How Does My Credit Score Affect How Much I Can Borrow?

One of the most common problems borrowers face when getting a mortgage is their credit score.

Your credit score gives a lender an indication of how much risk there would be if they give you a mortgage but for some lenders this can be very strict.

It can be disheartening to walk into your high street bank and get rejected for a mortgage due to not meeting their credit score requirements.

But don’t give up just yet as there are plenty of solutions available to you even if you have bad credit.

This guide looks at how credit scores affect your borrowing chances and how you can track and improve your credit score. Let’s explore this further.

- Can A Credit Score Affect a Mortgage?

- How Do Lenders Make Their Mortgage Decisions?

- Credit Score Brackets and What They Mean for Your Mortgage

- What Happens with a Bad Credit Score and a Mortgage?

- How Do I Check My Credit Score?

- How Can I Improve My Credit Score?

- Be Careful When Paying Off Debt Entirely

- Managing Available Borrowing Limits

Can A Credit Score Affect a Mortgage?

Yes, your credit score will be taken into consideration when getting a mortgage. If you meet the lender’s credit score threshold, then you should have no difficulties applying for a mortgage.

If your credit score doesn’t meet the lender’s threshold, that means they will not offer borrowing to you.

Even if you do not meet the lender’s threshold, that does not necessarily mean you have a bad credit score some lenders set their credit score bar quite high.

In the UK there are hundreds of mortgage lenders and each one has different credit score and mortgage criteria.

This means even if you have been declined with one lender there should be other lenders that will be more favourable.

Free consultations are offered in the UK.

Get Started NowHow Do Lenders Make Their Mortgage Decisions?

Behind the scenes mortgage companies have actuaries who calculate financial risks for lenders when they offer loans. Actuaries will look at the risks they identify and advise a lender what interest rate they should be charging.

The interest rate charged by a lender is a combination of different aspects.

For example, most lenders will have borrowing of their own which is normally made at the Bank of England base rate.

A lender therefore needs to ensure the interest rate they charge exceeds any rate they’re borrowing at.

Aside from this, lenders are in the business of making profit too and they have overheads to cover such as physical branches and staff.

Lastly as mentioned, credit scoring also reflects the interest rates that lenders charge.

You will find lenders with more flexible credit score requirements tend to have higher interest rates.

The higher interest rates cover the additional risk to the lenders who offer those mortgages.

This means if they have lent to someone who is unable to maintain the mortgage commitment, they can cover the loss against the other borrowers paying the higher rate on their mortgages.

Of course, this is a very simple explanation of how mortgages work and there are plenty of other considerations a lender has to make before offering a mortgage.

Credit Score Brackets and What They Mean for Your Mortgage

There are 3 major credit reference agencies that mortgage lenders use in the UK.

- Call Credit (Previously TransUnion)

- Equifax

- Experian

Of the 3 agencies the most widely used in the industry is Experian with 76% of credit searches conducted through them. Equifax follows with 54% of searches and Call Credit 30% according to Debt Camel.

Each credit reference agency has different brackets a customer can fall into with a credit score. Equifax uses the following brackets;

- Bad

- Not Good

- Good

- Very Good

- Great

You may notice other services change these terms so your report might read very poor instead of bad but in general there are 5 brackets across the board.

Different agencies use different numerical scales to calculate which section you fall into, so a score of 760 with Equifax would be in the ‘Great’ section whereas with Experian, 760 would be a ‘Good’ score.

If you’re looking at your credit score and hoping to get a mortgage, the good news is that there are lenders who lend across the entire credit score spectrum (including bad credit score lenders).

That doesn’t mean you will be able to get a mortgage regardless of your credit score though, it really depends what has caused your score to be bad and even adverse credit lenders can be reluctant to lend if you’re bankrupt.

What Our Clients Have To Say

What Happens with a Bad Credit Score and a Mortgage?

If you have a bad credit score you will only be able to approach a handful of lenders who have created mortgage products specifically for higher risk borrowers.

As mentioned, it really depends on WHY you have a bad credit score as opposed to having a bad credit score alone.

Lenders for example are more likely to consider someone with a few defaults in the past compared to someone with a County Court Judgement (CCJ) or bankruptcy.

If you do have CCJs or you’re registered bankrupt, it doesn’t exclude you from the mortgage market and the adverse credit lenders have different rules around both.

In these cases, you should contact Boon Brokers so we can advise you of your options.

Boon Brokers is a whole of market mortgage broker, and our advice is FREE with no obligation to take a product.

We have arranged numerous adverse credit mortgages and should be able to find a lender that is suitable for you if you have a bad credit score.

How Do I Check My Credit Score?

There are a number of ways to check your credit score in the UK. Experian for example allows you to sign up to a subscription with them and monitor your score.

There are also a number of other ‘paid for’ or subscription services that provide you with your credit score. Some of these services use multiple credit reference agencies while others concentrate on one credit reference agency.

For example, subscribing to Experian will only show your Experian credit score. If the lender you’re using uses Equifax, you might find a few surprises when your credit score comes back different to expectations.

For this reason, it can be preferable to use a service that checks your score across all 3 major credit reference agencies and then provides an overview. One such service is CheckMyFile.

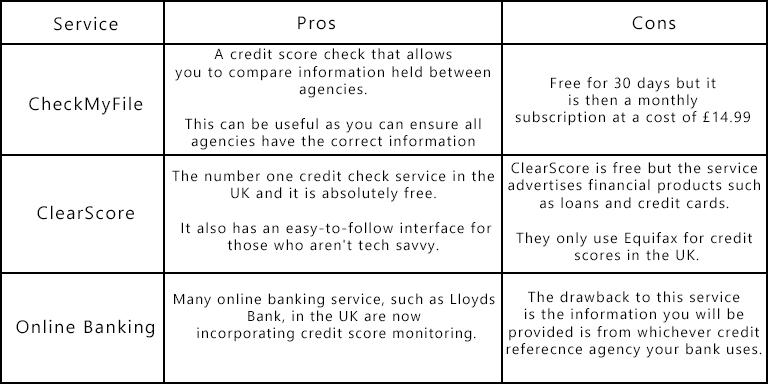

Below is a small table outlining credit score services and some of the pros and cons of each.

Another good free service that operates in similar fashion to ClearScore is CreditKarma (previously Noddle).

How Can I Improve My Credit Score?

There are 5 key ways that you can improve your credit score and some of them can make a drastic difference to your score in a very short space of time.

Registering to Vote

The single most significant action you can do to improve your credit score is register with the electoral roll to vote.

This is because credit reference agencies like to see that you’re relatively settled at an address.

When you aren’t registered on the electoral roll it can seem as though you’re more difficult to tie to a fixed address and lenders might be worried that finding you and enforcing a debt will be more difficult.

So, first and foremost you should look to register to vote on the electoral roll. It is also important when you moving you update the electoral roll.

Maintaining Financial Obligations

This is also an important action to improve your credit score.

When you take finance, in most cases each time you make a payment it will be shown on your credit file.

Failing to make payments on financial obligations will also be updated on your file.

These include missed payments which may be a one-off failure to make payment or defaults which are typically three or more missed payments.

In short, making payments and meeting financial obligations will have a positive impact on your overall credit score over time and failing to pay will impact your score negatively.

Free phone and video consultations are available in the UK.

Get Started NowBe Careful When Paying Off Debt Entirely

Over a long term this won’t impact your credit score negatively, but in short term timeframes paying off a finance agreement in full can damage your credit score for a period.

This is because lenders set terms and calculate interest rates (profit) for those terms and if you’re paying off debt before the term has expired the lender makes less profit.

When this is updated on your credit report other lenders might be hesitant to lend because they will be concerned that you will pay their finance off sooner than expected and they will make less profit as a result.

This is an exercise in financial risk, and lenders don’t like risk. They create products envisioning a clear profit margin and paying off finance too soon can deeply affect their margins.

Some lenders (especially in the mortgage sector) will apply early repayment charges to penalise borrowers who pay off finance too soon.

After a few months have passed your credit score should return to normal, but if you have noticed a drop in score after clearing debt and found it perplexing -this is why.

Managing Available Borrowing Limits

If you have a credit card or an overdraft your credit profile will track how close you are to your credit limits.

For example, if you have a £1000 credit card limit and you have £750 owed on that card it will begin to negatively impact your score as you approach your limit.

This is because financial institutions like people to be comfortably living within their means and within their borrowing limits.

Approaching a limit on a credit card sends red flags to a lender that you might not be living within your means, and you may instead be relying on that finance to get by.

Some mortgage lenders are extremely strict with this and don’t like borrowers to use their overdrafts regularly.

You should ask your broker how a lender approaches overdraft usage and then use your overdraft (or not as the case may be) in a way that is conducive to a mortgage application.

Use Savings Instead of Borrowing More

You might have a great credit score and it is easy to think about borrowing money to finance a car for example.

It can be deceiving to think of a low monthly payment being better than spending your savings pot in one go.

The truth is, the more you borrow the more impact it will have on your credit score.

If you accumulate too much debt this will also start to negatively affect your credit profile.

When it comes to savings, your interest rate on your savings account is almost always going to be less than the rate you can borrow at.

For example, if you have a savings account with a rate of 0.5% and borrowing available at 5% you are likely going to be better off using your savings simply because of the difference in interest rates.

Where possible use existing funds and live within your means. Over time you will notice your credit report thanks you for it and you will probably be grateful for the amount of interest you have saved over the years too!

The advice here doesn’t constitute personal financial advice and is for general information purposes only.

For specific advice about getting a mortgage and your credit score, contact Boon Brokers today for FREE, impartial and tailor made no obligation advice.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Mortgage Broker Fees

- How Much Does The Average Mortgage Cost

- Mortgage Affordability Calculator

- How To Get A Mortgage After Bankruptcy

- The Mortgage Underwriting Process

- Advantages Of A Mortgage Broker

- How Long Does A Mortgage Application Take?

- How Long Does A Mortgage Application Take?

- Purchasing A Property With Shared Ownership

- The House Buying Process

- What Should I Ask When Buying A House?

- Military Mortgages Guide