How Do Buy to Let Mortgages Work?

Making income through rent is an attractive proposition for many people and Buy to Let mortgages are an important tool to help landlords build out a property portfolio. If you are new to the Buy to Let market or want to manage your Buy to Mortgages better, understanding how they work can be invaluable.

This complete guide outlines everything you can possibly imagine about Buy to Let mortgages, how they work and the alternatives you might wish to consider.

Let’s discover how Buy to Let mortgages work.

- What is a Buy to Let Mortgage?

- How Do Buy to Let Mortgages Work?

- How Much Deposit is Needed for a Buy to Let?

- Are Buy to Let Mortgages Regulated?

- Reasons to Become a Landlord

- How to Become a Landlord?

- Buying a Buy to Let with a Company

- Can I Use a Buy to Let Mortgage for Land or Commercial Premises?

- Are Buy to Let Properties Worth it?

What is a Buy to Let Mortgage?

A Buy to Let mortgage is a special product aimed at helping landlords purchase property to generate income from rent.

They are packaged differently to a traditional residential mortgage because there are different risks for lenders. For example, with a residential mortgage, the lender knows the borrower will be living in the property and have an incentive to keep it in good repair.

With Buy to Let mortgages a lender understands it will be rented out and tenants might not take as much care of the property as you would.

Because of the different risks involved, lenders tend to have higher interest rates on Buy to Let mortgages alongside higher deposit requirements.

Free phone and video consultations are provided in the U.K.

Get StartedHow Do Buy to Let Mortgages Work?

Most Buy to Let mortgages are taken on an interest only. Each month you will pay the interest due on the loan and at the end of the mortgage term the capital remains outstanding.

You can choose to repay this capital by using the saved rental income or selling the property. A lender is not concerned how you repay the capital, providing the sources come from a legitimate source and the capital is cleared at the end of the mortgage, they are satisfied.

In rare cases you might look at a repayment Buy to Let mortgage however these are rare and difficult to obtain. This is because lenders will want you to demonstrate the rental income is high enough to pay the capital and interest each month.

Rental Stress Testing

If you have a residential mortgage, you will know that a lender conducts an affordability calculation.

With Buy to Let mortgages there is no need for an affordability calculation on your own income and financial commitments as the idea is that you pay the interest on the loan from your rental income.

Instead Buy to Let mortgage lenders process rental stress tests. These tests will determine you expected rental income and compare it to the monthly interest payment. Your rental income will need to be much higher than your interest payment for it to be acceptable.

Discussing the rental stress test with your mortgage broker is an excellent idea as each lender approaches the stress test differently and have varying thresholds. If you are buying a property in an area that does not command much rent but has medium to high property values, you will need help from your broker to match you to the correct product.

See What Our Clients Have To Say

How Much Deposit is Needed for a Buy to Let?

Typically, your deposit requirement will be much higher on a Buy to Let mortgage comparative to a residential mortgage product.

Each lender sets their own minimum deposit amount. You should expect to put down at least 25% of the property value for your deposit to access a competitive interest rate.

Some lenders demand much more than 25% so you should discuss the deposit amount you have available with your mortgage broker so they can source you the right mortgage.

Are Buy to Let Mortgages Regulated?

When deciding on a Buy to Let mortgage you should understand you will not be treated as a consumer in the same way as if you took a traditional mortgage product.

Instead, you will be treated as a commercial borrower, someone who is able to borrow money for commercial gain.

In terms of regulation, it is a little complex. Your mortgage broker and lender will ultimately be authorised and regulated by the Financial Conduct Authority, but they will be acting outside of the remit of the FCA when advising and arranging Buy to Let mortgage business as they are largely unregulated.

If you are concerned about consumer protections, you might wish to look at Regulated Buy to Let mortgages which are available in special circumstances such as selling a property to a family member. This is also known as a consumer buy to let.

Reasons to Become a Landlord

There is a chasm between successful landlords and landlords scraping by with meagre profit. Some landlords even record losses year on year.

The key to being a successful landlord is approaching your property like a reputable business. This means actively ensuring you are up to date with legislation, managing your tenants properly and conducting necessary repair work to prevent it becoming a larger financial burden in the future.

Make no mistake, being a successful landlord requires effort and you will need to dedicate time and energy to ensure you are making the most of the opportunity.

Once successful, landlords can earn a lot of money, which can be reinvested into more property or help you enjoy a more financially stable lifestyle.

How to Become a Landlord?

Landlords have a received a lot of media attention lately and whenever a particular group is under scrutiny, it tends to lead to tighter government legislation.

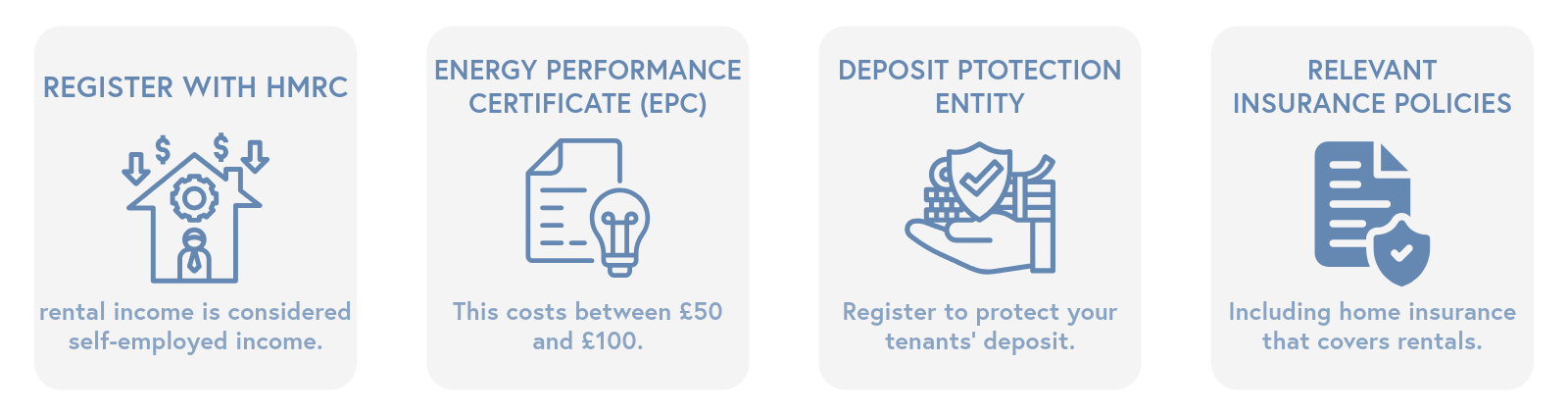

If you want to be a landlord, there are now several steps you must take by law including:

You should also consider drawing up a list of rules you intend to impose on your tenants that is passed on to a solicitor to draw up a legal contract. Remember your wishes and feelings expressed to a tenant will have no bearing in court unless there is a legally enforceable tenancy agreement in place.

If you intend to rent out the property as a House in Multiple Occupation (HMO) you will often require a licence. Although, this requirement will differ from council to council.

Other Expenses and Managing Your Rental

Finally, a good landlord has an emergency pot of money to cover:

It can be tempting to see all this expenditure and the need for a pot of money to be unnecessary or a burden. However, the landlords that suffer the most are those who cut corners, especially with the updates to legislation.

For example, failing to protect a deposit can result in hefty fines and not having an EPC in place and up to date will prevent you from being able to evict a tenant.

Lastly, repairs should be organised in a timely fashion because once again the cost accumulates the longer you leave a problem. If you have ever owned a car and put off a repair, you will know how expensive it can get when the problem worsens.

Tenants can now also claim compensation if repairs are not conducted to a desired standard and in a timely manner.

Buying a Buy to Let with a Company

Depending on the size of your rental portfolio you may wish to set up a Limited Company and manage your rental income through the company.

This can even be attractive if you have a single property.

There are two key advantages to setting up a LTD company for your rental property:

- You might be able to reduce your tax burden. For higher tax bracket earners this is especially true.

- You can claim back some of the expenses through your company account and offset the interest on the loan.

For taxation purposes, at basic rate your tax percentage beyond the tax-free threshold is 20%. When taking money from a company, directors often take up to their tax-free threshold and draw down any further money in dividends. The basic tax rate for dividends is currently 8.75%.

If you believe that setting up a company might be a more efficient way to earn income, you should consult with a tax adviser or your accountant to check if it is the right choice for you.

There is a big drawback to Limited Company Buy to Lets because lenders typically charge much higher interest rates.

Can I Use a Buy to Let Mortgage for Land or Commercial Premises?

Yes, Buy to Let mortgages are not limited to residential letting and there are specific mortgages called Commercial Buy to Let mortgages that allow you to buy land, offices, warehouses, and other commercial property.

The underwriting on these loans is slightly different as you might need to demonstrate a business plan alongside your rental stress-test. This is more than likely when purchasing land to rent out as you will need to show a lender the land is usable, in demand for the rental purpose and will meet the lender’s stress test.

Are Buy to Let Properties Worth it?

All financial products and decisions will have advantages and disadvantages. For some a Buy to Let mortgage and becoming a landlord would be wholly unsuitable and the disadvantages would far outweigh the advantages.

For others, the list of disadvantages is significantly lower than the positives and becoming a landlord is highly desirable.

In short, it really depends on your personal circumstances, your ability to meet your financial commitments and legal obligations as a landlord. If you are equipped to deal with those factors, a Buy to Let product could be an amazing opportunity.

Undoubtedly, your mortgage broker will have numerous success stories from clients who have built well-managed and profitable property portfolios – and it would likely have all started with their first Buy to Let mortgage.

Alternatives to Buy to Let

Becoming a landlord in the traditional sense is not appealing to everyone, especially with the governmental scrutiny ongoing at the moment.

Other economies are emerging that previous landlords are moving into like Air BnB and other holiday letting sites.

Your mortgage broker will be able to discuss various options available to you and there are dedicated mortgage products for any property purchasing circumstance. If the holiday let market is attractive, there are Holiday Buy to Let mortgages.

Speak to a Mortgage Broker

When used correctly, a Buy to Let mortgage can be a lucrative way to generate ongoing long-term income. Becoming a landlord can be a liberating experience and if you do it correctly, it can also be highly rewarding.

Boon Brokers is a Whole of Market Mortgage, Insurance and Equity Release Broker. Boon Brokers provides fee free Buy to Let mortgage advice.

Contact Boon Brokers to discuss your Buy to Let mortgage needs today.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Switching to a Buy to Let Mortgage

- Is Buy to Let a Good Investment?

- The Best Buy To Let Areas in the UK for Investment

- Getting a Buy to Let Mortgage with Bad Credit

- Buy to Let Mortgages with a Limited Company

- Converting a Residential Mortgage to a Buy to Let

- Equity Release For Buy To Let Mortgage

- Guide to Holiday Let Mortgages

- How Long Does It Take to Get a Let-to-Buy Mortgage?

- What is a Let to Buy Mortgage?

- Everything You Need To Know About Buy To Let