How Much Deposit Do You Need for a Mortgage?

One of the main challenges that first-time homebuyers face is being able to afford the required deposit to get onto the property ladder. In the past, mortgage lenders offered 100% mortgages where the applicant did not require a deposit but this is no longer the case.

Currently, the majority of mortgage lenders will lend up to 95% of the property value, meaning that the applicant will need to put 5% towards the property.

Short for time? Here’s a quick video giving an overview of the specifics of a mortgage deposit.

Some lenders will lend no more than 90%, or will take the applicant’s affordability, past financial history and other factors into account when determining the deposit required.

Recommended deposit for a mortgage

Many first-time buyers will need to spend time saving up in order to afford a deposit. If you were looking at a property valued at £150,000 and you need a 5% deposit, then that works out at £7,500 that you would need to save. Sometimes parents might help out by lending or gifting a sum of money that can be used towards the deposit but for most it means saving up for years.

However, for those that have the finances readily available for a deposit, the more that they can afford to pay against the home, the lower the mortgage amount would be and that means there is less interest to pay. Therefore, some mortgage applicants try to put as high a deposit down as they can afford to, in order to save themselves paying more interest over the term of the mortgage.

A deposit of 20% will place the mortgage applicant in a good position in terms of finding a good mortgage deal and it also improves their chances of having an application accepted.

Typical deposit amounts

The lending criteria varies from one mortgage lender to another but most lenders will not provide a mortgage loan unless a minimum of a 5% deposit is put forward. This is because the lender does not want to take on the risk of lending the full property value, in case they are financially impacted by it.

There are a few lenders that do still offer a 0% deposit mortgage but these usually are in the form of guarantor mortgages, where the lender is neutralising the risk by having an agreement that a guarantor will pay the mortgage payments if the borrower cannot afford to. Usually a parent or grandparent who matches the required criteria can act as a guarantor.

The lowest deposit required by the majority of lenders is 5%, with different interest rates offered depending on the size of deposit. Some lenders may request a higher percentage of deposit such as 10%, 15% or 20%, depending on different risk factors like bad credit history.

When you are looking at mortgage loan calculators and comparison tables, the mortgage deals advertised are usually shown in relation to 5% increments based on the loan to value ratio (LTV) i.e. 80%, 75%, 70%, 65%, 60% etc.

Free phone and video consultations are provided in the U.K.

Get StartedLoan to value (LTV) explained

The loan to value is a ratio that indicates how much you are lending, compared to the value of the property. For example, if you are looking at buying a property that is valued at £200,000 and you have a deposit of £20,000 then you have a 10% deposit, meaning that your LTV is 90%. In other words, you are lending 90% of the value of the property.

In order to access the best mortgage deals with the lowest interest rates, a low LTV is required. Generally, having a LTV of 80% or lower will get you a good mortgage deal in the current market.

Loan to value calculations are also important for people remortgaging, as the mortgage deals will be better for those who have a lower LTV. When property values rise, this provides an opportunity for many homeowners to negotiate a better deal, as their LTV ratio is lower than when they took out their mortgage. For example, if someone buys a house for £200,000 and two years later the house value has increased to £210,000 then that £10,000 could have pushed them into the next LTV bracket with lower interest rates.

Help to Buy scheme deposits

The government introduced a Help to Buy scheme in 2013 that is aimed at helping first time buyers get onto the property ladder and to also help people who want to move home. It is only available on new-build homes and is funded by Homes England, the government section that is responsible for making homes more affordable.

It involves the government lending a Help to Buy equity loan which is interest free for the first five years, providing that the applicant meets the necessary criteria.

An example of how a Help to Buy scheme works:

- Property value = £200,000

- Homebuyer pays 5% deposit of £10,000

- Government provides 20% equity loan of £40,000

The homebuyer is able to get a mortgage deal based on 75% LTV, which will enable them to pay less interest charges for the first five years than if they were to take out a £190,000 mortgage at 95% LTV.

After the first five years are over, the homeowner will then start to pay interest on the equity loan, which is 1.75% of the loan taken out, rising each year by the RPI (Retail Price Index plus 1%. This will be in addition to the payments that they are making to their mortgage lender.

The equity loan must be paid off in the event that the house is sold, which will be calculated as a percentage of the sale value, not the initial loan amount taken out.

See What Our Clients Have To Say

Who is eligible for a Help to Buy scheme?

Both first time buyers and existing homeowners are able to apply for the Help to Buy scheme provided that:

- They have a 5% deposit

- The property value is less than £600,000

- They will be living in the property most of the time

- They are buying a new-build property

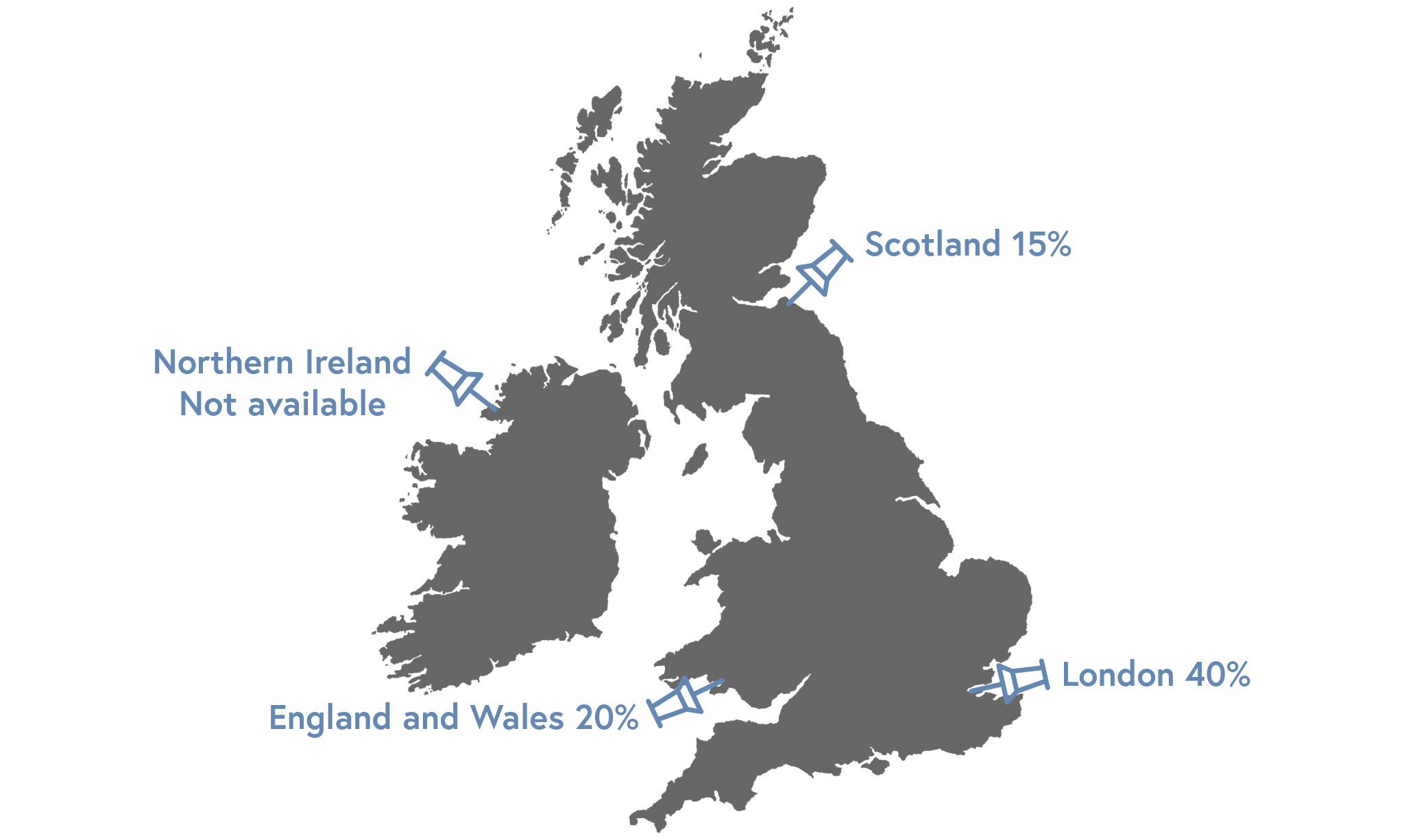

The amount that you are able to borrow from the government varies depending on where in the UK you are:

Reasons to save a bigger mortgage deposit

Whether you are applying for a Help to Buy scheme or you are arranging a standard mortgage, there are many benefits to paying a bigger mortgage deposit, such as:

-

Better mortgage deals

As we mentioned earlier, the lower the LTV, the better deals you can access. For example, if you are able to put £5,000 more deposit down than the minimum, over the term of 25 years that is £5,000 that you will not be paying interest rates on.

To provide an example from the current mortgage market, Barclays are currently offering an initial interest rate of 1.77% for a maximum LTV of 90% but if you were able to put more deposit down to make it 85% LTV then the rate offered is 1.64%, saving significant interest charges (0.13%).

-

Cheaper monthly repayments

Bigger deposits mean that your loan will be smaller, therefore your monthly payments will be less. This will help your monthly cashflow situation, so those who save up for that bit longer have long term financial benefits.

-

Less risk of negative equity

Going into negative equity is a big worry for homeowners and can often prevent them from being able to sell their property. Negative equity is when you end up owing more on your mortgage than your property is worth. This typically happens when house prices drop, for example when the financial crash of 2008 occurred.

However, this can also happen in the case of new-builds being sold at values higher than they are worth and when the property goes for re-sale, the valuation is lower and sells for a lower amount.

The higher amount of deposit you are able to pay, the less chance that you will go into negative equity, preventing the issues that you could face in that situation.

-

More likely to get accepted for a mortgage

Mortgage lenders look favourably on borrowers that are able to put a bigger deposit down, as it means there is less risk for them. Problems such as negative equity are less common when a homebuyer has a bigger deposit. It also indicates that the borrower has been able to save up, or wants to pay more of their home value, showing their commitment and ability to paying debt off.

Conclusion

When it comes to mortgage deposits, it can be a real struggle for first time buyers to get the money together to afford a good deposit but schemes such as the Help to Buy scheme are able to help people overcome the challenge. The greater the deposit that you are able to put down, the less interest you will pay, so it makes good financial sense to try and save up as much deposit as possible when you apply for a mortgage.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- What Proof Of Income Is Needed For A Mortgage?

- How Long Does A Mortgage Application Take?

- What Is A 100% Mortgage

- What Is A Deed Of Covenant?

- Should I Buy A House At Auction?

- How Does Being Self Employed Affect A Joint Mortgage?

- How To Buy A House After Lockdown

- Preparing For An Interest Rate Rise

- Everything You Need To Know About Buy To Let

- What Is A Tenants In Common Agreement?

- The House Buying Process

- What Is A Key Facts Illustration?