The Financial Education Reform Forgot to Teach Finance [April 2025 Study]

New research from Boon Brokers reveals that despite Financial Literacy being introduced into the National Curriculum over a decade ago in 2014, the majority of young adults in the UK are leaving school with a worrying lack of financial education. Download the full research file in the footer of this article.

Key Findings:

- 83% of young adults did not list school as their main source of education around finance and mortgages

- 92% of young adults want mortgages to be taught in schools

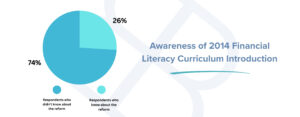

- 74% of young adults did not know financial literacy was part of the National Curriculum

- 58% of young adults said no facilities were provided at school to learn about mortgages

- 39% of young adults listed their parents as the primary source of their financial education

- Despite all of this – 67% of young adults worryingly still think they have an above-average understanding of mortgages

Following the release of Santander’s findings on the general state of financial education, Boon Brokers conducted its own investigation into the financial education of young people, and specifically, what they are learning about mortgages.

While our previous research explored the mortgage knowledge crisis among first-time buyers, this study narrowed its focus to young adults aged 18 – 24.

This specific age range captures both the first generation that was expected to benefit from the 2014 rollout of Financial Literacy into the UK National Curriculum, and the generation that just missed this supposed advantage.

Unfortunately, the research provides an unwelcome picture: Ten years after financial education was reformed, most young people don’t even know it exists.

Data Summary:

| 1,000 Respondents Across the UK |

| Respondents aged 18-24 |

| Conducted by Savanta Research Group |

Not Learning at School

Data shows that 83% of young adults did not list school as their main source of education around mortgages.

Moreover, the research reveals that the majority of respondents will rely on their family to provide them with the educational and working knowledge of mortgages.

When we start to think about the fundamentals of mortgages and what should be taught, it doesn’t take long to list a few key areas.

Interest rates, debts, mortgage length, and the basic affordability requirements – these key elements should shape the foundations of an education that teaches the importance of mortgages for young adults.

Currently, there appears to be no guarantee – and evidence to the contrary – that these topics are being taught, either by schools or by families.

Naturally, when parents start to become the main source of information on the topic of mortgages, we start to risk recycling outdated misinformation, generation after generation.

A further 14% of respondents noted social media as their primary source of education, demonstrating only a 3% influential gap between social media and schools (17%).

This research shows that young people are leaving their financial education and security, not in the hands of a qualified and educated institution, but in the hands of potentially unqualified ‘influencers’ that infest the webbed world of social media.

While the 2014 reform stated it sought to cover “income and expenditure, credit and debt, insurance, savings, and pensions, financial products and services” – all topics that related implicitly with mortgages – the results are showing a different story.

The reality of today is that the educational principles that should’ve been put in place are seemingly as influential to young people as ‘Tik-Tok’ learning and unsolicited video ‘shorts’. In addition to this, pupils are turning to their families for help, leaving their financial education at the whim of their parents’ generational knowledge.

Forgotten Education Facilities

Despite the array of government initiatives and increased funding that has been implemented over the years – and a decade on from the initial National Curriculum reform – 58% of young adults say there were no facilities provided at school for them to learn about mortgages.

More tellingly, among the respondents aged 18-21, who should have been directly impacted by the curriculum changes, revealed an almost identical percentage to those aged 22-24.

A miniscule 2% difference is what separates the generations that were caught in the reform and those who were not. This research suggests that the impact of the reform has barely moved the needle in regards to the facilities and accessibility to the fundamental knowledge around finances that arguably every student needs.

Furthermore, with 17% of respondents stating that their only exposure came from web-based tools, the methods of teaching themselves appear to be indicative of the importance that the current education system is placing on financial awareness.

While online learning is increasing in popularity and certainly isn’t without merit, one can ask the question of whether it lacks the structure and engagement needed for an essential long-term financial comprehension.

Simply: young adults will not be able to prepare for the financial commitment of a mortgage if they’re not taught how debt, interest, and long-term repayments work.

The research outlines the gap between policy and practice, and it’s a price that young adults entering into the world of finance and economy are unavoidably paying today.

A Financial Blind Spot

The data also highlights the point in which a lack of understanding is becoming dangerous, as 67% of young adults still believe they have an above-average understanding of mortgages.

It is the absence of what a young student or adult should know in regards to finances and mortgages that shines through here.

Despite the majority of respondents stating that they never received a formal education on the subject, and instead rely on parents, social media, or assumptions, the majority of young adults still believe in their ability to confidently navigate the world of mortgages.

While one might read such a statistic with a whimsical ‘the ignorance of youth’, this misplaced confidence can lead to a vicious cycle of debt, negative equity, and potentially repossession.

Ironically, when asked how important mortgage education is, 92% of respondents rated it between 7–10 out of 10, with 28% rating it as a straight 10, being the highest level of importance.

This combination of a strong desire to learn, paired with false confidence and low foundational knowledge, creates a dangerous mix.

Mortgages are likely to be the most significant financial commitment that borrowers ever agree to. Therefore, financial education around mortgages should be a mandatory inclusion in the national curriculum.

Gerard Boon Managing Director (B.A Hons, CeMAP, CeRER)

Without an official and institution-led education, young adults are entering into mortgage agreements without understanding interest rates, repayment terms, or the value of refinancing.

The Invisible Curriculum

Perhaps the most impactful statistic of this research is that 74% of young adults didn’t know Financial Literacy was even part of the National Curriculum.

Perfectly reflecting the failings of the current educational approach, young adults who should have first-hand experience of the reformed curriculum are left unknowing that such a thing was even supposed to take place.

This statistic alone leaves us asking: “If young people don’t know that financial education is being taught, then how can we expect them to notably learn from it?”

It goes without saying that a curriculum means nothing if the subjects aren’t actually being taught.

The research exemplifies the need for a more visible and accessible line of resources and teaching.

It suggests that there is no active promotion or reinforcement on the value of understanding how mortgages and personal finances correlate in the real world.

Reforming the Reform of Financial Education

The results of this research makes one thing abundantly clear: the current financial education in the UK is not equipping the young people of today with the financial skills that they will need to navigate real-world financial responsibilities.

It is ten years after the reform of the National Curriculum and financial awareness around mortgages remains a missing piece in the average student’s education.

With 83% of young adults not viewing school as a primary source of education on the topic of finance and mortgages, we’re starting to see social media rise as a more impactful source of education than that of the educational institutions.

With data outlining how parents and social media are leading the way as ‘reliable’ sources of financial education, the structures of formal education are taking a back seat, as young adults are stepping into one of life’s biggest commitments with confidence but no clarity.

To prevent a generation from unknowingly walking into poor mortgage decisions and long-term debt, a new focus on practical and relevant financial education is urgently needed.

It’s time to stop treating mortgage knowledge as optional, when it is so very clearly essential for everyone who wants to own their own home.

Notes to the editor

Research was conducted between 10th and 17th April 2025 amongst 1,002 applicants aged between 18 – 24.

About the Researcher:

The Researcher for this article is Gerard Boon (B.A Hons, CeMAP, CeRER). Mr. Boon is the Managing Director of Boon Brokers Limited, a Directly Authorised Online Mortgage, Insurance & Equity Release Brokerage in the U.K. Boon Brokers boasts over 9,000 clients across the country and is quickly scaling year on year. Mr. Boon is passionate about Artificial Intelligence in the industry. During his studies at the University of Leeds in 2018, he achieved a First classification for his dissertation project titled “Artificial Intelligence in Financial Intermediation: An Investigation into the Prospects of Robo-Advice Developments for Independent Mortgage Brokers in the United Kingdom”. Since 2018, AI technology has rapidly developed. Mr. Boon is hoping to update his research on the topic following this survey.

Download the Full Results of the Financial Literacy Reform Study April 2025