49% of Young Mortgage Borrowers Believe Paying Broker Fee Results in Better Rates

Every so often we conduct independent research to find out the latest attitudes and trends in the mortgage industry. Our latest research encompasses mortgage broker fees to find out everything we could about your experiences with these charges. Our nationwide research surveyed 1,000 mortgage borrowers for their views on broker fees and the mortgage market.

To say we were surprised by the results is an understatement and we have outlined the good, the bad, and the ugly in this article. Buckle in as we get to grips with mortgage broker fees and dispelling myths around them.

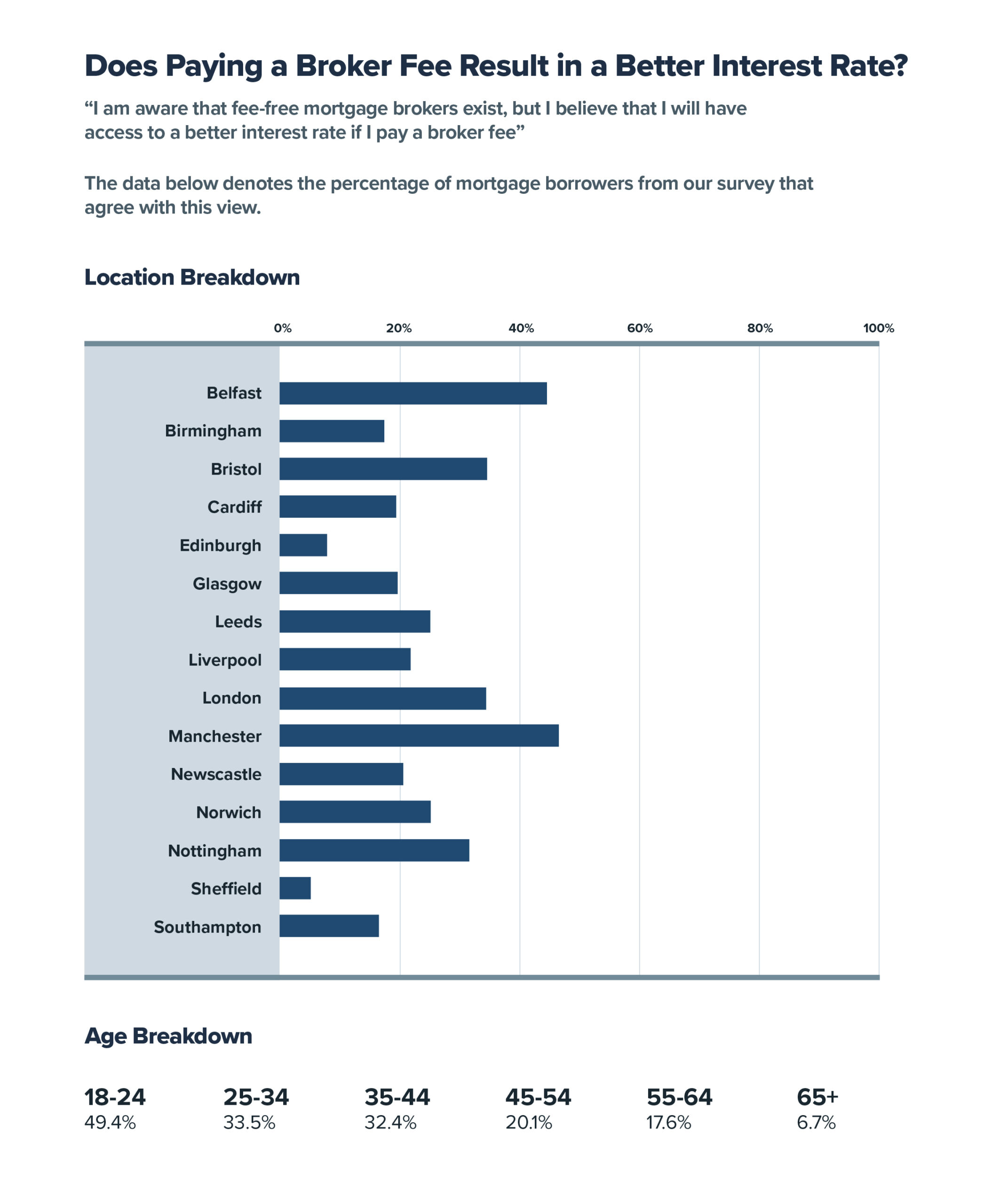

Does Paying a Mortgage Broker Fee Result in a Better Rate?

The headline surprise from our research was that almost half (49.4%) of young people (aged under 24) believed that paying a broker fee would result in a better interest rate.

We shouldn’t blame the naivety of youth for this statistic as other age groups also scored high on this question. For example, a third of respondents between the age of 25-44 also believed paying a broker fee would get them a better mortgage interest rate.

Older borrowers over the age of 45 were not immune to this misconception with an average of 14.8% (over 1 in 10) expecting better rates by paying a broker fee.

Myth Busting: Paying a mortgage broker fee DOES NOT result in a better rate. Mortgage brokers have access to a range of lenders, and no one broker gets preferential rates by charging clients broker fees.

For example, if your mortgage broker finds a deal with Barclays Bank, you will be able to obtain that same deal with another whole-of-market mortgage broker.

Why Do People Believe Paying Fees Results in a Better Rate?

When we buy property and get a mortgage we are bombarded with costs. Surveyors, solicitors and even the lender themselves charge fees.

It is fair to say buyers have come to expect fees and when a mortgage broker informs them that they charge a fee, it is almost always unchallenged. After all, if every other service including your chosen lender is charging a fee, why would a mortgage broker be different?

And – if a fee is charged, it must be for something, so it stands to reason it must be for a better mortgage rate or a better service. There are also brokers who underhandedly advise clients that the fee being charged helps them achieve the best mortgage rate or a higher level of service – which is untrue.

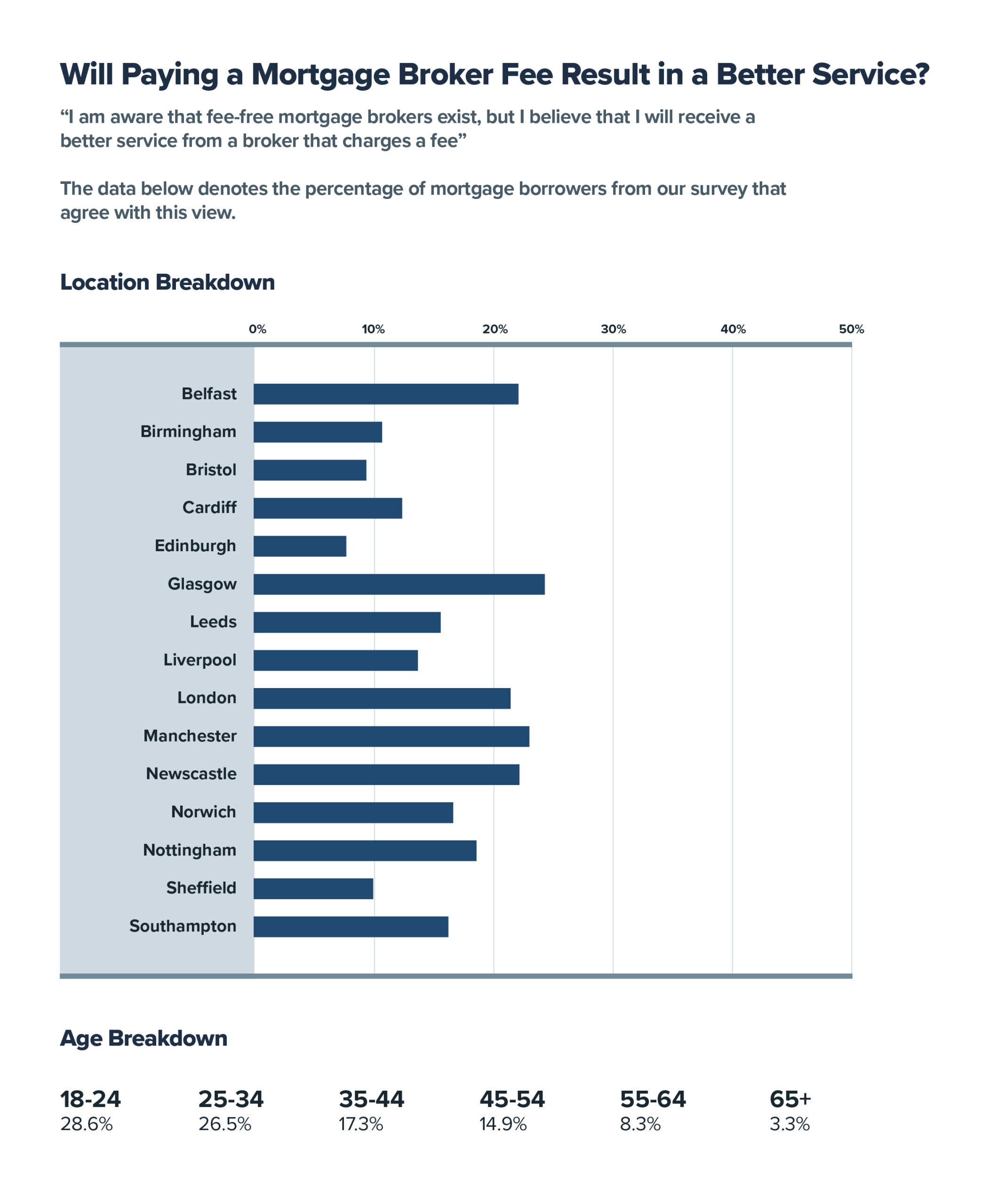

Will Paying a Mortgage Broker Fee Result in a Better Service?

We have touched on interest rates and debunked the myth that paying fees results in a better mortgage interest rate, but what about service?

Before we tackle that question, we will look at the responses to our survey to see what the perception is around broker fees and service.

Most people rightly believe paying a broker fee does not improve the service they receive. But surprisingly almost 20% or 1 in 5 respondents under the age of 64 believed paying a broker fee affected the expected service from a mortgage broker.

Myth Busting: Paying a mortgage broker fee DOES NOT impact the service you will receive.

Mortgage brokers who charge fees are no more qualified and no more service oriented than free mortgage brokers. In fact, the argument could be made they are less customer focused by charging unnecessary fees.

Why Do People Believe Paying a Fee Equates to Expected Better Service?

This is an interesting concept. A psychological study evaluated whether paying more for the same pizza affected the taste of the pizza and found people paying more for the same slice of pizza said it tasted better.

Whenever we pay more money, we have an expectation of quality difference and to some extent this is happening when we pay mortgage broker fees.

The truth is paying a mortgage fee will have no bearing on the level of service you can expect in the same way that paying more for the same slice of pizza has no bearing on its flavour.

There is also the chance paying a mortgage broker fee can result in poorer service, for example fee free mortgage brokers get more business and process more mortgages on average than fee charging brokers.

This means if your mortgage is unusual or challenging, a fee charging broker might not have come across the scenario before and may not have the experience needed to process your application effectively.

Free consultations are available in the UK.

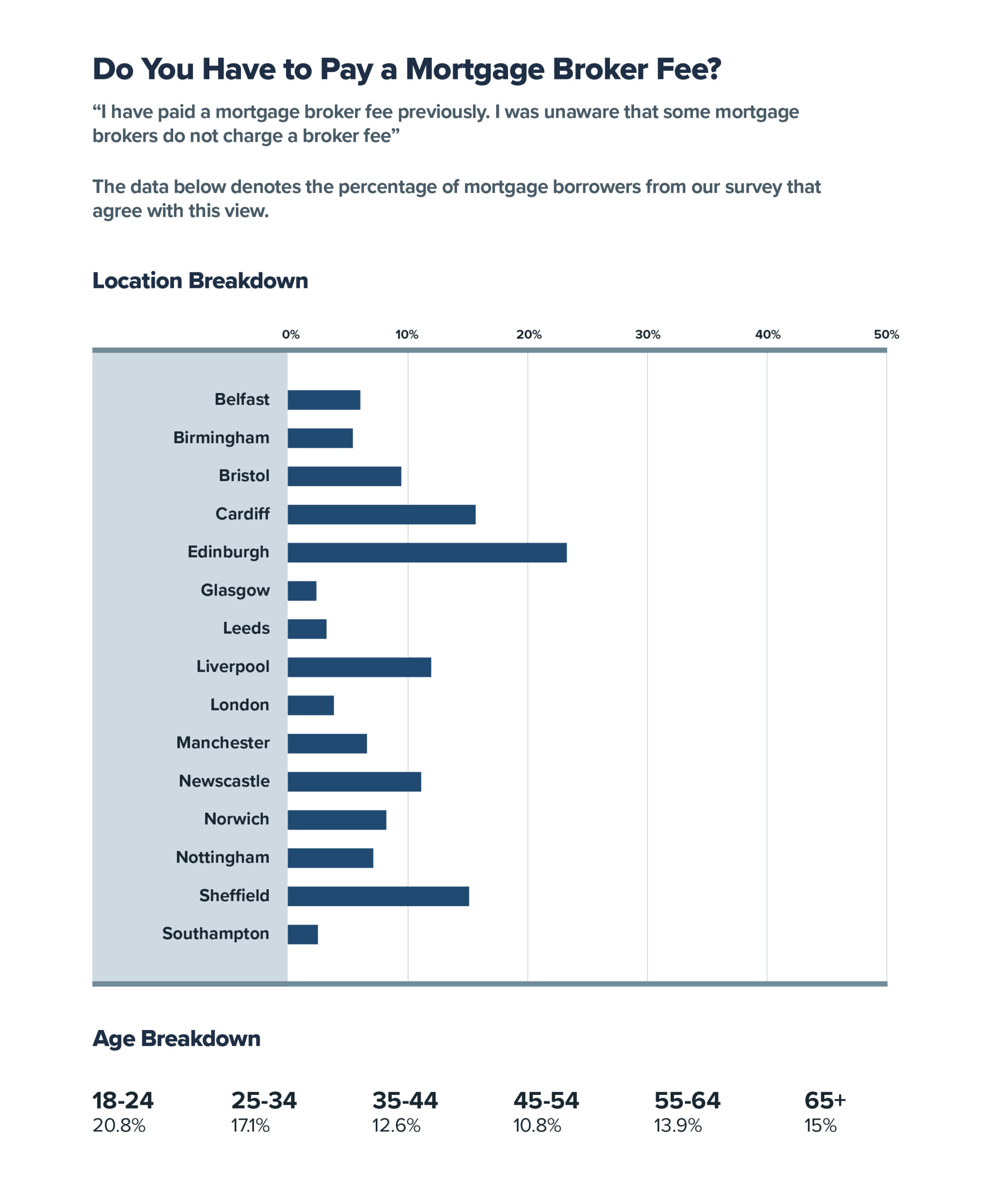

Get Started NowDo You Have to Pay a Mortgage Broker Fee?

No, there are mortgage brokers who do not charge a fee for their services.

In conducting our survey, it was older borrowers who were most likely to believe that all mortgage brokers charge fees. Perhaps this is because older generations have not come across online advertisements for fee free mortgage brokers.

Our survey results indicated as age progressed, people expected mortgage broker fees as the norm with 1 in 5 over the age of 65 never using a mortgage broker because of this.

Historically, mortgage broker fees were more common and older generations are more likely to have encountered them, especially if they have allowed a financial adviser to undertake mortgage work alongside pensions and investment advice.

How Much Mortgage Brokers Can Charge

Some brokers charge a single all-encompassing fee while others operate staggered fees.

It is common for fee charging brokers to charge an advice fee and a mortgage application fee.

As mentioned earlier in the article, there are also fee free mortgage brokers.

Our survey highlighted some alarming results of the amount people had been charged by mortgage brokers in the past.

Respondents indicated they had paid mortgage broker fees at the following values:

- Under £250 (average of 11% across all age brackets)

- £250 – £500 (average of 19% across all age brackets)

- £501 – £750 (average of 11% across all age brackets)

- £751 – £1000 (average of 4% across all age brackets)

- Over £1000 (average of 4% across all age brackets)

You may be asking how high a mortgage broker fee can go, and the truth is there is no upper limit and there are brokers who charge over £2000 for their services. Fees are often larger from brokers that charge a percentage of the loan. For example, some brokers charge a flat fee rate of 1% of the loan sum.

How Mortgage Brokers Make Money

Everybody has to eat, right? Surely mortgage brokers who charge fees rely on this income to remain operational.

This is true to some extent as brokers who charge fees often find they are unable to make a decent level of profit from mortgage commissions alone.

But – you should be aware; brokers will be paid some money regardless of the fees they charge. Banks and building societies pay mortgage brokers a commission for all mortgage products they arrange.

Being completely frank, these commission amounts are not generous and if you are a mortgage broker struggling to find clients you may have to charge some form of fee as a necessity. Furthermore, if a mortgage broker is not directly authorised and operates in as an Appointed Representative for a Network, they may have to pay the Network a percentage of their mortgage commission. This adds further pressure for those brokers to change client fees to increase their profit margins.

From a customer perspective though, you should not be drawn to a fee charging mortgage broker who is struggling to attract business. They may not be particularly reliable in the first place hence the lack of clients and they may not have the experience to arrange your mortgage effectively.

Fee free brokers attract a lot of customers, have large teams dedicated to arranging your mortgage and have built up a reputation and relationship with lenders and Business Development Managers.

Other Payments Brokers Receive

You might be surprised to learn; mortgage brokers make commission on supplementary products they package in with the mortgage like home insurance (a small commission) and protection insurance.

Protection insurance like your mortgage life insurance policy has a generous commission rate. In fact, on a comparable basis to mortgage products, life insurance policies generally have higher commission rates.

Regardless of the ins and outs of commission payments, mortgage brokers can generate a substantial income from insurance and mortgage commissions alone if they have built up a large client base.

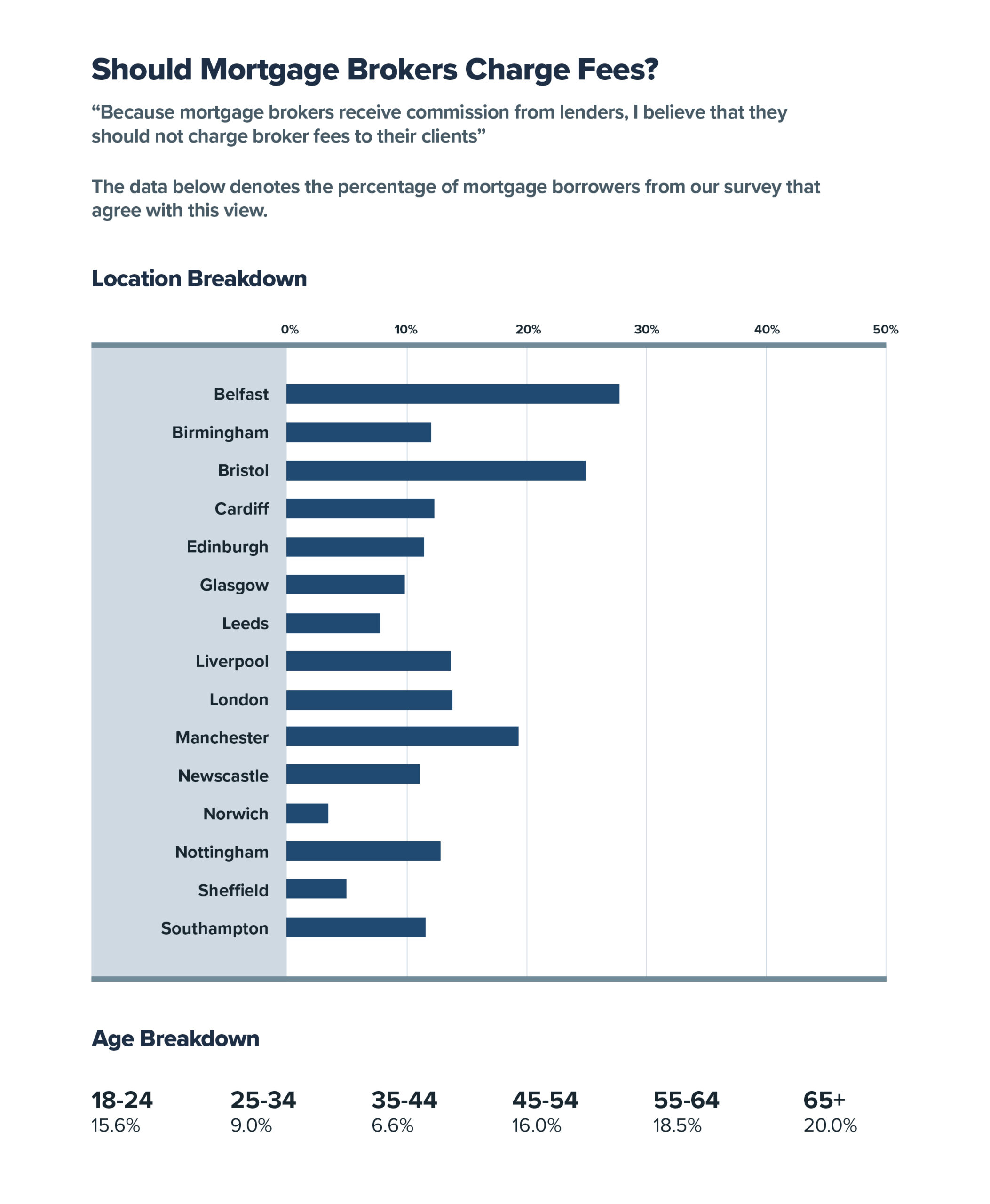

Should Mortgage Brokers Charge Fees?

From a customer perspective, no, mortgage brokers should not charge fees as they represent additional unnecessary cost at a time when you will want to be making money go as far as possible.

Surprisingly, only a minority of respondents to our survey believed a mortgage broker should not charge a fee.

This may be because some people are unaware about the commission attached to mortgages and insurance. Our survey hinted a minority of respondents fell into this category.

Our survey also indicated where people had paid fees, a significant portion felt the fees being charged were excessive.

To conclude, borrowers are happy to pay mortgage broker fees if the fee is reasonable.

This does not mean you should pay a mortgage broker fee even if you think it is fair or reasonable as there are fee free mortgage brokers offering the same service and interest rates.

What Our Clients Have To Say

Should You Use a Mortgage Broker?

In almost all cases it is advantageous to use a Whole of Market mortgage broker. A mortgage broker can compare mortgage products and provide advice and recommendations specific to your personal circumstances.

For example, if you walk into your building society and ask for mortgage advice, the adviser can only provide advice in relation to the products the building society offers.

If you are self-employed, you may find your bank or building society products are incompatible with your work. There may even be no mortgage product available to you.

Whole of Market mortgage brokers provide a solution for borrowers from all walks of life. Sourcing the best mortgage product for you without being tied to a narrow set of products or lenders.

Should You Pay a Mortgage Broker Fee?

As many mortgage brokers are now operating remotely following the pandemic, fee-charging brokers are competing with fee-free brokers with a comparable service. Fee-charging brokers could previously justify a client fee by offering face-to-face consultations. However, face-to-face broker services have reduced significantly since the pandemic. This means that unless you value a face-to-face service and are prepared to seek it out and pay for it, it is difficult for mortgage brokers to justify charging client fees in the current market.

If you are currently looking for a mortgage you should seek a reputable, whole-of-market, fee free mortgage broker.

Many fee charging brokers only charge fees at point of application so you may still be able to avoid a broker fee by switching to a fee free mortgage broker.

Should You Switch Mortgage Brokers?

Our survey highlighted that respondents were looking to remortgage or seek a mortgage with a fee free broker for several reasons:

- No difference in interest rates offered

- No difference in service provided

- Cost-of-living crisis making fees unaffordable

Many borrowers also indicated they would be seeking out a fee free broker or cheaper mortgage broker when their mortgage is due for review.

This shows that slowly, attitudes to mortgage brokers and the fees they charge is changing and people are keen to switch to low cost or free alternatives.

This puts unscrupulous mortgage brokers who charge unreasonable fees in a tough position and may mean the industry over time reduces the fees charged or removes them altogether.

For now, unless you value a face-to-face service and are prepared to pay for it, there is no need to pay a mortgage broker fee. You might be torn between your existing relationship with your mortgage broker and saving money, but if your existing broker is charging you fee, you will be losing a significant sum in the long-term – especially if the broker is charging a fee for each re-mortgage.

Boon Brokers is a Whole of Market, Directly Authorised, Mortgage, Insurance and Equity Release Brokerage. Boon Brokers provides a fee free mortgage service for all clients.

Contact Boon Brokers to book your initial mortgage consultation today.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles