What is Mortgage Underwriting from a Lender?

Underwriting is an essential part of the mortgage application process. In the article below, we explain the underwriting process in great detail. Let’s get started.

Are you short for time? Watch the video below from our Managing Director.

Mortgage Underwriting Overview

You may have heard about underwriting in the context of insurance. Mortgage underwriting works in a similar fashion. It allows lenders to assess the risk of lending for each mortgage in a streamlined process.

The mortgage interest rate offered by lenders will typically reflect the application’s risk level.

For example, if a bank offers a headline rate of 4%, this will be for their lowest risk mortgages.

The interest rate on a mortgage depends on the risk of the case. Sometimes you might find a mortgage that has higher interest after the underwriting process completes. Mortgage interest rates will also be influenced by current market conditions. For example, interest rates for almost all mortgage applications are higher than they were just a few years ago.

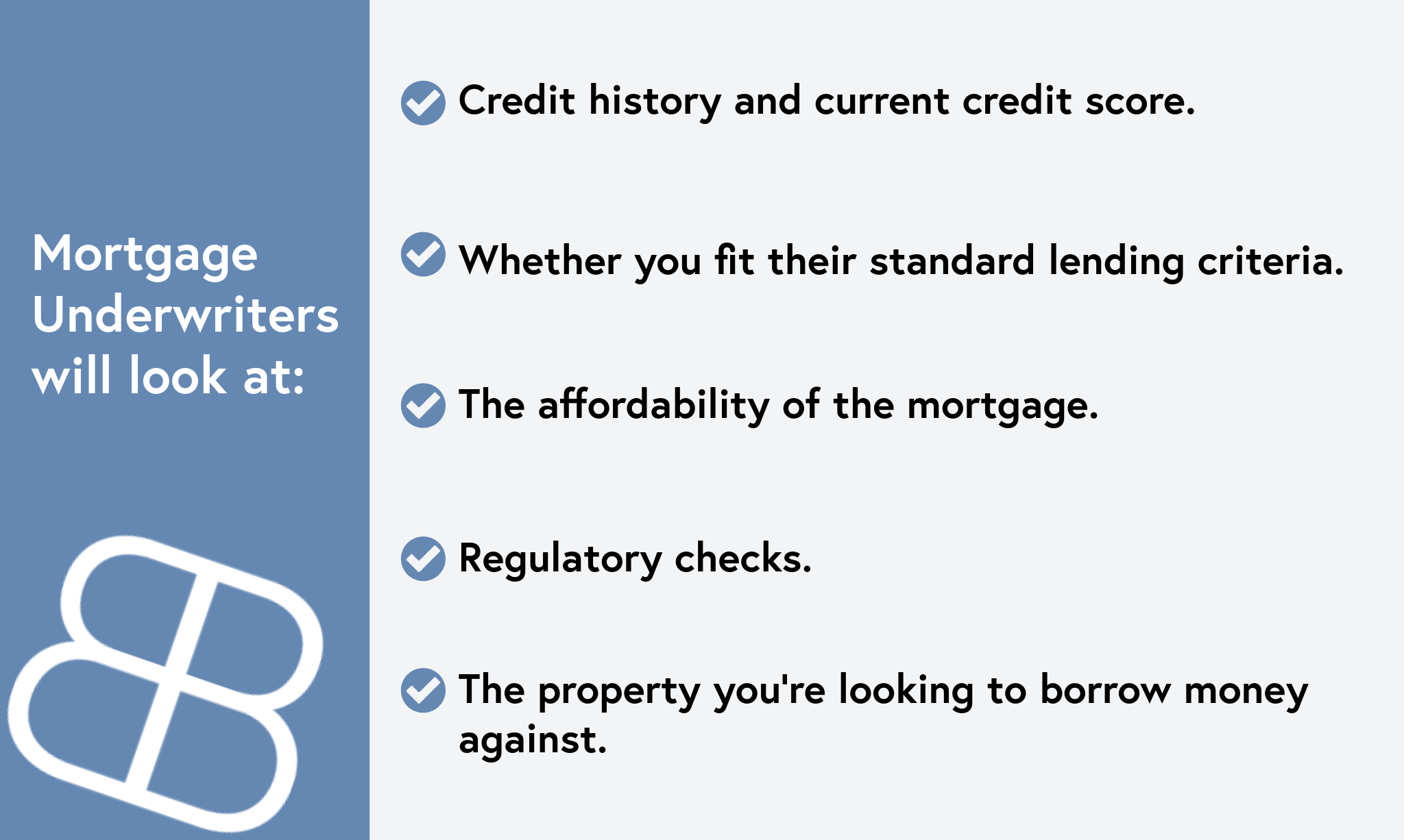

A mortgage underwriter will look at several factors when deciding on whether to approve a full mortgage application.

They review the following:

We will examine each of these in more detail shortly.

What is an Underwriter and What Do They Do?

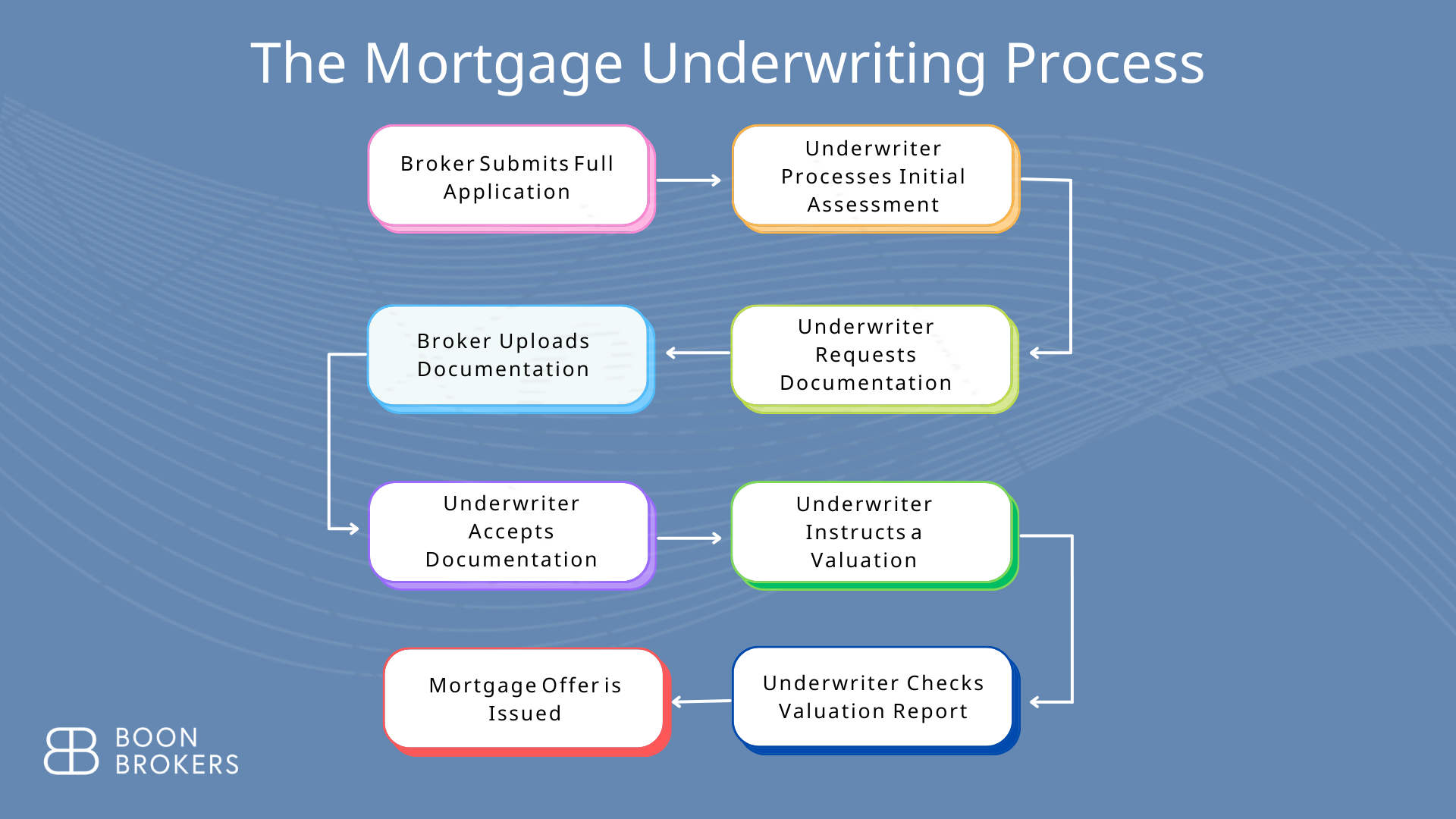

Mortgage underwriters work for banks or building societies. Their job is to evaluate the risk of each mortgage application received. Underwriters have a checklist and criteria guidelines to follow. They must be satisfied that the lender’s borrowing requirements are met before they can approve a mortgage offer. Underwriters are normally responsible for:

- Assessing the Accuracy of an Application

- Checking the Authenticity of Documents Uploaded

- Checking that the Lender’s Criteria is Met

- Instructing the Valuation

- Assessing the Valuation Report

- Issuing a Mortgage Offer

Your mortgage broker can help explain the underwriting process for each lender specifically. Mortgage brokers normally have access to underwriters during the application process. Whereas, if you apply directly to the lender yourself, you may not have the same access.

With some lenders, underwriters are unable to contact applicants or brokers because of their high case volumes. However, some cases present an exception to this rule. Many mortgage lenders have ‘large loan’ underwriting divisions. In these teams, applicants may receive bespoke underwriting and have direct access to the case’s underwriter.

Still unsure about mortgage underwriter? Speak with our Fee-Free Advisers.

What Factors Are Checked During the Underwriting Process?

Below we outline the key aspects checked during the underwriting process.

Credit History and Current Credit Score

This is important because a lender will want to check that you are likely to make mortgage repayments on time.

Many lenders are not keen on offering mortgages to borrowers that pose a high risk of defaulting on mortgage repayments. Even though lenders can repossess a property if monthly mortgage repayments are not maintained, lenders prefer not to repossess properties. This is because there are large costs involved in repossession which will reduce their profitability on the loan.

They usually sell repossessed properties at auction. Selling properties at reduced value and even make losses in the process is common for lenders.

In short, a lender wants to avoid hassle. They want to ensure that you are a reliable borrower who meets the payment terms of your financial commitments.

Checking a credit history will give underwriters an understanding of how responsible you are as a borrower. Lenders will often check your credit file at the Agreement in Principle (via a Soft Credit Check) and Full Mortgage Application (via a Hard Credit Check) Stages of the application process.

Soft Credit Checks These don’t appear on your credit record and provide lenders with your credit history and score.

Hard Credit Checks When a lender performs a hard credit check it will appear on your credit record. This means other lenders can see if you have applied for a mortgage elsewhere.

Checking the Property

When you buy a house or flat, the mortgage provider will have a strict set of guidelines about the condition and type of property that is acceptable to their lender.

For example, most lenders require a property to be of standard construction. This normally means that it has brick walls and a tiled roof.

If you are planning to purchase a home with a unique roof, such as a thatched roof or one made from unusual materials, it may be unacceptable to a mainstream mortgage lender. Speaking with mortgage broker will be the best option. Reputable whole of market brokers, like Boon Brokers, can help you identify lenders who are willing to finance non-standard properties.

Lenders will likely want a survey conducted of the property to ensure it meets their guidelines.

In some cases, if the survey highlights issues or if the property fails to meet the lender’s criteria, an underwriter may be able to offer a different product rather than immediately declining the case.

The valuation report will also highlight the market value of the property.

If the seller or the real estate agent overvalues a property, it can increase the lender’s perceived risk. This is because, if the borrower is applying for a mortgage with a high loan-to-value ratio (limited to 95%), the lender could be in a situation of negative equity when the mortgage application completes. This is a common problem because real estate agents often earn a commission based on the sale price of a property. Underwriters are aware that estate agents are incentivised to overvalue their listings. For this reason, they always instruct a valuation (either Automated or Physical) on every mortgage application.

Affordability

Many mortgage borrowers believe that lenders will always allow borrowing up to 4.5 times of their annual salary. However, this is not true. There are many factors that influence mortgage affordability.

The following areas will have the largest impact on your mortgage affordability:

- Income Level

- Type of Income

- Financial Commitments

- Overall Mortgage Term Requested

- Mortgage Product Requested

- Monthly Expenditure

- Loan to Value Requested

You may be surprised at how detailed the questions are about your expenditure when you complete your mortgage application. However, lenders have a regulatory obligation from the FCA to lend responsibly. Mortgage underwriters must be comfortable that you can meet your monthly mortgage repayments now and in the future.

Standard Lending Criteria

All mortgage lenders have slightly different criteria from one another. A mortgage broker, like Boon Brokers, will understand the nuanced differences in criteria which may make one lender more suitable than others for your scenario.

Mortgage underwriters will have a full understanding of their lender’s criteria. Lending criteria is extensive and covers acceptable areas like income, property, age and loan-to-value.

There are certain criteria that most lenders will insist on. For example:

- Maximum age of 70 or 75 for a mortgage term.

- Being a UK resident with the right to reside in the UK.

- Using a deposit that comes from a suitable source (i.e savings, gift, etc)

However, many lenders are differentiated by their appetite for risk. For example, one lender may accept an application from an applicant with recent late payments, whereas another may firmly decline. If a lender has a higher appetite to risk, you should expect to see higher interest rates attached to their mortgages.

How Long Does Underwriting Take?

This depends on the type of mortgage you’re applying for and the lender you’re applying to.

Product Transfers

A product transfer is a change of mortgage product with the same lender. Product transfer requests are normally instantly processed by the lender’s systems. This means that no human underwriting normally takes place if a broker applies for a product transfer.

If you submit a product transfer application, the new mortgage product will generally begin when your current mortgage ends. This avoids any early repayment charges.

A mortgage lender will rarely request a valuation of the current property with a product transfer. AVMs use online house price index data to estimate a property’s value. Since AVMs can process information instantly, they significantly speed up the underwriting process.

The underwriting time for Product Transfers is less than 1 working day with most mortgage lenders. However, you may find that smaller lenders, like niche building societies, do not work with automatic systems. Mortgage underwriting with those lenders can take far longer – often between 3-6 working days.

Remortgages

A remortgage is a change of mortgage product with a different lender. Remortgages are normally treated as a brand-new mortgage application. This means that full human underwriting is likely to take place.

With remortgage applications, underwriters will review the risks involved of lending by requesting income documents. After the underwriters assess the risk profile of the case and are satisfied with the documents, they will instruct a valuation on the property.

Mortgage lenders tend to instruct third-party surveyors. This means that they are reliant on their timelines. However, most surveyors will contact the lender’s client within just a few working days to arrange a valuation. The valuation is often paid for by the lender and is free of charge to the client.

When the surveyor completes the valuation, the valuation report will be sent to the underwriters to examine. Most underwriters will assess a valuation report in 2-5 working days. Once they are satisfied with the valuation report, they will issue a Mortgage Offer.

Purchases

A purchase mortgage is a mortgage product designed for applicants buying a new property. Full human underwriting will take place. It is far more likely that a physical valuation will be instructed with a purchase application, compared to a remortgage or product transfer. This is especially true if the lender has not received a valuation report for the property previously.

As a result, you should expect the underwriting times to be longer for purchase mortgage applications than all other types of mortgage application. However, aside from the valuation report turnaround time, the underwriting process is the same as it is for remortgages. The only additional complication with purchase applications is that the surveyor must contact a third party, rather than the mortgage applicant. This is normally the property’s acting selling agent or the vendor.

The underwriting time for Purchase applications is typically 6-10 working days. Again, this assumes that the valuation report is booked in a timely manner with the selling agent and/or vendor.

What Our Clients Have To Say

What Happens if a Mortgage is Declined During Underwriting?

If a mortgage application is declined by a mortgage lender, the underwriters will normally provide a brief summary regarding why it has been rejected. The underwriter will usually send an e-mail confirming the reasoning for the decline. In rare cases, they will also call the broker to explain further.

If a mortgage application is declined during underwriting, a reputable broker will source alternative options before revealing the news to the client. This softens the blow of the client being rejected, which could be for reasons outside of their control.

Many borrowers worry about the impact on their credit file if they are declined by a mortgage lender. However, unless the client has been declined for credit-related reasons, there is no need to worry in most cases. Although, it is true that submitting many mortgage applications in a short space of time can negatively impact your credit file. This is because mortgage lenders often leave hard credit footprints on your credit report at the full mortgage application stage.

These checks appear on the Credit History section of your credit file, which is visible to other lenders. Other lenders can view this negatively as it indicates that you are struggling with your finances as you are frequently applying for credit commitments.

Ultimately, if a mortgage application is declined by an underwriter, there is often no need to panic. Your broker will discuss your options with you to ensure that you have a suitable plan of action to achieve your objectives.

Conclusion

Mortgage underwriting is a process that allows lenders to evaluate the overall risk of lending to you.

It has many aspects and can take a while to complete especially in unusual cases.

Using a broker like Boon Brokers can help you understand your particular mortgage application in a more in-depth way.

Boon Brokers is a whole of market UK mortgage, insurance and equity release broker.

If you have questions about underwriting or have had your mortgage application declined for any reason, contact Boon Brokers today for free, no obligation mortgage advice.

Need Mortgage Advice?

Submit an Enquiry

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles

- Military Mortgages Guide

- What Is An Offset Mortgage?

- The Mortgage Underwriting Process

- What Are Solicitor Searches?

- What Is A Deed Of Covenant?

- What Is A Mortgage Illustration?

- What Is A Mortgage In Principle?

- What Is A 5X Mortgage?

- How Much Deposit For A Mortgage?

- Benefits Of A Commercial Mortgage

- What Should I Ask When Buying A House?