How Does a Mortgage Work?

If you are new to the world of mortgages, it can be incredibly daunting to understand the various types of mortgage product and what you need to do in order to obtain one. There are so many mortgage options available today and lenders are keen to offer a variety of products to help you buy a house.

There is no need to panic as mortgages are straightforward products once you understand the basics. This complete guide explains what a mortgage is and answers the all-important question – how does a mortgage work?

Let’s explore mortgages and get to grips with how a mortgage works.

- What is a Mortgage?

- How is a Mortgage Different to Other Types of Debt?

- What is a Remortgage?

- How Much Deposit Do I Need for a Mortgage?

- How Do I Apply for a Mortgage?

- Documents Required for a Mortgage

- Are There Different Mortgages Available?

- Can I Use a Mortgage to Buy a Property at Auction?

- How Much Does a Mortgage Cost?

What is a Mortgage?

Simply put, a mortgage is a loan that is secured against an asset, typically a property. There are mortgage products available secured against land or if you want to build your own home, loans that allow you to borrow as you build.

A secured loan allows lenders to extend a greater level of borrowing because if you fail to make repayments, the lender still has the asset to sell and recoup their costs.

If you are buying a house with a mortgage, you will own the property, but the lender will secure a charge to it. Therefore, you still technically own 100% of the property and any equity growth in it. However, a mortgage lender has the right to repossess a property if you do not meet the conditions of your mortgage contract.

Repayment Mortgages

In the above example we have outlined a repayment mortgage. With a repayment mortgage your monthly payment consists of a capital portion and an interest payment.

The capital portion reduces your overall debt and increases your equity in the property.

The interest payment is the additional charge a lender applies to the product to make profit on the loan.

Interest Only Mortgages

Interest only mortgages operate differently to repayment mortgages. Your monthly payment will be the interest portion only and there is no capital repaid each month.

At the end of the mortgage term, your lender will request you pay the loan balance in full. If you have had a car finance agreement, this is similar to the balloon payment you make when your car finance term ends.

There are many ways you can budget for this capital repayment such as saving each month, investing, or using ISAs to build up a pot of money, or by selling the property at the end of the mortgage and using the proceeds to repay the loan.

Purpose of the Mortgage

For residential mortgages, lenders typically only allow you to use a repayment mortgage (though there are some exceptions to this rule).

Interest only mortgages are mostly used for Buy to Let situations where you wish to purchase a property and rent it out. Again, there are exceptions to this and depending on your circumstances, a mortgage broker may recommend an interest only product.

Free phone and video consultations are provided in the U.K.

Get StartedHow is a Mortgage Different to Other Types of Debt

The key difference between a mortgage and other debt types is that a mortgage is secured against a property.

If you have an unsecured loan, credit cards or overdraft facilities, a lender has to rely on you making payments to repay the lending. For this reason, lenders view unsecured lending as high-risk and typically offer lower borrowing amounts, higher interest rates and require a good credit rating.

With a mortgage, a lender has the ability to repossess the property and then sell it to recoup any losses if you are unable to keep up your mortgage payments.

Repossession is a last resort for lenders and most mortgage lenders have payment holidays or mechanisms in place to help you get back on track. Despite being a last resort, you should be aware that failure to maintain your mortgage payments can result in repossession and you may lose your home.

See What Our Clients Have To Say

What is a Remortgage?

When you take a mortgage, the lender will offer you an interest rate that is competitive. This can be thought of as a discounted or introductory interest rate.

The lender will tie you into this interest rate for a defined period of time, such as 2 years. Over the defined time, the interest rate will be the agreed lower rate.

Once the time expires, the lender moves you onto a Standard Variable Rate (SVR). The SVR is set by the lender and can be much higher than your initial mortgage rate. For example, you may have an initial interest rate of 5% and when the deal term ends, your interest rate could increase to a 7% SVR.

The SVR can also change over time and a lender may increase or decrease it at their discretion.

A remortgage is a way to avoid the SVR. You will be moving your mortgage to another lender and securing a new deal interest rate.

When you remortgage, your new lender will repay your existing mortgage from your old lender. The new lender will then register a charge on the title deeds.

How Much Deposit Do I Need for a Mortgage?

To reduce risk, a lender will ask you pay a deposit on your chosen property. The amount of deposit required will depend on the lender your mortgage broker has recommended and the property value.

If possible, it is always a good idea to put as much deposit down on a mortgage as possible. This will reduce the amount you need to borrow and therefore reduce the amount you repay over time.

Lenders also prefer you to put as much down as possible when taking a mortgage as it further reduces the risk of the mortgage being unaffordable for you. Lenders reward high deposit borrowers by offering them lower interest rates.

For example, if your mortgage broker recommends a lender and you have a 5% deposit, the interest rate will be higher than if you had a 20% deposit with the same lender.

Interest rates tend to change in 5% brackets. For example, if you have a 5% or 9% deposit, you will have access to the same tier of interest rates. However, when you have a 10% deposit, you then have access to a lower tier of interest rate. This continues until you have a 40% deposit. After that point, increasing your deposit will not reduce the interest rates available in the current mortgage market.

How Do I Apply for a Mortgage?

Applying for a mortgage is challenging for most borrowers. There are so many lenders to pick from and all have different lending requirements and terms and conditions on their products.

The best way to source a mortgage is through a Whole of Market mortgage broker as they will be able to match a lender to your specific circumstances and secure the lowest interest rate for your situation.

Once your mortgage broker has identified a lender and made their personal recommendation to you, your broker can apply for an agreement in principle.

Obtaining an Agreement in Principle

Your mortgage broker will provide your lender with your anticipated property value, your income details, any relevant expenditure among other details. The lender will assess this information and decide whether they would accept a mortgage application on that basis.

If they would potentially lend the money to you, a soft or hard credit check will be performed, and your broker will issue you an agreement in principle certificate if it passes. You can use this certificate to show estate agents you have a mortgage lined up and can afford to buy a property you wish to make an offer on.

Mortgage Application

Once your offer has been accepted, you will return to your mortgage broker and proceed to a full mortgage application.

The mortgage application is more intensive than an agreement in principle as you will need to provide documentation. This documentation will be used by the lender to evidence your ability to repay the mortgage.

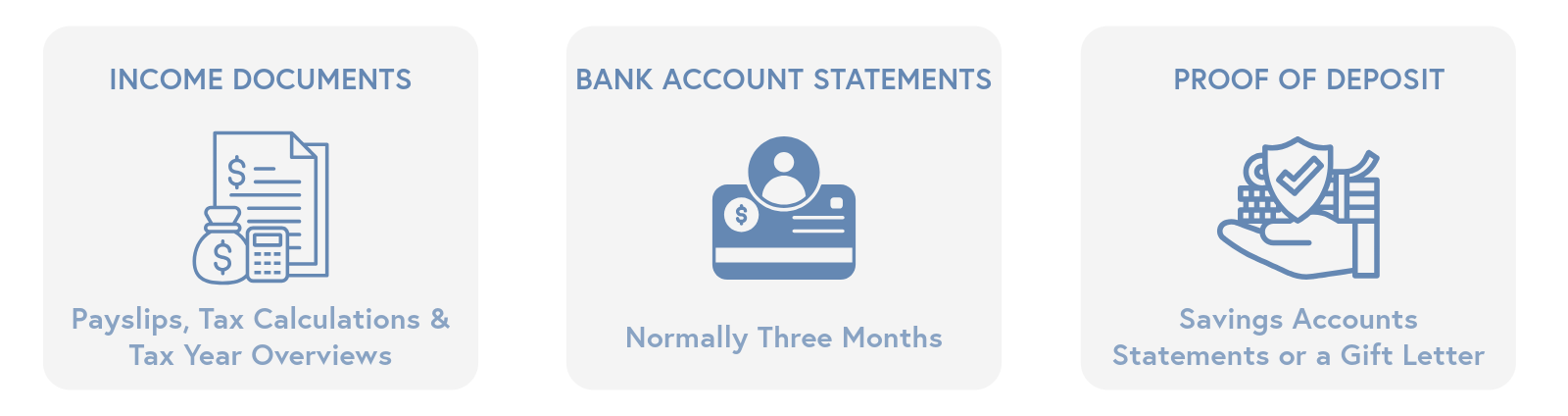

Documents Required for a Mortgage

Different lenders request different types of documentation. Typically, lenders request the following:

Lenders may also request more information depending on your personal situation. For example, if a lender has concerns about the bank statements or where your deposit came from, they may request further evidence. Normally, this will mean supplying statements that go further back.

Are There Different Mortgages Available?

Yes, there are a wide range of mortgage products available. In fact, the term ‘Whole of Market’ does not mean a mortgage broker has access to every single lender in the UK. Instead, it means they are able to offer all mortgage types, for example, Buy to Let, Residential and Bridging Finance.

The type of mortgage product you will need will depend entirely on what you are planning to do with your property purchase.

Can I Use a Mortgage to Buy a Property at Auction?

If you have been shopping around on property websites, you will have noticed some properties are listed as for ‘for sale by auction’ or ‘for sale by modern auction.’

Auction properties can be excellent first-time purchases as they tend to sell below market value, and you could save a considerable amount of money.

The problem with auctions is there are strict timeframes to adhere to and the exchange of contracts and completion will need to be done quickly.

A mortgage can work for auction properties, but you need to be on the ball, have your agreement in principle in place and all the documentation for your mortgage application ready beforehand. You should notify your broker in the first instance you are intending to buy an auction property many weeks before the auction date.

Your broker will then find lenders who can complete the mortgage underwriting quickly and, in some cases, there are lenders who may offer within 10 days of application.

The key to using a mortgage for an auction property is preparedness, so discuss everything with your broker and get all the work done upfront before you make a bid on a property.

You should also clarify with your broker whether the intended property is suitable for a lender’s property criteria as some auction properties are unmortgageable – hence why they have been put up for auction in the first place. With properties listed at auction, if it looks too good to be true, proceed with caution.

How Much Does a Mortgage Cost?

Buying a house comes with a myriad of fees. From conveyancing, surveys, and stamp duty, it can seem like you are locked into an endless cycle of paying money to various parties.

Buying a House Fees

There are three main fees you can expect to pay when buying a house.

Conveyancing – This is a fee paid for the legal aspect of buying a house including local authority property searches, contracts being drawn up and any additional searches or work a solicitor may need to do. Typical cost for conveyancing is between £1500 and £2000.

Stamp Duty – If you are a first-time buyer, stamp duty is waived up to a certain threshold (currently £425,000.00). Beyond that threshold tax is payable. For non-first-time buyers, tax is normally charged on a property purchase. You will need to use a Stamp Duty Calculator to budget how much will be charged in Stamp Duty.

Surveys – All properties bought in England and Wales are done under the legal doctrine of Caveat Emptor. This is commonly known as ‘Buyer Beware.’ Unless otherwise stated, you should expect to diligently check a property is up to your desired standard and a survey is a good way of assessing this. Surveys range in level of detail and cost.

Mortgage Product Fees

Most lenders have an application fee to cover the administration cost of arranging the mortgage. Mortgages typically have exit fees as well when your product term expires, and you remortgage.

Mortgage Broker Fees

Mortgage brokers can also charge fees providing they stipulate their fee structure up front. Some mortgage brokers charge very large fees – it is not unheard of to be charged a broker fee of £2000+. Some brokers even charge a percentage of the loan sum, like 1-2%.

Broker fees can also be charged at multiple points during the process, with some brokers charging a consultation and advice fee and then a subsequent fee when you apply for a mortgage.

The great news is there are a handful of mortgage brokers who operate on a fee free basis. Boon Brokers is one such broker and we will never charge you any fees in relation to your mortgage.

Speak to a Mortgage Broker

When used correctly, a Buy to Let mortgage can be a lucrative way to generate ongoing long-term income. Becoming a landlord can be a liberating experience and if you do it correctly, it can also be highly rewarding.

Boon Brokers is a Whole of Market Mortgage, Insurance and Equity Release Broker. Boon Brokers provides fee free Buy to Let mortgage advice.

Contact Boon Brokers to discuss your Buy to Let mortgage needs today.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Which Mortgage Repayment is Right for You?

- Do I Need a Mortgage in Principle to Make an Offer?

- Mortgage Terminology Explained

- What Is a Fixed Rate Mortgage and How Does It Work?

- What is an Offset Mortgage and How Does it Work?

- What Do I Need to Apply for a Mortgage?

- How Much Deposit Do I Need For A Mortgage?

- A Complete Guide to Mortgage Retention

- Can You Remortgage Early?

- Porting Your Mortgage – All You Need to Know

- When Should I Contact a Mortgage Broker?