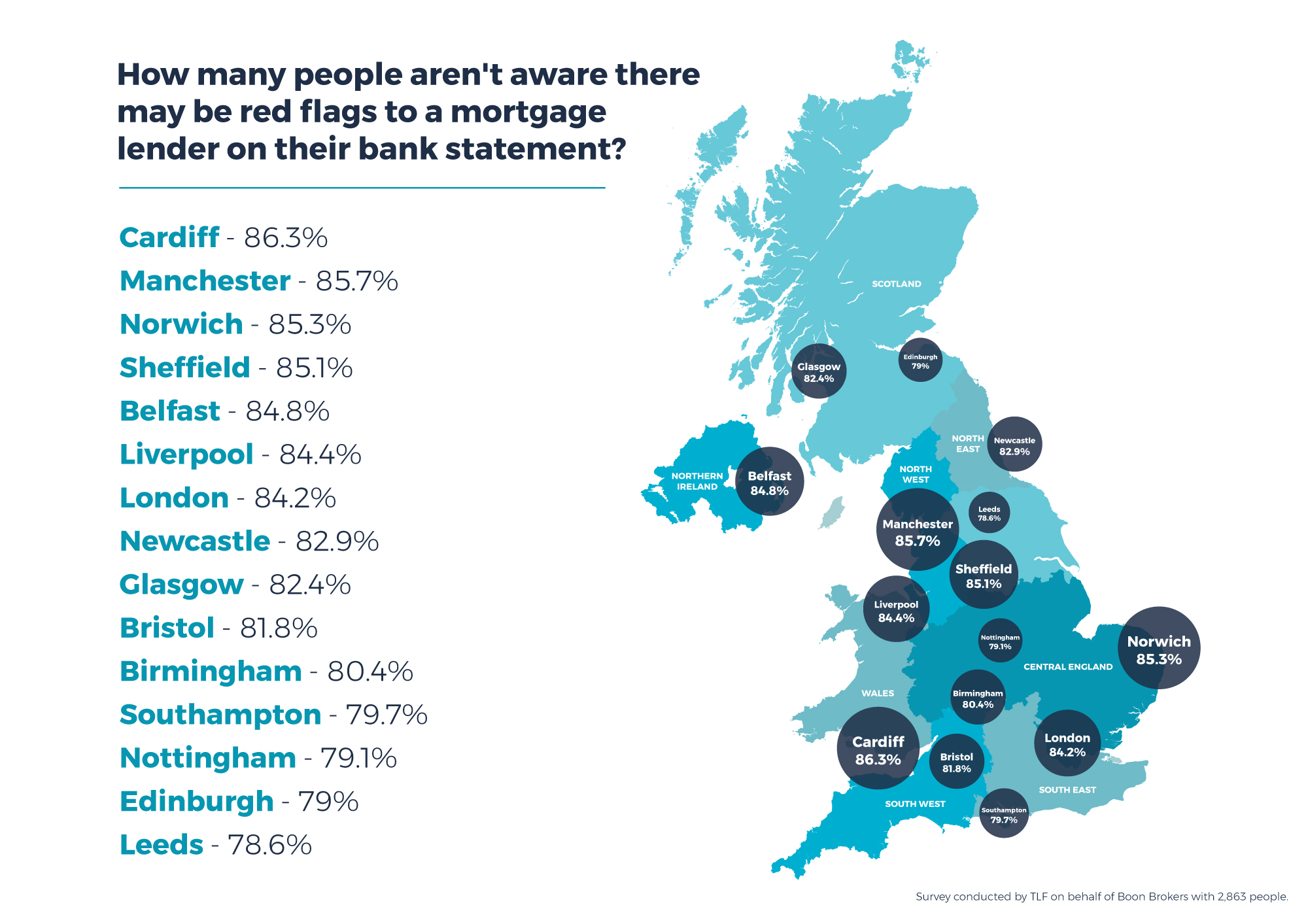

Location

The survey results split the data by city, which revealed a large variance of awareness levels, depending on what part of the UK people were in. Overall, people from Leeds had the greatest awareness about the red flags, while in Norwich, Manchester and Cardiff there was less awareness.

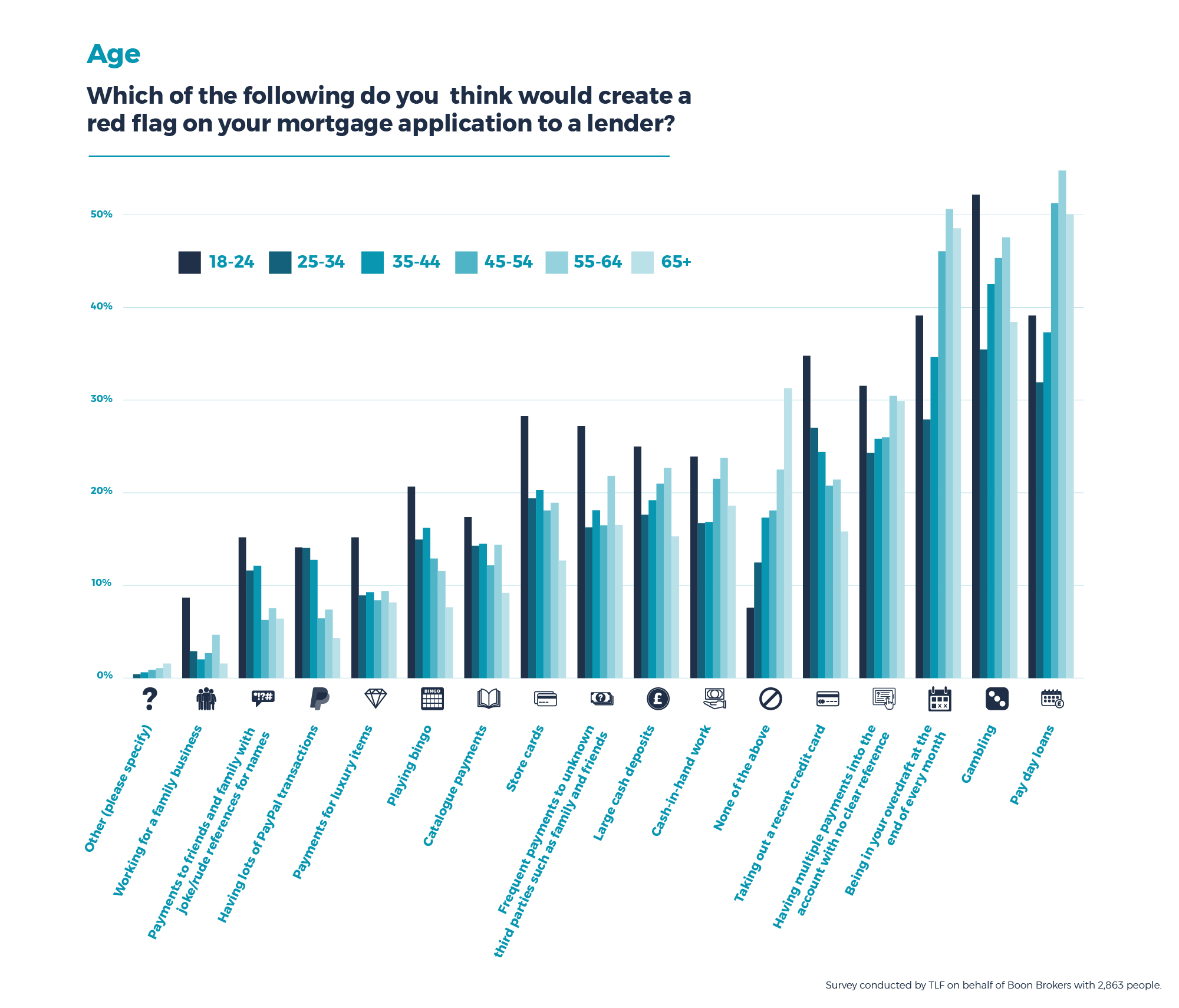

Age

The youngest age group (18-24) displayed the highest amount of awareness for most of the red flags, with the age 65+ category revealed to have the lowest awareness about the red flags that impact mortgage applications.

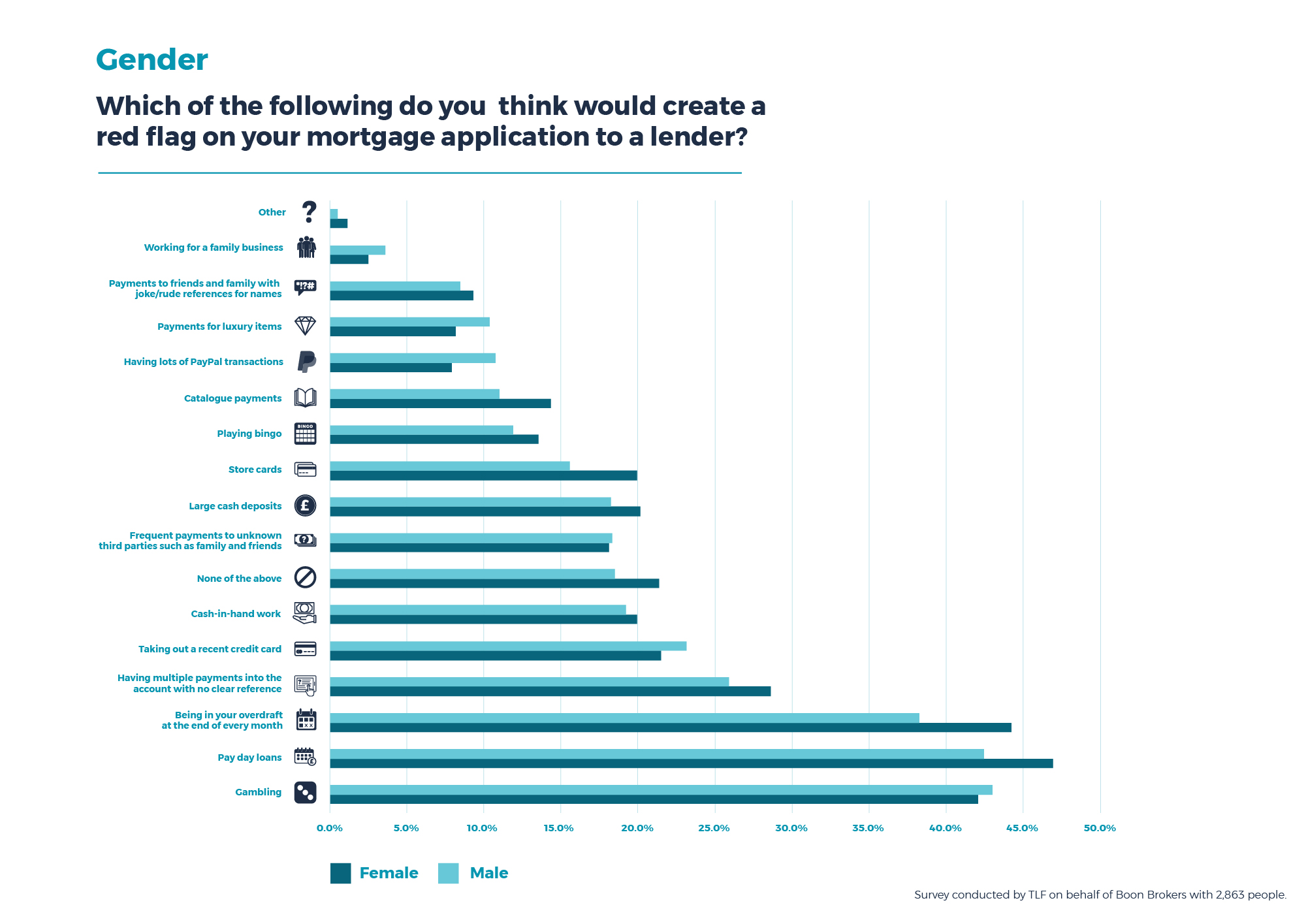

Gender

There were not any large differences between awareness for male and female respondents, with similar scores for awareness across the majority of the red flags listed.

Free consultations are offered in the UK.

Get Started NowWhat to do if you have any of these red flags on your bank records?

Typically, brokers will look at up to 3 months of your bank statements when they review your application, although some may request more than this.

Therefore, it is a good idea to try to practice good financial behaviour in the months leading up to your mortgage application.

In the same way that it is beneficial to improve your credit score in the months leading up to submitting a mortgage application, it will also work in your favour to make sure that there are no red flags on your bank statements.

Changing your spending habits and avoiding taking out any types of loans, store cards or credit cards prior to your application will boost your chances of having the application approved.

If you are transferring money to people, you should always give the transaction a clear reference so that the lender knows what you are spending the money on.

If you are self-employed, or have another type of job that involves cash-in-hand, in the lead up to your application, you should ask for payments to be made into your bank account instead of as cash.

Splurging out on any unnecessary items that could be considered as luxury items should be avoided until after your application goes through, to give you a better chance of getting your mortgage approved.

You should try to avoid using your overdraft, as even if you have an agreed overdraft with your bank, regularly going into your overdraft will count against you.

For most lenders, the biggest red flag will be regular gambling with large sums of money, as lenders could consider this as an indication of an addiction to gambling that could prevent the applicant from being able to pay their monthly mortgage repayments.

Therefore, you should keep gambling to a minimum, or avoid it completely to make sure you have the best chance of getting the mortgage approved.

As well as trying to avoid any of the red flags listed above from appearing on your bank statements, you should look at all the other ways you can boost the likelihood of having your mortgage approved.

This includes:

- Checking your credit score and making improvements where possible. Making sure that you make all of your loan and bill payments on time should boost your credit rating.

- Reduce debt as much as you can. If you have outstanding loans or credit cards, getting as much of the balance paid off as possible will be beneficial to your application decision.

- Save up as much deposit as possible, as the more deposit you have, the less risk you will pose to the lender. You can also get mortgage deals with lower interest rates if you have a better LTV (loan-to-value) ratio.

If you are considering applying for a mortgage in the future, even if it is likely to be in a few years’ time, you should try to improve your spending habits so that there are no red flags appearing on your bank statement.

While there are some lenders who will not scrutinise your spending habits as much as others, when you have your heart set on a property, you do not want to miss out on it through unnecessary delays or a declined mortgage application.

Boon Brokers can help you to find the right lender to suit your financial situation, so even if you think some of these red flags might be identified, we can find lenders who will still approve your mortgage.

Contact Boon Brokers today if you would like us to help you find the best mortgage deal for your specific circumstances.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- What Should I Ask When Buying A House?

- What Is A Mortgage In Principle?

- Remortgage Or Equity Release

- Why Buy A Home In Norwich?

- Benefits Of A Commercial Mortgage

- How To Avoid Early Repayment Charges

- Advantages Of A Mortgage Broker

- The House Buying Process

- How Long Does A Mortgage Application Take?

- What Is A 100% Mortgage

- Preparing For An Interest Rate Rise