Public Alarm Sounds Over Capital Gains Tax Reform [October 2025 Study]

New research from Boon Brokers reveals that UK homeowners reject the proposed Capital Gains Tax changes on main residences, believing the reform to be unfair and damaging for all homebuyers. Download the full research file in the footer of this article.

Key Findings:

-

- 97% of respondents disagreed that applying CGT to main homes is the fairest way to balance public spending.

- 78% of respondents believe this tax change would reduce Labour’s chances of re-election.

- 73% of respondents state that the proposed changes to CGT would be unfair and that “homeowners have already paid enough.”

- 71% of respondents say the proposed changes would make homeowners less likely to sell their main residence.

- 39% of respondents (largest single response) state the proposed changes to CGT would negatively impact all homeowners.

- 32% of respondents would prefer to reduce government spending rather than raise new taxes.

Data Summary:

| 1,000+ respondents – TLF Research |

| Participants from North, East, West and South of England |

| All Age Groups represented |

| All respondents were homeowners |

To better understand the UK’s public sentiment towards the proposed Capital Gains Tax reform, Boon Brokers commissioned a UK-wide survey examining perceptions of fairness and the potential consequences for homeowners.

Under the current UK tax system, main residences are exempt from Capital Gains Tax (CGT). CGT is instead only payable on profits from the sale of second homes, investment properties, shares, and other assets. The proposed reform to this structure would remove or reduce this exemption for higher-value primary homes, meaning a portion of the profit from selling a main residence could become taxable.

It is important to note that the exact details on thresholds, tax rates, and exemptions, have not yet been confirmed at the time of writing, however, the introduction of this proposed reform could create a significant shift in how homeownership is treated for tax purposes. If implemented, these changes could alter financial expectations and influence homeowners decisions about when, or if, to sell.

The research revealed that UK homeowners are both concerned and anxious about the proposed CGT reform, with most stating the introduction would be unfair and potentially damaging to the wider housing market. Many believe it would discourage property sales, place additional strain on ordinary homeowners, and that the government should instead focus on reducing public spending. The prevailing sentiment was clear: “homeowners feel they have already paid enough”.

UK Homeowners Reject Capital Gains Tax Reform as Unfair

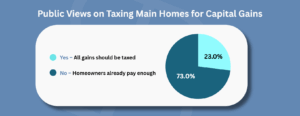

A central finding of the research was that, in response to the question “Do you believe it is fair for the government to apply Capital Gains Tax to main residences that were previously exempt?”, 73% of respondents stated that applying CGT to main residences would be unfair.

To outline this further, the research found 97% of respondents disagreed that applying CGT to primary homes is the fairest way to balance public spending, revealing a strong opposition across all demographics.

This data provides a strong reflection of a growing widespread view that additional taxing, especially in the form of a main residence, would impose an additional financial burden on individuals who have and are already contributing to the housing market.

As such, these statistics are indicative of a growing concern among homeowners: the perception that the proposed reforms could end up penalising those who have made long-term financial decisions that were predicated upon the existing system.

The research found this sentiment was consistent across the UK, with respondents from all regions, including the North, South, East and West of England, as well as Scotland and Wales. All regions align with the view that the proposed changes would be unfair, and if implemented, the reform would most negatively affect homeowners.

Market Freeze with Capital Gains Tax Reform

The data also revealed insights into how the proposed Capital Gains Tax changes could influence homeowner behaviour and impact the wider property market.

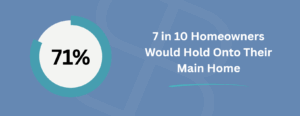

71% of respondents stated that the reforms would make them less likely to sell their main residence, indicating that, if implemented, a significant proportion of homeowners may choose to postpone selling in order to avoid additional taxation.

While respondents did not comment directly on market consequences, this reluctance to sell found in the data could lead to a constrained housing market. Reduced availability of homes for sale may, in turn, exacerbate the already existing affordability challenges, making it harder for first-time buyers and younger households to step onto the property ladder. As such, the UK homeowners, under the proposed reform, would have the potential to indirectly limit social mobility across the UK housing sector.

Introducing Capital Gains Tax on main residences could have serious consequences for the housing market. When fewer homeowners are willing to sell, supply will naturally constrict, driving up competition and prices. This imbalance between supply and demand doesn’t just impact affordability, it would risk stagnating the market and placing greater pressure across all levels of the housing market.

Gerard Boon Managing Director (B.A Hons, CeMAP, CeRER)

The findings reinforce this concern, showing that a reluctance to sell would be consistent across all age groups. Among respondents aged 18-24, 76% said they would be less likely to sell their main residence if CGT were applied, compared with 63% of those aged 25-44, 68% of those aged 45-54, and more than 80% of respondents aged 55 and over. This pattern clearly indicates that the potential impact of the proposed reform would span generations, with older homeowners appearing the most resistant to selling under the new tax conditions.

Homeowner Opposition Could Hit Labour Votes

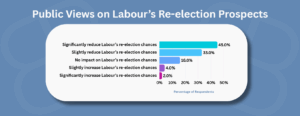

The commissioned survey also explored public opinion on how the proposed CGT changes might influence support for the current Labour government. Respondents were asked: “How do you think this tax change will impact Labour’s chances of re-election in the next general election?”

The results found that the proposed CGT reform could also carry political repercussions, with 78% of respondents believing it would reduce Labour’s chances of re-election. Of these, 45% stated it would significantly reduce Labour’s chances, while 33% said it would slightly reduce the party’s chances at the next general election.

This sentiment was consistent across all regions and age groups, indicating broad voter concern about policies affecting primary residences. When viewed alongside wider findings on fairness and financial impact, the data suggests that perceptions of the proposed reform may already be shaping public confidence in Labour’s approach to housing and taxation.

Homeowners Choose Spending Cuts Over New Tax Reform

While earlier findings revealed that a strong majority (97%) of respondents disagreed that applying Capital Gains Tax to main residences is a fair way to balance public spending, the research also highlights a broader view about the UK’s public opinion on how the government should approach the current fiscal crisis.

When asked which approach would be the fairest way to balance public finances, 32% of respondents – the largest proportion – stated that the government should reduce public spending rather than raise new taxes.

A further 22% said that wealth or high-income households should be targeted instead of main homes, while 19% preferred introducing a wealth tax on very high net-worth individuals. An additional 16% advocated maintaining current exemptions and focusing on economic growth to raise revenue, with smaller proportions supporting higher income tax for higher earners (7%) and only 3% believe that the reform of applying CGT to main homes is the fairest way to balance public spending.

These findings clearly outline that UK homeowners are seeking fairer, less disruptive solutions. By focusing on spending cuts, targeted wealth measures, or economic growth, UK homeowners believe the government could address public finances without placing additional burdens on those already heavily invested in the housing market.

Homeowners Have Sounded the Alarm on Proposed CGT

Ultimately, Boon Brokers research reveals widespread opposition among UK homeowners to the proposed Capital Gains Tax changes. This resistance is predominantly driven by the perception that the reform would be unfair, financially detrimental, and likely to significantly alter homeowner behaviour, making many less willing to sell their properties. Collectively, these effects could constrain housing supply, limit social mobility within the housing market, and create additional financial challenges for prospective buyers.

In addition, the data also indicates that the proposed reform could also carry political implications, with a majority of respondents believing that CGT on primary homes could reduce Labour’s re-election prospects. Homeowners are clear in their preference for alternatives, favouring spending cuts, targeted wealth measures, or economic growth over additional taxation on main residences.

These findings highlight a critical tension for policymakers: any move to tax primary homes risks not only financial strain for homeowners but also market disruption and voter discontent, reinforcing the need for fair and practical action. As one clear message from the research emphasises: “Homeowners have already paid enough.”

Notes to the editor

Research was conducted between 6th – 10th October 2025 amongst 1,000 applicants.

About the Researcher:

The Researcher for this article is Gerard Boon (B.A Hons, CeMAP, CeRER). Mr. Boon is the Managing Director of Boon Brokers Limited, a Directly Authorised Online Mortgage, Insurance & Equity Release Brokerage in the U.K. Boon Brokers boasts over 9,000 clients across the country and is quickly scaling year on year. Mr. Boon is passionate about Artificial Intelligence in the industry. During his studies at the University of Leeds in 2018, he achieved a First classification for his dissertation project titled “Artificial Intelligence in Financial Intermediation: An Investigation into the Prospects of Robo-Advice Developments for Independent Mortgage Brokers in the United Kingdom”. Since 2018, AI technology has rapidly developed. Mr. Boon is hoping to update his research on the topic following this survey.

Download the Full Results – Capital Gain Tax Survey – October 2025