How Many Times Salary is a Mortgage Calculation?

When you approach a mortgage lender or a mortgage broker, one of the first questions you will be asked is how much income you have. The reason for this is that mortgage lenders use your income, along with other factors, to decide how much to lend you.

This guide explores how many times salary is a mortgage calculation and the other variables you should be aware of.

Let’s explore how much you can borrow on a mortgage in more detail.

What is a Mortgage Calculation?

The first factor of a mortgage calculation is your annual salary or income. A lender will have a predetermined multiplier to calculate the uppermost limit for lending to you.

Each lender calculates how much you can borrow in different ways. You may have heard of salary multipliers to calculate your affordability, and as a headline calculation, this works across the board.

Some lenders allow you to borrow 4 times your annual salary, others 4.5 times your annual salary, and in rarer cases up to 5.5 times your annual salary. It all depends on which lender you approach and their attitude to risk when lending money.

Factors that Impact a Mortgage Calculation

Aside from the salary multipliers outlined above, there are a range of other factors that impact how much you can borrow. This means you might find that you can borrow more with a lender who offers 4 times your salary compared to a lender who allows you to borrow 5 times your salary.

This is because some lenders have very strict and differing criteria when it comes to the other factors. These are commonly:

- Financial commitments

- Overall term period (some lenders allow a longer term, which can boost affordability)

- Additional Income (commission, bonuses, etc)

- Loan-to-Value restrictions (i.e adverse credit and your choice of property can result in LTV restrictions)

All of the above can reduce the amount you can borrow across most lenders. However, the amount your mortgage is reduced will vary between lenders. Your mortgage broker will also ask if you are repaying any outstanding debts before making a mortgage application as this can push your affordability calculation back up.

Free consultations are offered in the UK.

Get Started NowTypical Salary Requirements for a Mortgage

There are two ways a lender will assess your income and expenditure.

The first is via a declaration you make on your mortgage application. In this declaration you will tell the lender how much income you have and how that income is generated.

Your income may not come from a single source, and it is common for people to have various income streams, such as:

- Main salary

- Overtime, bonuses and commission

- Other regular income such as part-time work or self-employed income

- Benefits such as tax credits, Universal Credit, or other state income

All lenders will consider your main income source; however, some lenders will not allow additional income sources. For example, you may be able to use your benefit income with a lender that would otherwise not be considered by another lender.

Expenditure Declaration

After you have declared all your income sources, you will need to detail your expenditure. Hopefully, at this point, you will have an accurate idea of your monthly outgoings and can provide your lender with a comprehensive list.

Once you have made your declaration on your application, a mortgage lender will verify the information you have provided by asking for evidence.

Evidencing Your Income and Expenditure

If you are employed, your lender will typically ask for your last three months’ payslips and corresponding bank statements.

In some cases, especially where you have recently been promoted or changed your job role, a lender may request additional information such as a letter from your employer or a signed contract.

The mortgage underwriter will compare the payslips and bank statements to ensure the income matches up and then use your bank statements and credit profile to identify any regular outgoings.

If your evidence is wildly different from your mortgage application, you may find your mortgage is declined outright as lenders will be extremely cautious when there is a mismatch of figures.

What Salary is Required for a £300K Mortgage?

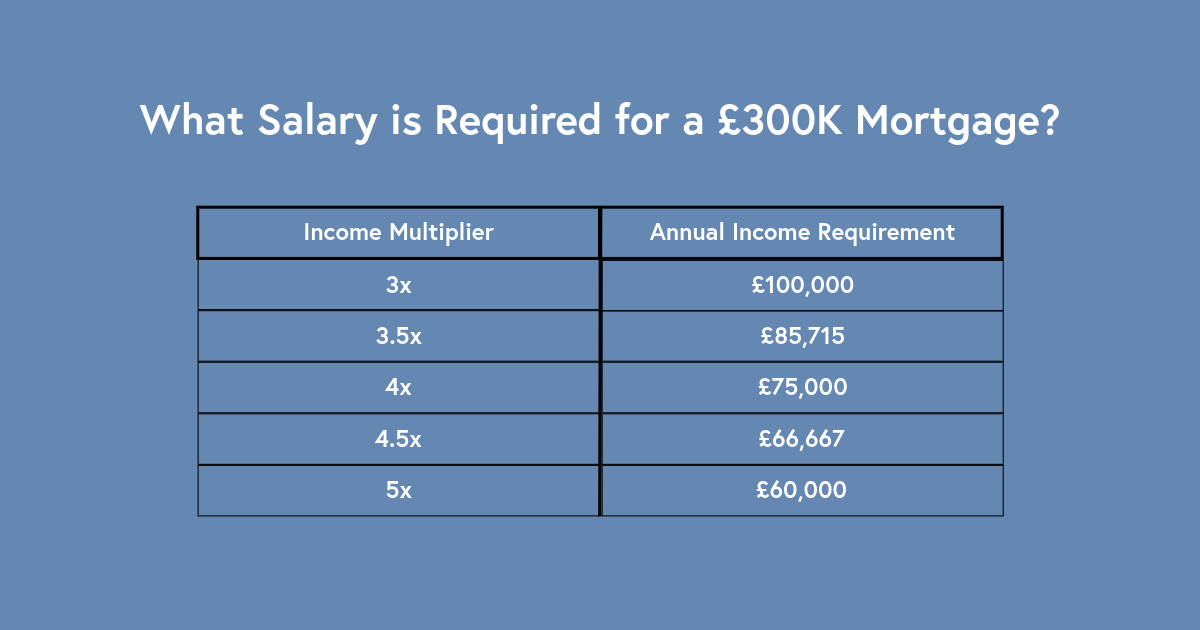

As a rough idea, if you are looking to obtain a £300k mortgage, you will need the following levels of income.

As you can see by the variances in income requirements, selecting the right lender with the best income multiplier can make a vast difference when you wish to obtain a mortgage.

It is also extremely common for people to apply for a mortgage on a joint basis. This splits the income requirement between two (or more) people and makes passing affordability much easier.

For example, a couple earning £30,000 each per year could qualify for a £300k mortgage with a 5 times multiplier lender.

Employed Income

If you are employed, your mortgage application is streamlined compared to other income types. This is because the Pay as You Earn (PAYE) system provides lenders with a verifiable document for your income.

Most employed people will not need to provide additional evidence for their income beyond payslips and corresponding bank statements showing receipt of income.

Self Employed Income

Self-employed income can be trickier, especially as each lender has different guidelines for self-employed people getting a mortgage.

Some lenders will be extremely strict and request a number of years’ worth of tax statements alongside accountants’ letters to outline your income will continue or increase in the future.

The great news is there are a handful of lenders who are exceptionally good with self-employed income and only require your latest year of Tax Calculation and Tax Year Overview documents to meet their criteria.

Some lenders will take an average across a number of years to calculate your annual income and others will simply use your latest years’ income documents.

As you can imagine, this way of calculating self-employed income between lenders can make it much more difficult to pass affordability calculations. You should be prepared to provide as much information as possible and speak to a mortgage broker, like Boon Brokers, to source the best lender for your circumstances.

Historically, self-employed people could self-certify their income but due to frequent manipulation of this process, this is no longer allowed.

Company Directors

Like self-employment or sole traders, company directors will have to provide varying evidence depending on the lender.

You should expect to provide your latest Tax Calculation and Tax Year Overviews with all lenders. The Tax Calculations breakdown your Salary & Dividends.

Some lenders will use your company accounts to calculate your income. Others will request your SA302 statements.

Once again, the variance of how much you will be able to borrow will be great depending on the lender and how they assess your income. A mortgage broker experienced in company director mortgages like Boon Brokers will be invaluable if you wish to borrow as much as possible.

Contractors

Self-employed income proof requirements for contractors can vary significantly from lender to lender.

For the most part, contractors are deemed as self-employed by most mortgage lenders. You should expect to provide your latest two years of Tax Calculations and Tax Year Overviews along with 6+ months of Bank Statements to prove that you actively take contract work.

There are some contractors, like Construction Industry Scheme (CIS) workers who can use their payslips/invoices instead of Tax Calculation & Tax Year Overview documentation due to the way that their tax is paid through the scheme.

What Our Clients Have To Say

How Are Income Types Treated Differently for Affordability?

Each income type presents unique challenges when applying for a mortgage. Even employed income is not infallible and there are sometimes instances where being self-employed allows you to borrow more than employed people because of how the tax system is set up. Furthermore, self-employed limited company owners may be able to use net profit from their company to boost their affordability.

If you have multiple sources of income, it is vital you discuss this with your mortgage broker who will need to scrutinise lender guidelines to find the best lender for all your income types.

Speak to a Mortgage Expert

Although income multiples and affordability calculations can be confusing, there may be a lender available who is more favourable to your income source providing you have documentation to evidence it.

For this reason, it is best to discuss your financial situation in detail with an expert whole of market mortgage broker to find the best lender and rates for you.

Boon Brokers is a Whole of Market Mortgage, Insurance and Equity Release Brokerage. Boon Brokers provides fee free mortgage advice for all types of income.

Book your initial mortgage consultation with Boon Brokers today.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles