Guide to Debt Consolidation Mortgages

If you are struggling financially, you may be wondering what options you have to get yourself back on track. There are several ways to deal with debt, some of them are much more effective than others.

This guide gives general advice on how you could use mortgages to consolidate your existing debts with the overall goal of reducing your costs.

Debt consolidation mortgages can be a lifeline for those struggling with their finances. Let’s explore everything you need to know in this video about debt consolidation mortgages and whether they can be a solution for you.

- What is a Debt Consolidation Mortgage?

- How do Debt Consolidation Mortgages Work?

- Is it a Good Idea to Consolidate Debt into a Mortgage?

- What Are the Risks of a Debt Consolidation Mortgage?

- What Credit Score Do You Need for a Debt Consolidation Mortgage?

- Where Can I Get a Debt Consolidation Mortgage?

- What Do I Need to Provide for a Debt Consolidation Mortgage?

What is a Debt Consolidation Mortgage?

A debt consolidation mortgage is a product that allows you to remortgage and include your debt as part of your mortgage. They work in a similar way to debt consolidation loans except the consolidation is secured against your property.

Because these mortgages are higher risk to lenders there are strict guidelines in place to qualify for a debt consolidation mortgage. Your personal circumstances will dictate whether you can get a debt consolidation mortgage including:

- Your credit score and history

- How much equity you hold in your property

- Your income

There are also other circumstances that a lender will assess including how much debt you wish to consolidate into your mortgage and the loan-to-value of the property.

In the UK there are a select number of lenders who offer debt consolidation mortgages so you will need to approach a whole-of-market mortgage broker to secure the best deal.

How do Debt Consolidation Mortgages Work?

The way a debt consolidation mortgage works is quite straightforward. You will first need to calculate the total sum of the debts you wish to consolidate into your mortgage. This may include calling your creditors and finding out how much each debt is to pay in full.

Remember, it can take a few weeks to arrange a remortgage so interest on your debt may accrue in that time. Some loans also have penalties for paying them early. Ask each creditor if there is an early repayment charge.

Once you have the total figure for your debts you should contact a reputable mortgage broker. A mortgage broker will look at the amount you wish to borrow and how much equity you hold and match you with a lender that can facilitate the mortgage.

Once the mortgage is arranged, your monthly payments will incorporate the extra capital you have borrowed to consolidate your debt. The extra money will be released to you, and you will then need to contact your creditors again and make payments on your debt.

Is it a Good Idea to Consolidate Debt into a Mortgage?

There are a number of benefits to consolidating debt with a mortgage:

Potentially Lower Interest Rates

Most unsecured debt in the UK has a higher interest rate when compared to mortgage interest rates. This is because unsecured debt is much riskier for lenders and a mortgage is secured against your property. For mortgage lenders this lowers the risk as they can repossess a property in the event that you can’t make your mortgage payments and recoup the mortgage.

The average unsecured debt interest rate in the UK is 7.87% whereas the average mortgage interest rate in the UK is under 6%. Not all unsecured debts will have a higher interest rate than your remortgage so you should carefully consider this when consolidating debt. The average interest rate for personal loans over £10,000 for example is 4.11%.

One Fixed Monthly Payment

One of the primary problems people in financial difficulty face is keeping track of multiple payments. While having a fixed monthly payment shouldn’t be the deciding factor when consolidating debt, it can help you stay on top of your finances and budget more effectively each month.

Spread Short Term High-Cost Debt Over a Longer Term

If you have high monthly expenditure keeping up with debt payments, you can counter this by consolidating your debt into a mortgage. For example, a personal loan has a typical term of five years whereas a mortgage allows you to spread that cost typically over twenty-five years or more (depending on your age).

It is important for you to realise that although the monthly cost of the debt will reduce with a longer term, the total cost of the debt may be higher. This is because you will be paying interest on the capital for longer when you consolidate debt on a mortgage. Consolidating debt with a mortgage can reduce your monthly expenditure significantly and if you are struggling currently, this could be a valuable lifeline to get control of your financial situation.

Getting Control of Your Financial Situation

When you look back over your life you will probably realise there have been times where your financial situation has been good and other times when it might not be so good.

Over our lifetime our financial situation can ebb and flow which means a debt problem now might not be a significant problem in a few years time. The problem many debtors find themselves in though is getting out of a bad financial situation.

Consolidating debt with a mortgage can help you get above water, manage your monthly expenditure effectively and reduce the rate of interest on your existing debt. For this reason, it can be a life-changing opportunity for people who are struggling financially.

Free consultations are available in the UK.

Get Started NowWhat Are the Risks of a Debt Consolidation Mortgage?

There are drawbacks to consolidating debt on a mortgage, a few of them have been touched on already.

Securing Debt on Your Property

The biggest risk of consolidating debt onto a mortgage is that you are putting your property up as collateral against your debt. If you continue to have financial difficulties, you could find your house repossessed for debt that was originally unsecured.

While repossessions are rare, you really must consider it as a possibility if you are currently experiencing financial difficulty and want to secure your debt against a mortgage.

Higher Overall Cost of Debt

Depending on your situation and how long you are remortgaging for, you could find the total amount of money that you pay consolidating your debt onto a mortgage is significantly higher than the original total value of your debt.

This is because you will typically be paying interest for much longer on a mortgage than unsecured finance. With respect to the term on a mortgage, you will also find it takes you longer to clear your debt. This is because mortgage payments are mostly interest initially and capital is repaid increasingly as the mortgage term goes on.

What Credit Score Do You Need for a Debt Consolidation Mortgage?

Every lender has a different credit score requirement for mortgages. This means you can theoretically get a mortgage with a bad (adverse) credit score for debt consolidation.There are some problems that can occur when applying for a debt consolidation mortgage, most notably if you have struggled with your existing debt.

Missed Payments and Debt Consolidation Mortgages

One of the most common reasons why people wish to consolidate debt on their mortgage is because they have difficulty making monthly payments on their existing debt.

If you are applying because you anticipate a problem in the near future, you will probably be fine as you will not have missed a payment yet.

If you have missed a payment or multiple payments on your existing debts, you will find getting a mortgage more difficult. This is because every missed payment that a creditor marks on your credit profile will have a detrimental impact on your credit score.

If your credit score is high or great to start with, this might not prohibit you from obtaining a mortgage. However, if your credit score falls below a certain threshold you will notice the range of lenders available to you will decline.

If you are not careful, you could find yourself in a position where you can only apply to adverse credit lenders. These lenders are extremely accommodating to those with credit score issues but the interest rate on the mortgages they offer are much higher. The interest rates charged by adverse lenders is tied to the risk they take on by lending to those with bad credit scores.

Defaults and CCJs

If you have a missed payment on your credit file, the best action to do is to get caught up. Failing that, arrange your debt consolidation mortgage as soon as possible. The aim of catching up the missed payments or arranging the debt consolidation mortgage is to prevent a default from being registered on your credit file.

If three or more missed payments are registered on your credit file a creditor can place your account with them into default. A default is a serious financial mark placed by a creditor where they feel you are unable to meet your financial commitment to them.

Most mortgage lenders will decline a mortgage application if you have a recent default on your credit file. This leaves the adverse credit lenders mentioned above as your remaining option for obtaining a mortgage.

Once a creditor has a default registered, they are within their rights to seek a court order to recover the debt in full. This is known as a County Court Judgement (CCJ). A CCJ is considered one of the most serious negative marks you can have on a credit file and once more, many lenders will likely decline your mortgage application.

What Our Clients Have To Say

Where Can I Get a Debt Consolidation Mortgage?

You can obtain a debt consolidation mortgage in a few ways. For example, you could approach your existing lender and ask to remortgage for a higher value to incorporate the debt into your new mortgage payment.

If you want the best deal on your debt consolidation mortgage or have credit score problems, it is best to speak to a whole of market mortgage broker like Boon Brokers.

What Does a Whole of Market Mortgage Broker Do?

A whole of market mortgage broker has access to a panel of lenders that represent every aspect of the current mortgage market – including lenders who welcome debt consolidation mortgages.

Because a whole of market mortgage broker typically has much broader access to mortgage lenders, they can compare different mortgage products and application criteria side by side and find you the best deal. There are some whole of market mortgage brokers, like Boon Brokers, that will advise and arrange your mortgage free of charge and offer an excellent service.

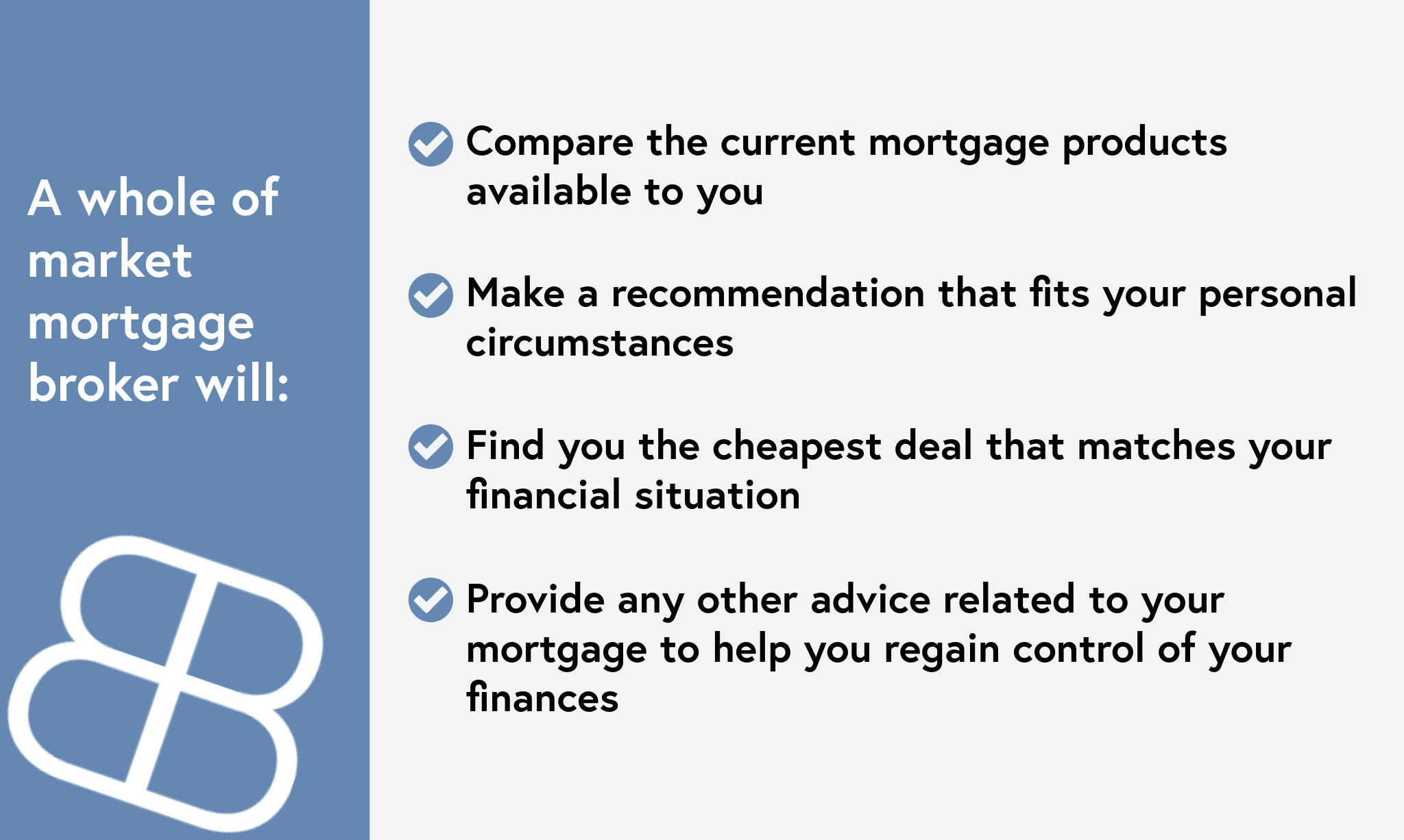

A whole of market mortgage broker will:

What Do I Need to Provide for a Debt Consolidation Mortgage?

Initially a mortgage broker will ask you to complete what is known as a Fact Find. This is a questionnaire that asks about your personal and financial circumstances. As part of this process, you will be asked to complete a list of your current expenditures including your debts. You will need to indicate which debts you aim to consolidate with the mortgage and how much you aim to borrow in total.

Once your adviser has this information, they will look at the lenders available to you and provide a recommendation. This recommendation will outline the application process and which lender is most suitable for you.

An adviser will often recommend the cheapest product available to you, however they may recommend a more expensive product if it matches your personal situation better. Your adviser will always outline what their recommendation is and why they have made it.

Looking to discuss consolidating your debt on your mortgage? We can help. We provide completely free unbiased mortgage advice with absolutely no obligation and will always try to find you the best mortgage solution. Complete our request a callback form to discuss your options.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles