Artificial Intelligence in Mortgage Broking [Nov 2024 Study]: Distrust from British Consumers

Research Objective

Our research objective is to gauge the opinions of British consumers on the adoption of Artificial Intelligence (AI) in the UK’s intermediary mortgage market. We will establish their current understanding of AI and how likely they are to trust the technology in the short, medium and long term.

The research also explores the implementation of AI and consumers’ preference for human monitoring of the technology.

We will determine consumers’ most valued aspect of the mortgage broker service. This will assist in predicting their buying behaviour following the launch of the UK’s first AI Mortgage Broker in the future.

Lastly, we will ascertain consumers’ thoughts on when/if they believe AI will replace human mortgage brokers in the industry.

Research Sample

Download the Full Survey Results below. The survey was conducted by TLF Research on behalf of Boon Brokers Limited with 1,500 homeowners across the United Kingdom. Respondents were targeted from all age groups. Both males and females were questioned.

- What is an AI Mortgage Broker?

- Results Across British Cities

- Consumers’ Trust in Artificial Intelligence

- Human Monitoring of Artificial Intelligence

- Consumer Values of a Mortgage Broker Service

- Communication Channel Preferences

- Artificial Intelligence Replacing Human Mortgage Brokers

- Conclusion

- About the Researcher

What is an AI Mortgage Broker?

An AI Mortgage broker is still a concept. The technology is being developed for practical use and it is unclear when, or if, a truly AI Mortgage Broker will be introduced to the mortgage market.

According to experts, AI is currently being used in a capacity to assist brokers with their daily operations. But our question is, how would consumers react if an AI Mortgage Broker launched which replaced all functions of the Mortgage Broker service?

According to Andrew Lo, a professor of Finance at MIT Sloan, AI would not be limited to administrative tasks such as scanning documents to check their authenticity, sourcing for suitable products, calculating maximum loan sums, etc. He claims it will also be able to suitably advise clients based on their evolving needs and circumstances. AI’s machine learning abilities enable the technology to stay updated with market changes around regulation, lending criteria, products and any other new introduction to the industry. As we have seen with existing technology, consumers benefit from immediate access to automated services (24 hours per day, 7 days per week), and supreme efficiency. AI’s cognition has the potential to operate at an excellent standard with an unlimited capacity. This is unlike humans whose productivity and mental capacity changes on a daily basis as a result of internal and external factors.

In addition, the lack of innate and environmental biases in regard to gender, income, age, and other socio-demographical factors improves the likelihood of a positive outcome for the end consumer with the use of AI. Unlike human counterparts, AI is fully adaptable in its language and communication style to suit the consumer’s preferences. As the UK becomes more culturally diverse, this adaption in communication will become more important to ensure that suitable financial advice is maintained in the industry in the long run.

It is clear that AI will be used by all stakeholders in the Mortgage Industry. However, the extent to which it will be used is currently uncertain. Once developed, AI Mortgage Brokers, often known as ‘Robo-Advisers’ in the industry, may be able to replace human brokers entirely.

Results Across British Cities

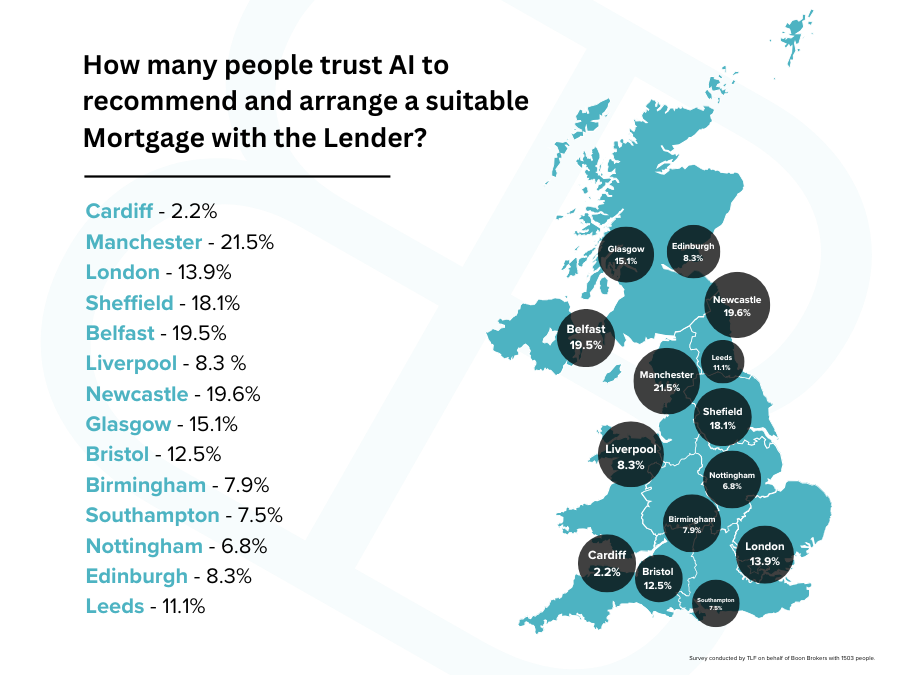

The Boon Brokers survey questioned respondents from the following British Cities: Cardiff, Manchester, London, Sheffield, Belfast, Liverpool, Newcastle, Glasgow, Bristol, Birmingham, Southampton, Nottingham, Edinburgh and Leeds.

Opinions on AI’s adoption in the Mortgage Broking industry differed across the country. Those respondents from Manchester, London and Sheffield were the most trusting of Artificial Intelligence. Whereas, respondents from Cardiff, Bristol and Southampton were least trusting of the technology.

Here is a highlight from the study:

21.5% and 18.1% of respondents in Manchester and Sheffield, respectively, would trust an AI Mortgage Broker to provide a suitable product recommendation and to arrange the mortgage with the lender.

Whereas, only 2.2% and 7.5% of respondents in Cardiff and Southampton, respectively, would trust the technology in both of those areas.

For the full results, view the Boon Brokers survey results at the end of this article.

Consumers’ Trust in Artificial Intelligence

The results of the Boon Brokers survey found that British Consumers across the United Kingdom overwhelmingly distrust Artificial Intelligence technology at present.

From the aggregate figures, 83.37% of respondents confirmed that they would not trust an AI Mortgage Broker to accurately assess their mortgage wants and needs.

73.72% of respondents confirmed that they would not trust the technology to provide a suitable mortgage product recommendation for their wants and needs.

However, there is a significant spread of opinion between age groups. 88.3% and 89% of those aged 65+ and 55-64 respectively would not trust the technology in this regard. Whereas, this percentage falls significantly for the younger age groups. Just 56.9% and 50.2% of those aged 18-24 and 25-34 respectively would not trust the technology to recommend a suitable mortgage product.

This indicates that First Time Buyers, who are often between the age of 18 and 34, are likely to be most drawn to an AI Mortgage Broker above any other category of client.

There is also a difference between males and females when it comes to trusting an AI Mortgage Broker.

22.8% of male respondents confirmed that they would trust an AI Mortgage Broker to accurately assess their wants and needs. Whereas, just 11.1% of female respondents claimed to trust AI for this purpose.

Regardless, these results demonstrate the significant value that consumers place on human mortgage brokers when assessing their mortgage requirements.

The Advice and Arrangement Functions of Mortgage Broking

For our next set of questions, we wanted to establish consumers’ trust in AI for the advice and arrangement aspects of mortgage broking. Would consumers trust it to perform one function better than the other? Overwhelmingly, there is distrust from consumers in both functions.

Just 13.6% of respondents confirmed that they would trust an AI Mortgage Broker to provide suitable advice or arrange the mortgage with the selected lender.

20% of respondents selected that they would trust an AI Mortgage Broker to provide a suitable product recommendation but not trust it to arrange the mortgage with the selected lender.

Lastly, 13.8% of respondents confirmed that they would not trust an AI Mortgage Broker to provide a suitable product recommendation but would trust it to arrange the mortgage with the selected lender.

This indicates that consumers trust Artificial Intelligence more to make a suitable mortgage product recommendation than to arrange the mortgage with the lender. Although, it is clear that they would still much prefer human brokers to process the case.

This result comes as a surprise. This is because one would think that the subjective advice side of the mortgage broking service would be better suited to a human broker with market experience. Whereas, the arrangement side of the process is largely objective data entry, which appears on the surface to be more suitable for Artificial Intelligence’s machine learning abilities.

Communication & Lender Correspondence

An important part of a mortgage broker’s job role is their communication with underwriters following submission of a mortgage application. Each lender has different systems and processes in place for their relations with brokers. As a result, brokers have to learn the communication channels of many different lenders to optimally navigate the process. This is in the hope that they can secure a quick turnaround time for a Mortgage Offer to be issued.

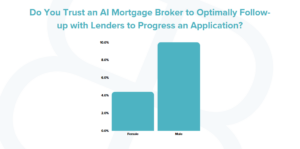

The Boon Brokers survey found that only 5.6% of respondents trust an AI Mortgage Broker to optimally communicate with an underwriter to progress their application. Furthermore, just 7.1% of respondents trust an AI Mortgage Broker to optimally follow-up with lenders to progress their application.

This indicates that mortgage applicants highly value a human mortgage broker’s ability to correspond with mortgage lenders on their behalf. Due to the complexity of each lender’s communication channel, we believe that this skepticism of AI is justified.

It is worth noting that the survey found a significant difference in the opinions of males and females on this topic. 10% of males would trust an AI Mortgage Broker to optimally follow-up with lenders to progress an application. Whereas, just 4.4% of females selected this answer.

Supplying Documentation

With almost all mortgage applications, brokers must supply client documentation to underwriters to review. Typically, identity, income and proof of deposit documents are requested.

The difficulty for mortgage brokers is that each lender has different criteria. For example, some lenders may be able to accept a signed employment contract as proof of income, whereas others may require 3 months of consecutive payslips. For this reason, experience with each lender plays a pivotal role in a broker’s documentation collection process.

If a human broker has experience with a given lender, they are likely to know which documents may be requested prior to submitting the application. By knowing this information in advance, experienced brokers can request it from clients as soon as they identify a suitable lender. They can then upload this documentation as soon as the application is submitted, which should reduce the turnaround time for an offer letter to be issued.

The documentation review aspect of an underwriter’s process is likely to be the cause of most of the delays that occur with mortgage applications. Therefore, it’s crucial that documentation is supplied to the lender in a timely manner.

Consumers understand this and it is likely to be the reason why just 6.1% of respondents would trust an AI Mortgage Broker to efficiently supply their documentation to the mortgage lender. For the genders, 8.5% of males and 4% females of females selected this answer.

Data Protection

As a society, we are stepping into the unknown when it comes to handling Artificial Intelligence. Many experts in the field believe that Data Protection is a significant cause for concern with the technology.

From our respondents, only 5.9% trust an AI Mortgage Broker to protect their data and only use it for the purpose of the broker service. Therefore, 94.1% of respondents believe that AI would not protect their data and may use it for other means, which is a worry.

To expand on this, almost a fifth of correspondents (18.2%) believe that an AI Mortgage Broker would use their personal data for unregulated activities, in spite of the FCA’s regulatory safeguards for data protection.

Changing Market Conditions

The UK’s mortgage market changes on a daily basis. In recent years, we have seen significant changes in interest rates, lending criteria, product features, affordability calculations, and more.

Due to the nature of the ever-evolving mortgage market, it is important for mortgage brokers to stay up to date with changes in the sector. If they are not well informed on the changing market, it may result in unsuitable mortgage advice for their clients.

If Artificial Intelligence is to replace human mortgage brokers, it must be able to adapt to changing market conditions.

From the Boon Brokers survey, just 7.5% of respondents believe that an AI Mortgage Broker will be able to stay up to date with changes in the market to provide suitable mortgage advice. Splitting the data across the genders, this was broken down as: 10.6% of males selected this answer, compared to just 4.8% of females.

Human Monitoring of Artificial Intelligence

Whether we like it or not, Artificial Intelligence is developing at a rapid rate across the world. Experts in the field have confirmed that the technology will improve as time goes on. However, in spite of this, 27.8% of respondents confirmed that they would never use an AI Mortgage Broker, regardless of how advanced the technology becomes. This indicates a reluctance to embrace seismic change from over a quarter of consumers and their distrust in Artificial Intelligence.

However, there is a significant difference in opinion across the age groups of the respondents. 48.1% and 44.1% of those aged 65+ and 55-64 respectively hold this view. Whereas, just 13.8% and 7.7% of those aged 18-24 and 25-34 agree.

In the long-term after the technology is well established in British Industries, experts believe that the primary focus of many human job roles will be to monitor the work of Artificial Intelligence.

That being said, 89.5% of respondents confirmed that they would only proceed with an AI Mortgage Broker’s product recommendation if the advice was checked by a human broker.

Just 10.2% of respondents selected that they would allow an AI Mortgage Broker to process their mortgage application from start to finish without monitoring from a human broker. For this answer, there was a significant swing between the genders. 14.9% of males selected this option, compared to just 6.6% of females.

Consumer Values of a Mortgage Broker Service

To determine whether Artificial Intelligence will eventually replace human mortgage brokers, we need to understand the key values for consumers from the service. By understanding these values, we can then assess whether the key features of an AI Mortgage Broker tailor more for those needs than a human alternative.

As part of the Boon Brokers survey, we asked respondents to rank the following values in order of preference:

- Mortgage Product Recommendation – Finding the most suitable mortgage product from the whole of market

- Accessibility – The ability to access the broker for communication and updates on demand

- Relationship Building – Receiving a personalised service and building a strong working relationship with the mortgage adviser

- Face to Face Interaction – Communication with a broker face-to-face in-person rather than over video call, phone call or live chat

- Case Processing Efficiency – In regard to checking for errors, submitting the application and documentation, communicating with lenders, following up applications, etc in a timely manner

- Industry Experience – With underwriters, business development managers, criteria, mortgage products, etc

Order of preference has been assessed by the overall mean score of each selection. The lower the mean score, the more important the preference.

The overall results were as follows:

With our survey, we wanted to establish the approximate time horizons for when consumers believe AI will be adopted in the mortgage intermediary market. Please see the options and selection percentages below:

| Preferences in a Mortgage Broker Service | Mean Score |

| Mortgage Product Recommendation | 2.3 |

| Relationship Building | 3.2 |

| Case Processing Efficiency | 3.4 |

| Industry Experience | 3.8 |

| Face to face Interaction | 4.0 |

| Accessibility | 4.3 |

Male and female respondents in the survey ranked the preferences in the same order on average.

Gerard Boon’s Assessment of the Results:

Mortgage Product Recommendation

Respondents ranked the Mortgage Product Recommendation as the most valuable aspect of the broker service, across all age demographics. This is not surprising. Ultimately, a borrower’s primary objective when applying for a mortgage is to secure the best deal available to them.

Over a third of consumers (33.4%) confirmed that they would not care if a human or AI Mortgage Broker advised/arranged their mortgage as long as they received the most suitable product available. This emphasises the fundamental objectives of mortgage borrowers, which is to obtain the best deal. More males had this opinion than females – 37.7% compared to 29.5% respectively.

Relationship Building

However, it is interesting that Relationship Building was the next most valued preference. One would have thought that Case Processing Efficiency would be of far greater value to consumers. This is because it is likely to result in a faster turnaround time for a Mortgage Offer to be issued. This is a tangible benefit to them. Whereas relationship building with an adviser is an intangible, less obvious, benefit.

Such communication is difficult for an AI Mortgage Broker to emulate.

The survey found that the older the consumer, the more likely they are to value an adviser’s interpersonal skills. For example, on the low end of the results, just 13.8% of those aged 18-24 valued interpersonal skills in the mortgage broker service. Whereas, at the top end, 36.7% of those aged 65+ value those skills.

When looking at the overall figures, 34.1% of respondents believe that a personalised mortgage broker service could not be provided by an AI Mortgage Broker.

Case Processing Efficiency

An AI Mortgage Broker’s ability to process the administrative aspect of a broker service should improve over time. This is because of its machine learning abilities. Therefore, if the technology is well programmed, in theory, it should become far more efficient than human brokers at case processing.

It should also process cases with fewer mistakes, as AI will not suffer from human error.

In spite of this, 92.8% of survey respondents believe that an AI Mortgage Broker is more likely to make errors on a mortgage application than a human broker.

Again, this highlights British consumers’ distrust in the technology. It also indicates a bias towards human brokers, as human error is a significant problem that AI is likely to resolve.This is because the technology does not suffer from fatigue, stress, distraction, or other drivers of human error.

Industry Experience

Respondents ranked Industry Experience as the fourth most important preference. This result comes as a shock. Many of the brokers working for Boon Brokers expected Industry Experience to rank as first or second in the order of consumer preference. As the mortgage market is so complex and ever-changing, industry experience can play a crucial role in product selection, navigating criteria and communicating with underwriters.

Just 17% of respondents claim to value a human broker’s industrial experience. In addition, only 17.8% of respondents believe that a human broker will obtain Mortgage Offers in situations where an AI Mortgage Broker will be unable to.

This is a positive outcome for AI Mortgage Brokers, who will have no track record of industrial experience when they launch in the UK mortgage market.

Face to Face Interaction

Since the COVID-19 Pandemic, British consumers have become more accustomed to remote services. This is because consumers were forced to use remote services and often worked from home themselves during those years.

Therefore, it is of no surprise that Face to Face Interaction is near the bottom of the respondents’ preference list. British consumers have realised that remote services are far more convenient and less daunting than meetings in person. Just over a fifth of respondents (20.6%) consider face to face in-person interaction as an important part of the Mortgage Broker service.

Consumers’ lack of perceived value in face-to-face interaction with their broker favours developments in Artificial Intelligence. This is because AI will never be able to mimic face to face in-person conversations unless the technology is robotised.

However, the Boon Brokers survey highlights that Face to Face Interaction is clearly an important value for older age groups. Aside from Face to Face Interaction, value preferences are broadly similar across all age ranges of respondents.

But for those aged 55 and above, Face to Face Interaction was valued as the second most important preference. This is an important finding. It implies that for mortgage products aimed at consumers over 55, like Lifetime Mortgages and other later life products, face to face communication will remain highly demanded in the market.

Accessibility

Respondents ranked Accessibility as least valuable from our list of broker service features. This result comes as most shocking to the advisers at Boon Brokers. Anecdotally, our advisers have confirmed that most clients frequently contact them – especially for updates on their mortgage application. However, the results indicate that as long as British consumers’ trust their mortgage adviser, they are less likely to require on-demand contact with them.

Only 12.5% of respondents confirmed that they value being able to access their broker on-demand at a time that suits them.

A significant benefit of Artificial Intelligence is its ability to be used on-demand at any time suitable for consumers. Unlike human brokers, who are unable to work constantly due to sleep, holiday and sickness, AI can operate 24 hours per day, 7 days a week.

On-demand access is one of the most significant selling points of any AI service. Therefore, this result should come as a pleasant surprise to human brokers as they would be unable to compete with an AI’s accessibility.

For full details, download the Boon Brokers Survey results below.

Communication Channel Preferences

Human and AI Mortgage Brokers are likely to communicate through different channels, especially when the technology is in its infancy. Therefore, understanding consumer preferences for their communication channel is important in determining whether they would consider adopting Artificial Intelligence.

Artificial Intelligence is operating as a chatbot in most industries and significantly improving productivity. For example, a study from Stanford University found that ChatGPT reduced the time it took to complete professional writing tasks by 70%. Businesses can interact with AI tools like Chat GPT in a conversational style to access useful information.

Therefore, based on the current use of AI, it is fair to assume that it will take the form of a chatbot when it first launches as an AI Mortgage Broker. We will work on that assumption for now. However, we understand that AI may be able to operate any communication channel in the long-run.

The Boon Brokers survey asked consumers to rank the following communication channels in order of preference:

1) Phone Call

2) Video Call

3) E-mail

4) Text

5) Live Chat

The overall results were as follows:

| Preferred Communication Channel (UK) | Mean Score |

| Phone Call | 2.1 |

| 2.5 | |

| Video Call | 3.2 |

| Live Chat | 3.4 |

| Text | 3.8 |

Order of preference has been assessed by the overall mean score of each selection. The lower the mean score, the more important the preference.

Males and females from the survey ranked the communication channels in the same order on average. This is true for most age demographics. However, interestingly, those aged 65+ ranked the Live Chat communication channel as a higher preference than any other age group. They ranked Live Chat as third most important, behind Phone Call and E-mail communication.

Gerard Boon’s Assessment of the Results:

These results favour the operations of human brokers over an AI alternative at this time. It is true that AI can offer live chat and text communication. However, there is currently no evidence to show that the technology can perform phone calls or e-mails to the same standard as humans.

Again, this result should be pleasing to human brokers. Most mortgage brokers still utilise phone calls and e-mails as their primary communication channels with clients.

Therefore, if an AI Mortgage Broker is introduced to the market in the near future, consumers may opt for a Human broker instead due to their communication preference.

Artificial Intelligence Replacing Human Mortgage Brokers

Human mortgage brokers across the country will be concerned about the prospect of Artificial Intelligence replacing their service in its entirety. However, the Boon Brokers survey found that consumers believe AI is unlikely to replace human mortgage brokers in the short, and perhaps medium, term.

With our survey, we wanted to establish the approximate time horizons for when consumers believe AI will be adopted in the mortgage intermediary market. Please see the options and selection percentages below:

| Options | Answer Spread |

| I think that AI will fully replace human brokers within the next year | 6.5% |

| I think that AI will fully replace human brokers within the next 2-5 years | 16.4% |

| I think that AI will fully replace human brokers within the next 6-10 years | 15.2% |

| I think that AI will fully replace human brokers within the next 11-15 years | 5.6% |

| I think that AI will fully replace human brokers within the next 16-20 years | 3.1% |

| I think that AI will fully replace human brokers in more than 20 years | 5.0% |

| I do not think that AI will ever fully replace human brokers | 34.3% |

| I don’t know | 13.9% |

34.3% of respondents selected that they do not believe that AI will ever fully replace human mortgage brokers. This is likely to be because they highly value the personalised service offered by human brokers, which they believe would be difficult for AI to replicate.

As AI technology is still in its infancy, it is also of no surprise that only 6.5% of respondents believe that AI will fully replace human mortgage brokers within the next year.

However, almost a third of respondents (31.6%) believe that AI will replace human brokers in the next 2-10 years. This view must be based on what they have seen in the technology’s developments thus far.

As expected, based on the other results from the survey, more than half of respondents over the age of 55 believe AI will never fully replace human brokers. Whereas, only 18.5% and 16.6% of those aged 18-24 and 25-34, respectively, share this view.

Over half of the younger respondents (between the ages of 18 and 34) believe that AI will fully replace human brokers within the next 10 years.

Conclusion

We have identified a distrust in Artificial Intelligence from British consumers in this research article. This distrust is across the board for all age demographics and genders. However, it is notably prevalent in older respondents.

The results clearly show that consumers are unlikely to fully adopt AI in the short and medium term. Consumers will need to see a proven track record from an AI Mortgage Broker before they trust the technology to arrange their most significant financial commitment.

It also seems likely that some consumers will never adopt AI, regardless of how the technology develops. This view is likely to be held by older generations. Even though their jobs are likely to be safe for the time-being, human mortgage brokers should be prepared to adapt to the changing needs of the market.

Most of the younger respondents in the Boon Brokers survey expect AI to fully replace human brokers within the next 10 years. This suggests that they are likely to at least trial the technology to see its benefits. In light of this, mortgage brokers should consider means of adopting AI to assist in their day-to-day operations. By doing this, they can understand the technology and recognise its advantages as it develops in the future.

If an AI Mortgage Broker launches in the future, human brokers can see the technology as an opportunity rather than a threat to improve the quality of their service.

Based on the results of this survey, mortgage brokerages should consider adopting a hybrid model in the future. This model would combine the services of humans and Artificial Intelligence to maximise productivity. In particular, the survey highlights consumers’ need for a personalised broker service. This need should be a priority for any brokerage, regardless of their technological vision for the future. Until AI technology is proven in the market, consumers should be given the option to proceed with a human broker at their discretion.

About the Researcher:

The Researcher for this article is Gerard Boon (B.A Hons, CeMAP, CeRER). Mr. Boon is the Managing Director of Boon Brokers Limited, a Directly Authorised Online Mortgage, Insurance & Equity Release Brokerage in the U.K. Boon Brokers boasts over 9,000 clients across the country and is quickly scaling year on year. Mr. Boon is passionate about Artificial Intelligence in the industry. During his studies at the University of Leeds in 2018, he achieved a First classification for his dissertation project titled “Artificial Intelligence in Financial Intermediation: An Investigation into the Prospects of Robo-Advice Developments for Independent Mortgage Brokers in the United Kingdom”. Since 2018, AI technology has rapidly developed. Mr. Boon is hoping to update his research on the topic following this survey.