Porting Your Mortgage – All You Need to Know

Moving home can be a stressful process and if you have a mortgage already, you may be wondering what happens to it. It is common for people to want to move property during their mortgage deal – but is it possible?

The answer is yes, in most circumstances you can transfer (port) your entire mortgage sum, or part of it, to your new property. This guide looks at mortgage porting, what porting entails and how to go about porting your mortgage. Let’s explore further.

We produced a comprehensive video guide about all you need to know about porting mortgages:

What Does Porting a Mortgage Mean?

In simple terms, porting your mortgage means transferring your existing mortgage product to a new property. When you take a mortgage product, the lender puts a charge on the property the mortgage is secured against. If you decide to move during your existing mortgage deal you will need to port the mortgage so that the lender can resecure the mortgage with a charge against the new property.

Porting a mortgage isn’t always the best option. It might be the case that arranging a new mortgage on the new property is better than porting a current mortgage. You may also find your mortgage product isn’t portable. This is where a lender has a restriction on your mortgage that prevents you from transferring it to a new property.

Lastly, you may find your new property is not a sufficient security for the mortgage and a lender may decline the option to transfer the mortgage.

How Does Mortgage Porting Work?

In the first instance you should check that your existing mortgage product is portable. If it is, you can arrange a port in one of two ways:

- Speak to your current mortgage lender

- Discuss your options with a mortgage broker

In almost all cases, it is best to discuss your options with a mortgage broker. This is because porting a mortgage may not be the best option for you and there may be other ways of arranging your mortgage that saves you money. For example, even if early repayment charges are payable, a broker will be able to calculate whether taking a new mortgage product is more cost-effective in the long-run.

Once you have discussed your options and decided to port your mortgage, your lender will check the new property meets the security requirements of the mortgage. In practise, following the sale of your property, the existing mortgage product on your former property is redeemed and then re-opened on the new property with the same account details.

Property Requirements and Lenders

You should be aware that each lender has different requirements regarding properties they lend on. Some properties will be suitable for one lender and unsuitable for another. This can be because of construction materials, type of property or whether the property is listed.

You will need to make sure your desired property meets the lenders requirements before attempting to port a mortgage. Failing to do so could result in your port being declined and fees being incurred such as early repayment charges where you must arrange a new mortgage.

Free consultations are available in the UK.

Get Started NowIs Porting a Mortgage a Good Idea?

There are two main reasons why porting a mortgage is a good idea for some borrowers:

- If your existing mortgage deal is cheaper than other deals on the market

- If you wish to avoid early repayment charges

With mortgage rates on the rise at this time alongside the Bank of England base rate, you may find your existing mortgage deal is much cheaper than other mortgage deals currently available. Porting a mortgage may also be the only way you can move home during a mortgage deal without incurring early repayment charges.

Unfortunately, it is quite common for borrowers to lock into long term deals and move into a property only to find they dislike their neighbours or neighbourhood. In these instances, having the ability to port a mortgage can be a valuable lifeline to move home and not be financially penalised by early repayment charges.

Do You Have to Pay a Deposit when Porting a Mortgage?

Yes, a deposit will still be required for the new purchase to satisfy the lender’s loan-to-value requirements. The lender may insist that your loan-to-value ratio remain in the same bracket for your new purchase to port the mortgage. For example, if you had 30% equity in your previous property, the lender may insist on at least 30% equity in your new property as a minimum.

In the extreme instance where your existing property is in negative equity, you will need to pay an even larger deposit to port the mortgage.

What is Negative Equity?

Negative equity is where you have bought a property and it has dropped in value to the point it has negated the deposit and mortgage payments you have made. In other words, the outstanding mortgage balance now exceeds the value of the property. For example, if you buy a property with a 10% deposit (£40,000) at £400,000 purchase price and the property has dropped in value to £350,000 you will find you are in a negative equity of £10,000.

You might think the mortgage payments will offset this loss, but the earlier you are in a mortgage the less likely you are to be paying significant capital. Initial mortgage payments will cover interest mostly and as time goes by, you will begin to clear a greater portion of capital. With property prices beginning to fall, the risk of negative equity is increasing and may become a problem over the next few years.

Deposits and Porting

If you are buying a property of similar value to your current residence, you will normally have enough equity (from your original deposit and mortgage payments) to cover a mortgage port without needing a deposit. However, if you are buying a property of different value to your current residence, your porting process may be impacted as explained below. In cases of negative equity, a lender may request a further deposit to act as a security on the mortgage.

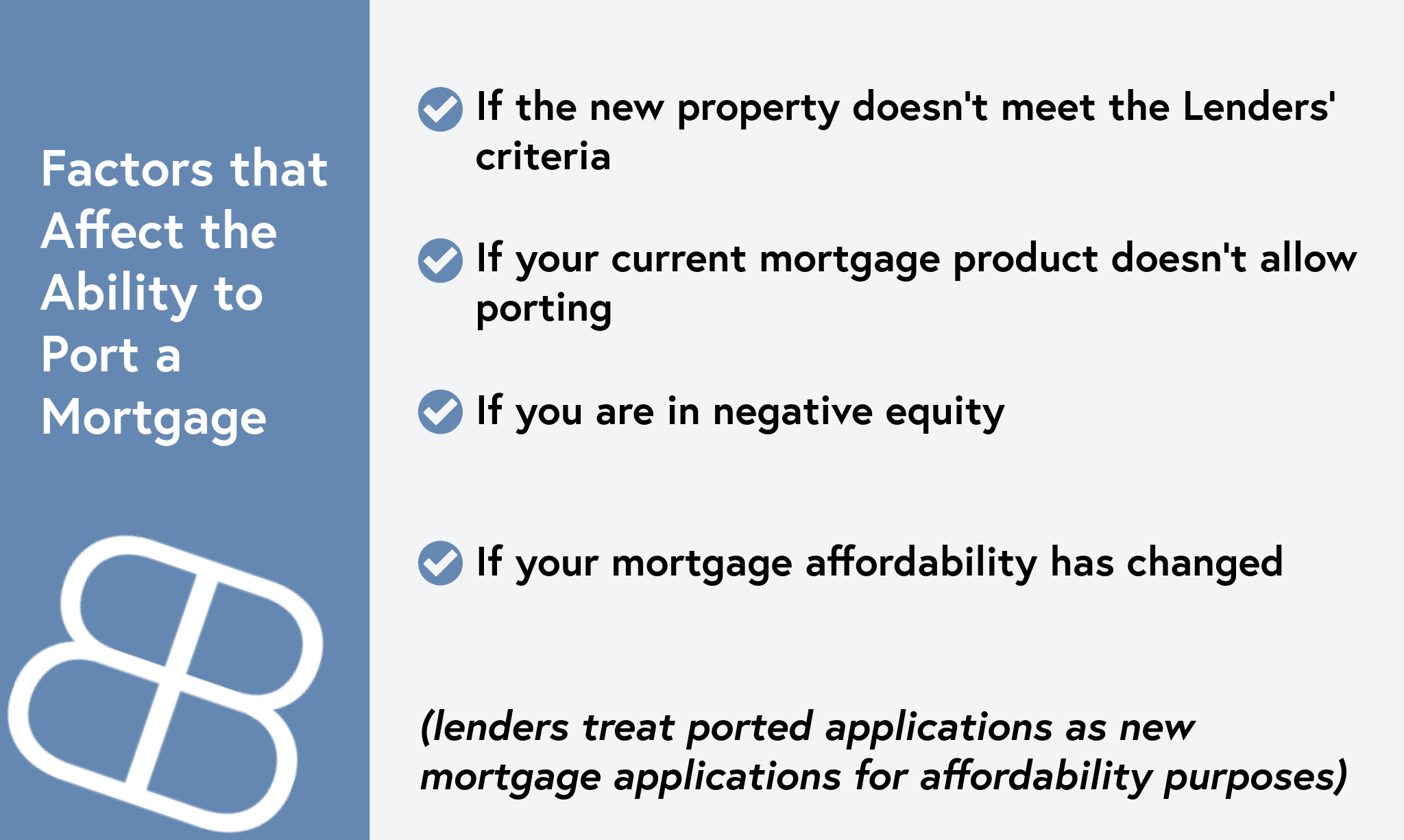

What Factors Affect the Ability to Port a Mortgage

The largest problems faced when porting a mortgage are:

What Our Clients Have To Say

What If I Am Moving to a Smaller or Larger Property

It is common for a new property to be a different value to an existing property. If the new property is cheaper than your existing property you might find your lender declines to port the mortgage. This is because they will need the new property value to cover the mortgage in the event you fail to make payments. As mentioned previously, the lender may insist that the new property meet their loan-to-value ratio for the mortgage product before allowing you to port it.

If the new property is more expensive than your existing property you will need to cover the difference by putting down an additional deposit. This is likely to be from personal sources such as savings or family gift.

In both circumstances, it is best to discuss porting with a mortgage broker for mortgage advice specific to your situation. Boon Brokers is a UK-based Whole of Market Mortgage broker. We can assess you mortgage options and advise if porting your mortgage is the best outcome in your circumstances. No client fees are charged at any stage of the process. Contact Boon Brokers to discuss porting your mortgage today.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles