Mortgage Capacity Reports Explained

It goes without saying – going through a divorce can be a stressful and difficult time. And so, when it comes to considering your financial and legal responsibilities – including how your assets and property will be divided – the process can start to feel unclear.

If your solicitor, or indeed the court, has requested a mortgage capacity report, then the first question you might have is “What is a mortgage capacity report and why do I need one?”

A mortgage capacity report can provide unique insights into your financial information, allowing the court to decide on how much you would likely be able to borrow for a new property, post-divorce.

Mortgage raising capacity can be a primary source of information during divorce proceedings, and in this article, we will explore the what, why, and how you can secure a mortgage capacity report. Let’s begin.

Short for time? Here’s a quick video on what exactly is a Mortgage Capacity Report:

- What is a Mortgage Capacity Report?

- Why Do I Need a Mortgage Capacity Report?

- What Information will I Need to Provide?

- Who Produces the Report?

- How Much Does a Mortgage Capacity Report Cost?

- How Can I Get a Mortgage Capacity Report?

- Our Mortgage Capacity Report Process

- Frequently Asked Questions About Mortgage Capacity Report Scenarios

- Speak to a Mortgage Capacity Report Specialist

What is a Mortgage Capacity Report?

Simply, a standard mortgage capacity report – also known as a mortgage capacity assessment – is a financial report that outlines the possible mortgage amount and type you would qualify for in the event of a divorce or separation.

Mortgage capacity reports are commonly used by courts to help understand whether you would be able to secure a mortgage to either buyout your ex-partner or afford a new property purchase.

In the UK, as of April 2022, mortgage capacity assessments are now required in Family Court. In addition to a mortgage capacity report, there may also be other necessary legal documentation when affordability needs to be assessed.

In essence, a mortgage capacity report will provide financial insight into your life post-divorce, and will be used by judges and solicitors to ensure a fair financial settlement.

Watch the video below for a more in-depth explanation on exactly what is a Mortgage Capacity Report :

Why Do I Need a Mortgage Capacity Report?

The purpose of a mortgage capacity report is to provide the court with an insight into your financial standing, post-divorce, allowing the court to determine a fair division of assets. It has become an essential aid that is commonly used in courts to mitigate disputes when dividing property in a divorce settlement.

It is important to note that the court may request reports from both parties, helping to ensure a holistic view and balanced financial outcome.

The mortgage capacity report will assess your financial situation, including: income details, current debts, savings, children and dependants, and financial history.

What Information Will I Need to Provide?

To complete a mortgage capacity report, you will need to provide the following details:

- Any current mortgage information (this will include the remaining balance)

- A recent property valuation

- Detailed about your income and expenditure

- Information on other owned assets (this will include investments and pension details)

- How your finances will be affected by the divorce

- Any additional financial factors, such as dependents or childcare costs

As a mortgage capacity report will form the basis of a legal judgement, you should ensure that all information provided is as accurate as possible.

If you’re looking for additional information on handling finances and property in a divorce settlement, you can visit the government guidance page here.

What Our Clients Have To Say

Who Produces the Report?

Here at Boon Brokers , our mortgage capacity reports are always prepared by a fully qualified and experienced mortgage broker. While online mortgage calculators – and even advice from a local bank – could provide incorrect information, our mortgage capacity reports are prepared and provided with a comprehensive approach that ensures a reliable assessment will be carried out.

Crucially, this document will be shared amongst solicitors and judges, and can be used in court. And so, it is vital that all the information is accurate, clear, concise, and meets the highest standard by an FCA-qualified broker.

How Much Does a Mortgage Capacity Report Cost?

If you’re looking to your financial future and other potential mortgage options, then you might be wondering exactly “how much does a mortgage capacity report cost?”

The total cost of a mortgage capacity report will be wholly dependent on the broker that you choose, with potential additional costs dependent on the complexity of your personal circumstances. This can include:

- Deposit amount

- Maintenance payments

- Child custody arrangements

- Childcare costs

- Any additional benefits you receive

At Boon Brokers, we offer a competitive and comprehensive pricing based on the type of report you will require.

Nil Capacity Report

Commonly known as a zero capacity report, a nil capacity report can cost as little as £149.99 with Boon Brokers. These reports provide evidence to the court that you are unable to secure a mortgage at this time.

A nil capacity mortgage report will be required if you have recently become self-employed, have significant adverse credit, or any other reason that would result in a maximum mortgage sum available of £0.

Single Capacity Report

If you have mortgage capacity and require an individual assessment, we offer a single mortgage capacity report for a flat fee of £299.99 – regardless of complexity.

We conduct mortgage affordability assessments with a whole-of-market range of regulated lenders. This type of report will involve a more detailed mortgage capacity assessment, and is the reason for the increased cost to generate the report.

Here at Boon Broker’s, we maintain a transparent and competitive pricing structure to ensure affordability. However, if you’re looking at the range of costs, you may find that some brokers can charge over £1,000 for complex reports, especially if multiple mortgaged properties or high net worth assets are involved.

Joint Capacity Report

Should you want to apply for a mortgage with a new partner, you may require a joint mortgage capacity report. This type of report – as the name would suggest – assess both applicant’s finances and affordability.

For a joint mortgage capacity report, we charge a fee of £399.99. If your ex-partner also requires a mortgage capacity assessment, you can pay for a joint report instead of two single ones, which will result in a £100.00 saving.

Request a Mortgage Capacity Report

Get Started NowHow Can I Get a Mortgage Capacity Report?

Before committing, it is worth asking the court if an agreement in principle would be sufficient evidence. In some cases a court will accept an agreement in principle and you will not need a full report.

An agreement in principle can be obtained with little to no upfront cost.

If you need a report you should approach a mortgage broker, like Boon Brokers, to complete it on your behalf.

It’s important to choose your mortgage broker carefully because even a minor error in the report can have a long term impact on your finances post-divorce.

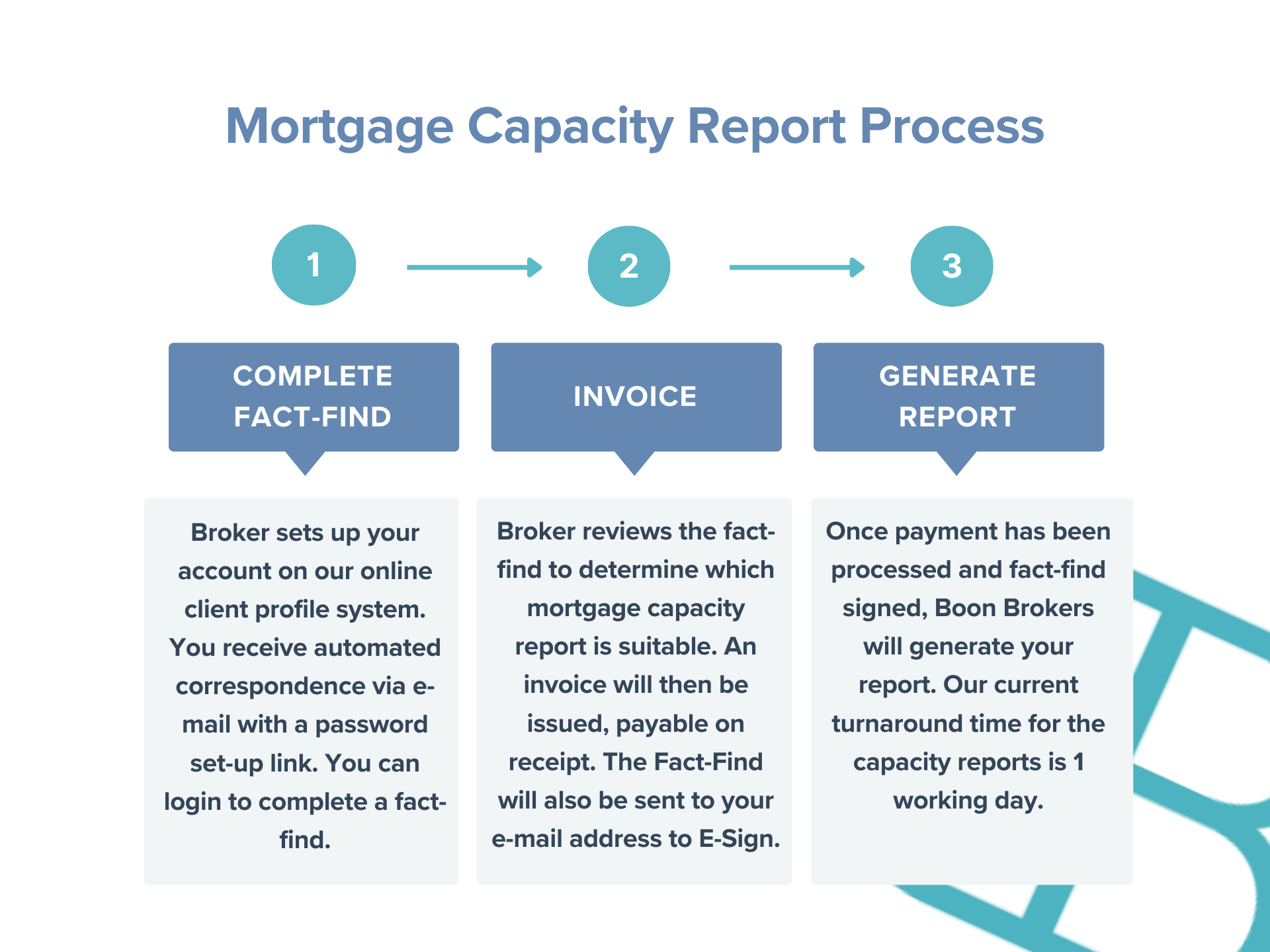

Our Mortgage Capacity Report Process

We have created a quick and easy bespoke process:

Your broker will set up your account on our online client profile system. You will receive automated correspondence via email with a password set-up link. You can then login to complete a fact-find on the system.

Your broker will review the fact-find and determine which mortgage capacity report is most suited to you. A suitable invoice will then be issued, which is payable on receipt. The Fact-Find will also be sent to your e-mail address to E-Sign.

Once the payment has been processed and fact-find signed, we will generate your report. Our current turnaround time for the capacity reports is 1 working day.

Frequently Asked Questions About Mortgage Capacity Report Scenarios

What is a Joint Mortgage Capacity Report?

As we touched on earlier in this article, a joint mortgage capacity report is an assessment that evaluates the mortgage affordability of two applicants. A joint mortgage capacity report will assess both parties’ income, credit score, and expenditure to decide how much you would be able to borrow collectively.

This is typically the type of report you might need if you are applying for a mortgage with a new partner.

What is a Mortgage Capacity Assessment?

A standard mortgage capacity assessment – otherwise known as a mortgage capacity report – is a detailed report that will help calculate your borrowing capacity based on your financial circumstances.

The assessments are typically used in divorce settlements to provide courts with a financial insight into each parties’ financial standing, allowing for an equal/fair distribution of finance and assets. The assessment will look at your overall finance, including: income, current debts, savings, children and dependants, and financial history.

How Does a Mortgage Capacity Report Relate to Divorce?

Generally, you would only need a mortgage capacity report in the event of a divorce. The report can provide crucial financial insights for both judges and solicitors, to ensure a fair financial settlement for both parties.

A mortgage capacity report can also provide information on whether one party can afford to buy the other’s share of a jointly owned property.

What is a Single Mortgage Capacity Report?

As the name would suggest, a single mortgage capacity report is tailored to one individual and is an assessment of their ability to secure a mortgage independently.

This type of financial report is commonly needed for individuals who are looking to buy a property following a divorce or separation, and need further information as to their new borrowing capacity based on their post-divorce financial situation.

What is a Nil Mortgage Capacity Report?

A nil mortgage capacity report is issued when an individual is unable to secure any mortgage. Simply, the report is a formal documentation that identifies that the individual is unable to borrow money for a mortgage at this time.

What Information is Included in a Nil Mortgage Capacity Report?

A nil mortgage capacity report will include details about your income, debts, credit history, and overall financial situation. Its purpose is to assess and outline why you are currently unable to secure a mortgage.

As such, a nil mortgage capacity report is commonly used in legal proceedings, such as divorce or separation, to provide an accurate assessment of your financial situation.

Speak to a Mortgage Capacity Report Specialist

Going through a divorce can be a difficult time, but we are here to help you get your finances settled. As a trusted whole-of-market broker, we can provide you with both expert mortgage advice, and a comprehensive and accurate mortgage capacity report.

Book your free consultation with us today and discuss how we can help you.

Need Mortgage Advice?

Submit an Enquiry

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- How Can I Buy Out My Partner from a Joint Mortgage?

- How Do Joint Mortgages Work?

- Is Now the Right Time to Put Your House on the Market?

- Remortgaging When You’re Self-Employed

- Is Remortgaging the Same as Porting Your Mortgage?

- How to Add Someone to an Existing Mortgage?

- Mortgage Capacity Reports for Solicitors