The Mansion Tax Trap: Popular in Principle, Divisive in Practice [December 2025 Study]

New research from Boon Brokers explores public opinion on the newly announced Mansion Tax, a high-value council tax surcharge that has been confirmed in the Autumn Budget. Download the full research file in the footer of this article.

Key Findings:

-

- 66% say that wealthier homeowners should contribute more tax to public spending.

- 78% say the Mansion Tax will not improve Labour’s popularity.

- 42% say high‑value property owners will raise asking prices to offset the tax.

- 53% say the additional tax will not deter wealthy individuals from investing in UK property.

- 54% say the tax will not impact wealthy individuals’ investment in the wider UK economy.

Data Summary:

| 1,000+ respondents – TLF Research |

| Participants from North, East, West and South of England |

| All Age Groups represented |

| All respondents were homeowners |

Following the Autumn Budget, Boon Brokers commissioned new research to understand public opinion on the recently announced ‘Mansion Tax’ that will apply to high-value property.

Under the new policy, properties valued at over £2 million will face an additional annual charge starting in April 2028. Charges will range from £2,500 for properties over £2 million to £7,500 for those over £5 million, and the tax will be added to existing council tax bills.

The implementation of this additional tax has been coined “a wealth tax” and presents a significant new cost for owners of high-value assets, raising questions about fairness, market impact, and investment decisions.

Boon Brokers latest research explores the UK’s public opinion on the government’s introduction of this additional tax and the potential consequences for the property market and investor behaviour.

The research found strong public support for the notion of wealthier homeowners contributing more to public spending, but scepticism remains over the real-world impacts of adding this surcharge.

UK Public Support a Fair Share from the Wealthy

The research found a clear majority of the UK public support Labour’s introduction of taxing high-value homeowners, with 66% of respondents stating that wealthier individuals should contribute more to public spending.

This overwhelming support indicates a strong consensus that those living in the UK’s most expensive properties are believed to be financially capable of absorbing an additional surcharge, without significant disruption to either their assets or finances.

Interestingly, what emerges from this data is the implication that the UK public have an expectation of fairness in taxation – something that has historically been the subject of wide debate.

The data shows that the public see a tax on high-value homes as both fair and proportionate, but what is of particular interest is the suggestion that wealth-focused measures are broadly accepted with the conclusion that those with high-value assets can naturally afford them.

Gerard Boon Managing Director (B.A Hons, CeMAP, CeRER)

With the research showing how respondents view the Mansion Tax as a fair taxation measure, there is a clear connection between targeting those with the greatest financial means while leaving middle and lower income households untouched.

High-Value Sellers Predicted to Offset the Surcharge

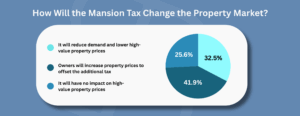

The research uncovered a significant 42% of respondents believe that, following the implementation of the additional surcharge, high-value homeowners will raise their asking prices to counter any additional tax fees. This expectation suggests that the public anticipates active behavioural changes at the top end of the housing market, where properties valued above £2 million already command a premium.

In contrast, 33% of respondents stated that the additional tax would result in a reduced demand for high-value properties, causing property prices to fall.

As a result, the data shows public opinion is split on how the introduction of this surcharge could influence pricing strategy, but there is certainly an anticipation of change in both property prices and wider market behaviour.

Public opinion shows a distinct contrast with commentary from housing economists, who note that tax increases at the top of the market more commonly slow buyer appetite rather than drive sellers to increase prices. Economists further predict that this would place downward pressure on demand in prime areas, rather than trigger the type of price inflation that 42% of respondents expect.

Analysis from the Centre for Policy Studies supports this view, warning that a high-value property surcharge is more likely to dampen high-end market activity, reduce international investment, and weaken buyer confidence than push asking prices higher.

This disconnect points to an educational gap in how taxation interacts with high-value property markets. The inference from this data suggests a public sentiment that assumes all high-value property owners will find ways to absorb or redirect the cost. Whether or not high-value property sellers ultimately adjust asking prices, the belief alone underlines the sensitivity of the luxury housing sector to fiscal changes.

As the policy is set to come into force in April 2028, these assumptions may shape early market behaviour, pricing negotiations, and valuation trends in the immediate future.

Wealthy Investors Unlikely to Flee from Investments

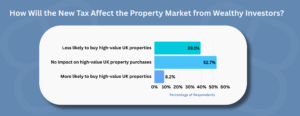

The research found that the majority of UK homeowners (53%) believe that the additional Mansion Tax will not deter wealthy individuals from investing in UK property.

This data highlights both a clear and broad public expectation that Labour’s introduction of the additional surcharge will have no effect on wealthy parties’ choice to invest in the UK property market.

While 39% of respondents believe the additional surcharge will make wealthy investors less likely to purchase high-value property in the UK, 8% felt the tax would result in an increase in the likelihood of investment.

Once again, the data points towards a public consensus that affluent investors are largely insulated from incremental tax changes, and are therefore unlikely to adjust their long-term property strategies or investment targets. However, additional economic evidence paints a different and more nuanced picture.

Additional global mobility data is showing an important counterpoint and consideration to the wider economic effect of introducing additional taxes. Recent wealth migration reports, including the 2025 Henley Private Wealth Migration Report and Financial Express, indicate a growing trend of millionaires relocating internationally in response to rising taxation and declining economic competitiveness. These reports show that the UK has experienced a net outflow of high-net-worth individuals in recent years, with forecasts anticipating further departures as tax burdens rise.

Taken together, these individual research insights show that, while the UK public believe that wealthy investors will remain anchored in the UK property market, there is legitimate evidence that sustained tax increases will influence behaviour by wealthy investors.

While the additional surcharge is unlikely to cause a dramatic exodus, there is still a data-driven possibility that higher fiscal pressure could contribute to a gradual drift of wealth if broader economic conditions fail to remain competitive.

Mansion Tax Seen as Minor Disruption to Broader Investment

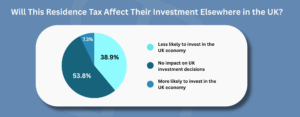

While our previous section highlighted perceptions around high-net-worth investment in the UK property market, this part of the research focused on the public view around broader economic activity. Respondents were asked how the Mansion Tax might influence wealthy individuals’ decisions to invest across the UK economy more generally.

The data reveals a similar pattern of cautious optimism with 54% of respondents stating that the surcharge will not affect wider investment, 39% feel it may reduce investment, and just 7% think that it could encourage additional spending.

There remains a prevailing public view that high-net-worth homeowners will be unaffected by the additional surcharges within the context of their broader spending or business decisions. As a result, while the tax may represent a significant new cost for some property owners, the general belief of the UK public is that it is unlikely to affect their overall economic behaviour.

With results closely mirroring those for property-specific investment, the data suggests that the UK public views the surcharge as a contained policy rather than a ‘game-changer’ for broader economic activity.

The inference from this finding is twofold: First, public opinion suggests that the Mansion Tax is unlikely to cause a knock-on effect on UK investment. Second, it highlights a general belief that wealthy investors will be resilient, and are expected to absorb the surcharge while continuing to participate in the economy.

The Political Backlash of Raised Taxes

The final question in the survey looked to assess the overall impact that introducing this policy would have on Labour’s popularity, asking: “How do you think the proposal to apply National Insurance to landlords’ rental income will affect Labour’s popularity in the next election?”

The research concluded with a very clear warning for Labour: extending National Insurance to landlords’ rental income could significantly impact the party’s political standing.

While the proposal to introduce National Insurance tax is undoubtedly part of Labour’s efforts to close the growing fiscal gap, the data found that more than half of the respondents (51%) believed that the introduction of this policy would damage Labour’s popularity.

In contrast, just 27% think the proposal would improve Labour’s appeal, and 21% remained impartial, noting it would have no impact on voter sentiment.

As public concerns focus on the potential for raised rents, reduced supply, and a growing monopoly on residential properties, this new taxation could exacerbate existing pressures rather than alleviate them.

With nearly nine in ten respondents (88%) already viewing the proposed tax as unfair and potentially destabilising, the research suggests that public sentiment overwhelmingly believes the negative consequences of this policy outweigh any potential benefits.

As such, the introduction of this policy could alienate key segments of the electorate – from renters concerned about rising costs to small landlords worried about sustainability.

Labour’s Mansion Tax Moment Fails to Boost Popularity

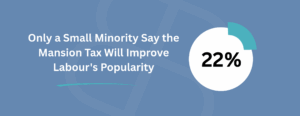

With the Autumn Budget offering Labour an opportunity to assert influence over the UK’s economic direction, our research asked UK homeowners how the introduction of the new Mansion Tax might affect the party’s popularity.

The data revealed that just 22% of respondents believed that the introduction of the Mansion Tax would improve Labour’s popularity, with the overwhelming majority specifying that it will either make no difference (40%) or will specifically damage Labour’s popularity (38%).

The majority of the public remains uncertain about the political impact of the surcharge, with most neither associating it with increased support for the party or viewing it as a decisive factor in voter behaviour.

Interestingly, this highlights that while the principle of taxing high-value homeowners is widely accepted, the policy itself is not seen as a major driver of political loyalty. Instead, the data shows that Labour’s efforts have not yet generated a widespread enthusiasm or tangible political advantage for their voters.

Mansion Tax: Popular in Principle, Questionable in Practice

Boon Brokers’ research underlines a clear consensus: UK homeowners broadly support the principle of taxing high-value homeowners, viewing it as a fair contribution to public spending. 66% of respondents agreed that wealthier homeowners should shoulder additional fiscal responsibility, reflecting a strong endorsement of targeted wealth taxation.

However, while the surcharge is widely seen as reasonable in principle, scepticism remains about its practical impact. 42% percent anticipate high-value property owners may raise asking prices to offset the cost, and 53% believe it will not deter wealthy investors from the UK property market. Similarly, 54% do not expect broader economic investment to be affected, suggesting the public perceives the policy as contained rather than transformative.

In the context of political implications, the introduction of this named mansion tax appears to have a limited effect on Labour’s overall popularity. Only 22% of respondents felt that the Mansion Tax would improve Labour’s popularity, indicating that the measure is unlikely to generate any major political support or momentum.

What is clear is that there is a notable disconnect between public perception and economic studies, with global wealth mobility data showing that sustained fiscal pressure can encourage relocation of high-net-worth individuals.

This raises a question for economists, policymakers, and the general public alike: as the Mansion Tax comes into force in 2028, to what extent could it influence wealthy investors’ decisions and the broader migration of capital to less-taxed markets?

Notes to the editor

Research was conducted between 26th November – 1st December 2025.

About the Researcher:

The Researcher for this article is Gerard Boon (B.A Hons, CeMAP, CeRER). Mr. Boon is the Managing Director of Boon Brokers Limited, a Directly Authorised Online Mortgage, Insurance & Equity Release Brokerage in the U.K. Boon Brokers boasts over 9,000 clients across the country and is quickly scaling year on year. Mr. Boon is passionate about Artificial Intelligence in the industry. During his studies at the University of Leeds in 2018, he achieved a First classification for his dissertation project titled “Artificial Intelligence in Financial Intermediation: An Investigation into the Prospects of Robo-Advice Developments for Independent Mortgage Brokers in the United Kingdom”. Since 2018, AI technology has rapidly developed. Mr. Boon is hoping to update his research on the topic following this survey.

Download the Full Results – Mansion Tax Survey – December 2025