UK Tenants Warn New Landlord Tax Risks Destabilising Rental Market [November 2025 Study]

Boon Brokers latest research reveals a clear public concern: a new landlord tax could further destabilise an already fragile rental market and intensify the UK’s housing crisis. Download the full research file in the footer of this article.

Key Findings:

-

- 88% of respondents believe the proposed National Insurance charge on rental income would be unfair and lead to instability in the rental market.

- 79% of respondents aged 55+ believe the introduction of this tax would lead to increased rents.

- 73% of respondents believe the introduction of this tax would set a precedent for the government to tax other forms of investment income.

- 59% of respondents believe the tax would lead to increased rents as landlords offset the cost.

- 51% of respondents believe the proposal would damage Labour’s popularity and potentially worsen the housing crisis.

Data Summary:

| 1,000+ respondents – TLF Research |

| Participants from North, East, West and South of England |

| All Age Groups represented |

| All respondents were tenants |

Ahead of the Autumn budget, Boon Brokers commissioned a survey to uncover the UK public opinion on Labour’s proposal to apply National Insurance (NI) to landlords’ rental income.

The research aimed to examine perceptions of fairness, the anticipated economic impact, and potential political consequences of this proposed change.

Current legislation: Under the current UK tax system, rental income earned by landlords is not subject to National Insurance, as it is considered investment income rather than earnings from work.

Proposed Tax Change: The government has proposed extending National Insurance to include landlords’ rental profits, potentially at a rate similar to self-employed contributions (8%).

While details such as thresholds, exemptions, and transitional arrangements have yet to be announced, the proposal represents a major shift in how rental income could be taxed and carries potential implications for landlords, tenants, and the wider private rental market.

The research revealed a clear message: that such a tax could inadvertently worsen an already fragile housing market, raising fears that both tenants and landlords would bear the true cost.

Public Divided on Fairness of Landlord Tax

The first question of the survey uncovered an interesting paradox in public opinion, finding a clear divide in taxing landlords in theory, against the taxation in practice.

In answer to the question: “Do you think applying NI to all rental income would be fair?” 56% of respondents stated that they agreed that landlords should contribute National Insurance on rental income, with 44% disagreeing with this statement.

While this statistics appears to be clear-cut, when we look at this statistic in the context of the entire research, this narrow split only scratches the surface, masking a more striking public sentiment.

For example, when asked about the likely impact of introducing this policy, only 12% of respondents remarked that the proposed tax would improve fairness or stability in the rental market. By contrast then, an overwhelming majority – 88% – felt that introducing this change in practice would be unfair and risk destabilising the private rental market.

As such, the research highlights that the public support in theory does not translate into confidence in the policy’s practical effects.

A most interesting point of contention here is the clear disconnect between theoretical agreement and anticipated consequences.

While at this juncture it remains speculative that the longstanding perceptions of landlords as wealthy or exploitative may have influenced the initial support for increasing their tax, what the research clearly highlights is that the vast majority of respondents fear the negative consequences that the introduction of this policy could create.

As the research highlights as a whole, these fears more accurately translate into concerns over higher rents, reduced supply, and potential instability for tenants.

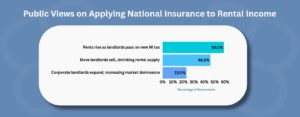

Landlord Tax Could Push Up Rents and Reduce Supply

Should the proposed National Insurance tax on landlords come into effect, the research revealed that there were three main public concerns: rents would rise, landlords would sell and reduce rental supply, and corporate landlords could create a monopoly, purchasing any remaining properties.

The most common concern out of these three was rising rents, with 59% of respondents predicting that landlords, in an effort to offset the introduction of their additional tax, would pass any additional cost onto their tenants.

The second most cited concern was that the introduction of this policy could prompt a mass exit of landlords, with 46% of respondents believing landlords would be more inclined to sell their rental properties as the tax further reduced the profitability of rental investment.

And finally the third cause for concern was the potential shift in the rental market structure. 23% of respondents predicted that the introduction of this NI Tax on rental income would inevitably lead to larger corporate landlords taking advantage of smaller competitors leaving the market, creating a more concentrated ownership and reducing competition.

This data underlines a clear public perception that the introduction of the proposed National Insurance tax on rental income could significantly disrupt the UK rental market. Respondents across all age groups and regions consistently expect higher rents, reduced rental supply, and a shift towards a concentrated corporate control of the rental sector.

Small Landlords Prepare to Face the Brunt

Compounding public concerns around the rental market competition, the research also found that smaller landlords are predicted to bear the heaviest burden of Labour’s proposed NI policy.

54% of respondents identified landlords who manage just one or two properties would be most negatively affected with the introduction of this NI tax, while just 14% of respondents expect corporate landlords to experience any negative impact.

These statistics clearly reflect a perceived vulnerability of smaller landlords, who would typically rely on rental income from a limited portfolio to cover mortgage costs and property maintenance.

Smaller landlords will typically operate on tighter margins than large corporate investors, meaning any additional tax will have quite a direct and impactful result.

Gerard Boon Managing Director (B.A Hons, CeMAP, CeRER)

The consistent patterns of concern among respondents points to a pronounced fear and the broader impact that this policy could have on the rental sector. Without a meaningful volume of competitive rental prices, tenants could face higher rents and fewer choices as corporate land and homeowners further develop, compounding the affordability challenges that are already present in the UK rental market.

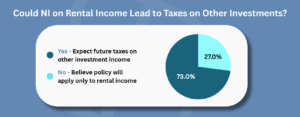

Opening the Door to Wider Investment Levies

Rental income currently falls under the category of investment earnings, a category that has been historically exempt from National Insurance precisely because it is not derived from employment. However, the research shows that Labour’s move to tax landlords’ profits could be evidence of a potential gateway to broader taxation across the investment sector.

A standout statistic from the research found that 73% of respondents believed that the introduction of this policy could pave the way for future government taxes on other forms of investment income.

Only 27% believe the measure would be a one-off change that would be limited to rental income alone, demonstrating an overwhelming scepticism amongst UK public opinion towards the scope of potential future taxation.

Crucially, this point of contention extends beyond the immediate impact on landlords and the rental market, reviewing whether the government’s willingness to apply National Insurance to rental income could mark the beginning of a broader taxation approach on other investment earnings.

This naturally raises the question: What other forms of passive or investment income could be taxed next?

While 73% of respondents have highlighted their concerns that this could extend to other forms of investment, including savings interest, dividends, and other passive returns, the answer to this question remains unclear, leaving investors facing uncertainty.

The Political Backlash of Raised Taxes

The final question in the survey looked to assess the overall impact that introducing this policy would have on Labour’s popularity, asking: “How do you think the proposal to apply National Insurance to landlords’ rental income will affect Labour’s popularity in the next election?”

The research concluded with a very clear warning for Labour: extending National Insurance to landlords’ rental income could significantly impact the party’s political standing.

While the proposal to introduce National Insurance tax is undoubtedly part of Labour’s efforts to close the growing fiscal gap, the data found that more than half of the respondents (51%) believed that the introduction of this policy would damage Labour’s popularity.

In contrast, just 27% think the proposal would improve Labour’s appeal, and 21% remained impartial, noting it would have no impact on voter sentiment.

As public concerns focus on the potential for raised rents, reduced supply, and a growing monopoly on residential properties, this new taxation could exacerbate existing pressures rather than alleviate them.

With nearly nine in ten respondents (88%) already viewing the proposed tax as unfair and potentially destabilising, the research suggests that public sentiment overwhelmingly believes the negative consequences of this policy outweigh any potential benefits.

As such, the introduction of this policy could alienate key segments of the electorate – from renters concerned about rising costs to small landlords worried about sustainability.

Tenants Warn of Rental Market Fallout

Ultimately, Boon Brokers’ latest research highlights the growing concern amongst tenants that introducing National Insurance on rental income could lead to wider-economic challenges in the housing market, including: increased rents, reducing competition as smaller landlords exit, and a pronounced shift toward corporate ownership of UK rental properties.

In addition, the research outlines how these anxieties are coupled with the growing apprehension that the government’s willingness to apply National Insurance to investment income could also open the door to broader taxation on savings, dividends, and other financial returns.

This research uncovers the public sentiment with a clear warning to policymakers: introducing National Insurance on rental income risks accelerating the decline of small landlords, driving rents even higher, and could remove competition entirely as the rental sector falls under corporate control; a shift that would invariably reshape the housing market for years to come.

Notes to the editor

Research was conducted between 1th – 7th November 2025 amongst 1,000 applicants.

About the Researcher:

The Researcher for this article is Gerard Boon (B.A Hons, CeMAP, CeRER). Mr. Boon is the Managing Director of Boon Brokers Limited, a Directly Authorised Online Mortgage, Insurance & Equity Release Brokerage in the U.K. Boon Brokers boasts over 9,000 clients across the country and is quickly scaling year on year. Mr. Boon is passionate about Artificial Intelligence in the industry. During his studies at the University of Leeds in 2018, he achieved a First classification for his dissertation project titled “Artificial Intelligence in Financial Intermediation: An Investigation into the Prospects of Robo-Advice Developments for Independent Mortgage Brokers in the United Kingdom”. Since 2018, AI technology has rapidly developed. Mr. Boon is hoping to update his research on the topic following this survey.

Download the Full Results – NI Tenancy Survey – November 2025