Created for Solicitors

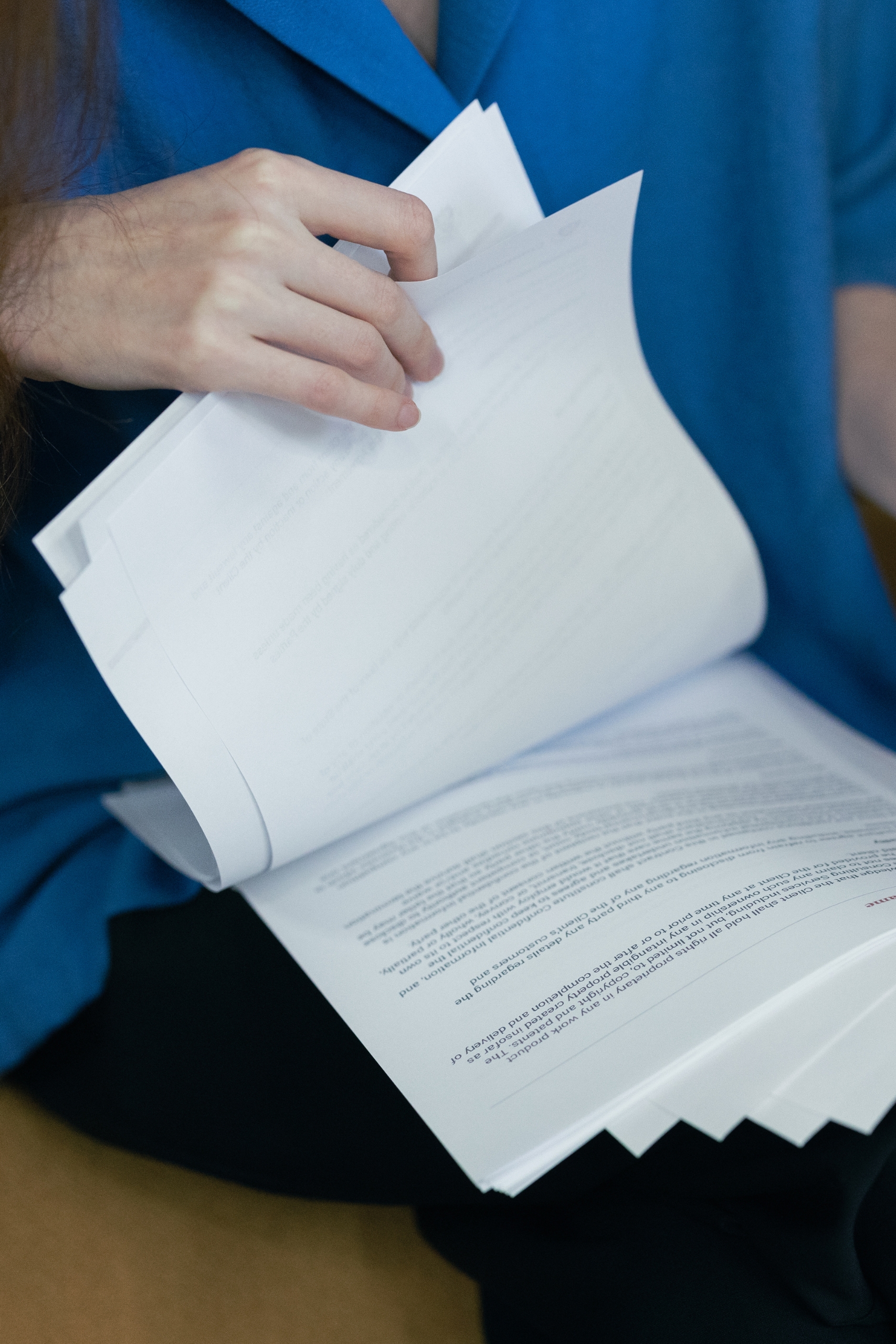

Inside the Report

All reports are prepared by FCA-regulated mortgage advisers with whole-of-market access to ensure a detailed borrowing capacity assessment across multiple lenders.

Our mortgage capacity reports include:

- Detailed income and expenditure analysis

- A clear borrowing capacity range across a whole-of-market panel

- Impact assessment of outstanding debts on borrowing potential

- A mortgage illustration for easy client communication

Court-Ready Delivery

Each report is professionally formatted to be court-ready and suitable for Form E disclosure, financial remedy hearings, or joint expert instructions.

We understand that legal deadlines can be demanding – that’s why we deliver our reports within 1 working day of receiving payment. All our reports are provided as signed PDFs, ready for a quick inclusion into your client’s legal bundle.

Every report also includes a clear, easy-to-read mortgage illustration for straightforward client communication.