The Four Different Types of Mortgage Capacity Reports

Chances are, if you’re reading this article, you have been advised by your solicitor to obtain a mortgage capacity report, or you have been issued with a court order requiring one. Court proceedings can be stressful, and you’re probably left asking the question: “What is a mortgage capacity report? And how do I get one?”.

The great news is you can obtain a mortgage capacity report with ease, providing you approach an FCA regulated mortgage advisor. A reputable mortgage advisor will take you through the process in a stress-free manner and compile a report for the court.

In this article, we cover everything you need to know about the four different types of mortgage capacity reports, what they are, why you might need one, and how to obtain them. Let’s jump in.

Short on time? Check out our video below for a comprehensive explanation on mortgage capacity reports:

Why Would You Need a Mortgage Capacity Report?

The most common usage of a mortgage capacity report is during divorce proceedings, where financial settlements are being agreed. The purpose of a mortgage capacity report is to demonstrate to the judge that you have the financial capability to afford a mortgage.

Typically, this will be on the family home, and will allow the judge to evaluate who receives the property and how the ongoing mortgage is covered. In other cases, the judge may want to evaluate how affordable a second property is alongside your existing property.

Finally, if you have a lot of property, a judge may want to ascertain your mortgage capacity across them all, and ensure they are considering the burden of your overall financial picture when dividing the assets.

However, mortgage capacity reports are not just for divorce proceedings. There are other instances where a judge may request a mortgage capacity report, normally in the context of Family Court and dealing with childcare or child arrangements orders.

How a Mortgage Capacity Report Helps Divorcees Secure Home Loans

In short: the purpose of a mortgage capacity report is to help divorcees understand their borrowing potential.

Securing a mortgage can be difficult for divorcees, particularly if one party is wanting to buy out the other’s share of the property.

A mortgage capacity report will provide a clear assessment of your ability to afford a mortgage, and will most importantly provide both solicitors and judges an insight into your financial position post-divorce.

For example, if a property in a divorce settlement needs to be divided, the mortgage capacity report would demonstrate whether you could sustain the mortgage on your own, or if alternative arrangements would need to be put in place. Similarly, the report would provide a holistic overview of your total affordability, and can often aid in negotiations during the divorce to fairly divide the finance.

It is advised by many high-street and specialist lenders to secure yourself a mortgage capacity report, as it can demonstrate to lenders an accurate overview of your financial standing. As such, obtaining a mortgage capacity report will help streamline the process of your next mortgage application.

What is a Mortgage Capacity Report?

Before your divorce was initiated, chances are you were paying for the mortgage on a joint basis. In most cases a family home is in the names of both married partners.

As part of divorce proceedings, a judge will evaluate how your marital assets are split and normally the family home is a cornerstone asset couples raise disputes over.

Absent an agreement between both parties, a judge will want to delve deeper into the financial situation of all parties involved and decide the fairest way to divide the marital assets.

It is important to remember that a judge looks at the picture in totality, rather than just from the perspective of you or your ex-partner. This is especially the case if you have inherited property or if there are children involved.

A judge will want to reach an equitable outcome for everyone without placing either party into financial hardship or causing what is known as an undue burden. Mortgage capacity does just that and outlines clearly how much financial stress it would cause for you to pay a mortgage separate to your ex-partner.

The Four Types of Mortgage Capacity Reports

There are four types of mortgage capacity reports, each used for a specific circumstance. Understanding the differences between the different types of mortgage capacity reports will help you determine which report is most suitable to your situation. Starting with:

Single Mortgage Capacity Report

The most common mortgage capacity report requested is a Single Mortgage Capacity Report. This single report is purposed to help demonstrate to a judge whether you would be able to pay a mortgage loan on your own.

In addition, this detailed report will help the judge establish a foundation of your affordability and financial circumstance. This is very important as the single mortgage capacity report is a key factor in helping the likelihood of a fair outcome in the division of assets.

Joint Mortgage Capacity Report

In some cases of divorce, one partner may have already moved on and may need to provide a mortgage capacity report to assess their joint capacity for securing a mortgage.

In rare instances, a judge may request a joint mortgage capacity report with your ex-partner. This will usually be the last resort, as courts prefer financial settlements that allow both parties to separate as cleanly as possible.

Multiple Scenario Mortgage Capacity Report

A multiple scenario mortgage capacity report is a niche report, where a claimant or respondent to a case is seeking to demonstrate their mortgage raising capacity under different scenarios.

Multiple scenario reports can be an extremely powerful negotiating tool. They can demonstrate your inability to afford a mortgage in one scenario while also showing how your affordability changes in an alternative scenario.

Naturally, by presenting different outcomes through a multiple scenario mortgage capacity report, you can show evidence to the judge that could assist in the final financial arrangements in the fairest way.

No Mortgage Capacity Assessment

A no mortgage capacity assessment is issued when you are unable to obtain a mortgage.

If you are not able to secure a mortgage, this type of report is crucial as it provides the court with clear evidence that obtaining a new mortgage is not a financially viable option for you.

If you have zero capacity to acquire a new mortgage but fail to demonstrate this fact, it could result in an unfair ruling that causes significant long-term financial hardship.

As your mortgage capacity report will be used as legal evidence, it is essential that you are honest and transparent throughout. Failing to disclose any relevant information could lead to financial consequences, especially if a judge makes a decision predicated upon incomplete and inadequate information.

What Our Clients Have To Say

When Might a Mortgage Capacity Report be Ordered?

Most commonly, a mortgage capacity report would be required during divorce proceedings. However, the reports can also be used in child arrangement cases, particularly when financial stability is a key consideration.

For example, if you have already divorced and are seeking to change the existing child arrangements order, a court may well want to address the financial implications changing this arrangements would have on both parties.

Child Arrangements

Historically this was called a custody proceeding, but in recognition that children are not property, modern courts now address child arrangement cases in a much more flexible way. Now, the preferred court judgment is to ensure a child has contact with both parents wherever practicable.

In this context, a mortgage capacity report may be required if one party wants to relocate and the children are to reside elsewhere. Additionally, due to the complex nature of life and welfare of children, a mortgage capacity report would be equally as necessary for several other reasons that can crop up during child arrangements proceedings.

In any case, a court will want to ascertain how your ability to repay or obtain a mortgage will impact your child arrangements.

Information on Benefits Payments

In rare cases, a court may want to know how much you rely on benefits to pay a mortgage, or whether the benefits you receive will have a bearing on a mortgage.

Mortgage Deposits

Ordinarily, a mortgage capacity report would not be ordered expressly to determine the size of your deposit.

Rather, in most cases an agreement in principle alongside a declaration or bank statement showing your deposit will suffice.

In some cases, however, your ability to obtain a mortgage may still be uncertain, resulting in the court wanting to double check your deposit and potential borrowing amount. At this time, a mortgage capacity report may be requested for the purpose of checking your deposit.

Childcare Costs vs Income

As with benefit payments, ongoing childcare costs can significantly alter the amount you can afford to pay on a mortgage. A judge may order a mortgage capacity report for one or both parties, factoring in childcare costs to decide which parent is best suited to provide for the children.

It is important to note that in most cases, this will be a secondary piece of evidence, and a judge is unlikely to make a ruling exclusively on your financial capability to look after your children. Generally, a judge will normally use this additional evidence to support their report and to bolster the decision that is made.

A court’s primary concern when children are involved is what is in the best interest of the children and your financial standing will often have little bearing unless one party is unable to provide adequate care.

Working Arrangements

A recent precedent was set in the family courts when a father appealed a court decision that ordered contact take place in a way that conflicted with his existing work arrangements – placing him in undue hardship.

As a result, a court must now ensure they are making child arrangement orders that allow the parents to meet their financial obligations unhindered by such rulings.

These reports have been rarely used in the past, but with a greater emphasis on undue hardship, they are likely to become more necessary in the years to come.

Request a Mortgage Capacity Report.

Apply NowMortgage Capacity Report Process

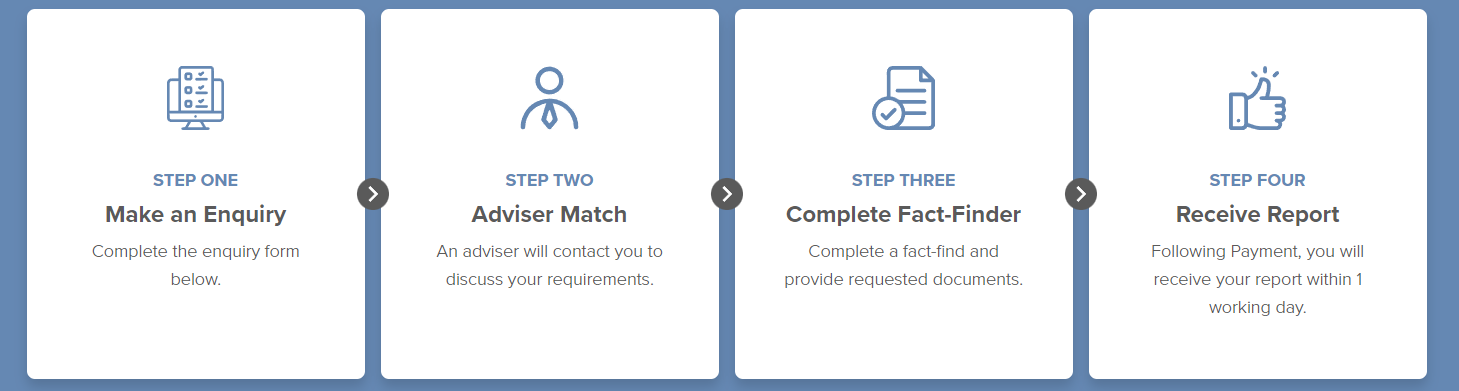

The process of obtaining a mortgage capacity report is easy and shares similarities with that of the process of applying for a mortgage.

To begin, you must first use a Financial Conduct Authority (FCA) regulated mortgage advisor. The process will then start with a fact-find to establish all of your details that will be needed for the report.

Next, with the details provided in the fact-find, the mortgage adviser will get to work creating and finalising your report.

Finally, you will be provided with the mortgage capacity report, ready to submit to the court.

It is important to note that the advisor will be conducting a lot of work on your behalf, and preparing a final legal document at the end, and so you should expect a fee to be charged.

After the ruling has been made, many people decide to return to their mortgage advisor to arrange their next mortgage. Simply, this can save a lot of time as it will save providing all your information again, as the advisor will already know exactly what mortgage you need.

Why You Need an FCA Regulated Mortgage Advisor?

Since a mortgage capacity report will be used in a court of law, it is essential that the report presented is prepared by a qualified mortgage adviser of good standing. To meet these standards, the advisor will need to be authorised and regulated by the FCA and have whole-of-market access. This will ensure that you will have received the best possible advice with a comprehensive overview of your mortgage options.

Although a mortgage capacity report may stand on its own, there is always the potential for an opposing side to dispute the information presented. In such a case, the court may request a fact-finding hearing. This is where the mortgage advisor would be called upon to provide evidence and validate all information that has been recorded on the report.

Put plainly, the court will need to trust the information provided. As such, having an FCA regulated mortgage adviser will help ensure that the court can see that all information recorded on your mortgage capacity report is honest and accurate, and can trust the adviser’s testimony.

Speak to a Mortgage Specialist

A mortgage capacity report can be an essential tool in securing your long-term financial stability and achieving a fair outcome in court. Ensuring your report is prepared by a trusted mortgage adviser could make all the difference in your case.

Boon Brokers is a Whole-of-Market Mortgage, Insurance, and Equity Release Brokerage, fully authorised and regulated by the Financial Conduct Authority (FCA). Our team of mortgage advisers specialise in providing mortgage capacity reports that are tailored for court use.

If you need a mortgage capacity report – Contact Boon Brokers today – our expert team are waiting to hear from you.

Gerard BoonB.A. (Hons), CeMAP, CeRER

Gerard is a co-founder and partner of Boon Brokers. Having studied many areas of financial services at the University of Leeds, and following completion of his CeMAP and CeRER qualifications, Gerard has acquired a vast knowledge of the mortgage, insurance and equity release industry.Related Articles